Public Storage 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

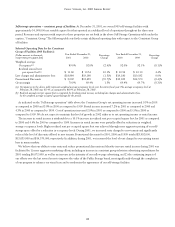

Depreciation and amortization: Depreciation and amortization expense was $168,061,000 in 2001, $148,967,000 in 2000 and

$137,719,000 in 1999. Depreciation expense with respect to our real estate facilities was $152,901,000 in 2001, $134,857,000 in

2000 and $123,495,000 in 1999; the increases are due to the acquisition and development of additional real estate facilities in 1999

through 2001. Depreciation expense with respect to non real estate assets, primarily depreciation of equipment and containers

associated with the containerized storage operations, was $5,851,000 in 2001, $4,801,000 in 2000 and $4,915,000 in 1999.

Amortization expense with respect to intangible assets totaled $9,309,000 for each of the three years ended December 31, 2001.

In accordance with the provisions of Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible

Assets,”(“SFAS 142”) and as discussed in Note 14 to the consolidated financial statements, amortization expense with respect to

intangible assets is expected to be reduced by $2,709,000 in 2002 and beyond as a result of certain provisions of SFAS 142 which

preclude amortization of goodwill and intangible assets with indeterminable lives.

General and administrative expense: General and administrative expense was $21,038,000 in 2001, $21,306,000 in 2000 and

$12,491,000 in 1999. General and administrative costs for each year principally consists of state income taxes, investor relation

expenses, certain overhead cost associated with the acquisition and development of real estate facilities, and overhead cost

associated with the containerized storage business.

The increase in 2000 as compared to 1999 is primarily due to increases in our product research and development efforts, costs

associated with lease terminations on leased storage facilities used by PSPUD which were replaced by newly-developed facilities,

and increased consulting fees. The total amount of such expenses was approximately $5,963,000 in 2000 as compared to

$1,291,000 in 1999. In addition during 2000, when compared to 1999, we experienced an increase in overhead costs associated

with the acquisition and development of real estate facilities amounting to $1,447,000.

In 2001, we continued to experience product research and development costs, lease termination expense as well as an increase

in employee severance costs which in aggregate totaled $5,630,000. During 2001, when compared to 2000, we experienced an

increase in overhead cost associated with the acquisition and development of real estate facilities amounting to $2,159,000.

Although we expect that our general and administrative expense for fiscal 2002 will be less than what we experienced in

2001 and 2000, we expect to continue to exceed the level of general and administrative expense experienced in 1999 because

the Company has continued to expand the size and scope of its operations.

Interest expense: Interest expense was $3,227,000 in 2001, $3,293,000 in 2000 and $7,971,000 in 1999. Debt and related interest

expense remain relatively low compared to our overall asset base. The decrease in interest expense in 2001 and 2000 compared

to 1999 is principally the result of increased capitalized interest, as well as a reduction in average outstanding debt balances.

Capitalized interest expense totaled $8,992,000 in 2001, $9,778,000 in 2000 and $4,509,000 in 1999 in connection with our

development activities.

The combined interest expense and capitalized interest was $12,219,000 in 2001, $13,071,000 in 2000 and $12,480,000 in

1999. The increase in 2000 as compared to 1999 is due to the addition of $100 million of notes payable assumed in a merger

during 1999, partially offset by regular principal amortization.

We expect that our aggregate interest cost (interest expensed and capitalized interest combined) during fiscal 2002 will

continue to decline as a result of principal amortization. During fiscal 2002, scheduled principal amortization approximates

$28.0 million. The amount of interest which will be capitalized during fiscal 2002 will be dependent on our development

activities which we believe will approximate the levels in fiscal 2001.