Public Storage 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

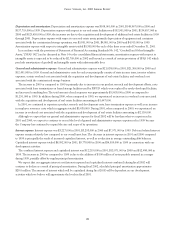

operate and enables us to use a variety of promotional activities, such as television advertising as well as targeted discounting and

referrals, which are generally not economically viable to most of our competitors. In addition, we believe that the geographic diversity

of the portfolio reduces the impact from regional economic downturns and provides a greater degree of revenue stability.

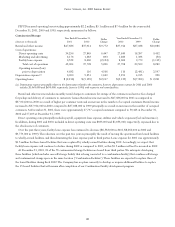

We will continue to focus our growth strategies on: (i) improving the operating performance of our existing traditional self-

storage properties, (ii) increasing our ownership of storage facilities through additional investments, (iii) improving the operating

performance of the containerized storage business and (iv) participating in the growth of PS Business Parks, Inc. Major elements

of these strategies are as follows:

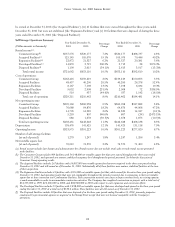

• We will continue to focus upon enhancing the operating performance of our existing traditional self-storage properties,

primarily through increases in revenues achieved through the telephone reservation center and associated marketing efforts.

These increases in revenue levels for 2002 are expected to result primarily from improvements in occupancy levels rather

than significant increases in realized rent per occupied square foot. During 2001, the Consistent Group of facilities (defined

below) exhibited growth in rental income and net operating income of 7.2% and 9.5%, respectively, over the prior year. We

do not expect to maintain this high level of growth in 2002.

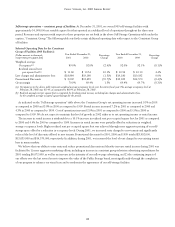

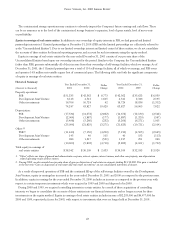

• We expect to continue our development program. Over the past three years, the Company and related development joint

ventures opened a total of 74 storage facilities at a cost of approximately $439.6 million, containing approximately 4,813,000

net rentable square feet. The Company has a total of 46 projects identified for openings after December 31, 2001 at an

estimated total cost of $298.4 million. These 46 projects (which include two facilities being developed by our second

development joint venture) are comprised of 25 storage facilities for which we have acquired the land at December 31, 2001

(total estimated costs upon completion of $171.4 million), 14 storage facilities identified for which we have not acquired the

land (estimated costs upon completion of approximately $98.0 million) and seven expansions of existing self-storage facilities

(total estimated costs upon completion of $29.0 million). In addition, we have 12 parcels of land held for development

totaling $30.0 million for which currently we have no specific development plans. Generally, the construction period takes

nine to 12 months, followed by an estimated 24 month fill-up process. Throughout the fill-up period, we experience earnings

dilution to the extent of our interest in the developed properties.

• We will acquire facilities from third parties. During 2000, we acquired 12 self-storage facilities from third parties. During

2001, we acquired one storage facility from a third party. We believe that our national telephone reservation system and

marketing organization present an opportunity for increased revenues through higher occupancies of the properties acquired

from third parties, as well as cost efficiencies through greater critical mass. With the exception of the acquisition of Storage

Trust in 1999, we have not acquired a significant number of facilities from third parties.

• We will acquire equity interests in entities owning storage facilities that we manage and already have an equity interest in,

as they become available from time to time. The pool of such available acquisitions has continued to decrease as we have

acquired such remaining interests over the last several years. Such potential remaining acquisition opportunities at December 31,

2001 include the remaining equity interests that we do not own in the entities described as “Other Equity Investments” as

described in Note 5 to the Company’s financial statements, as well as the “Other Partnership Interests” as described in Note 8

to the Company’s financial statements for the year ended December 31, 2001.

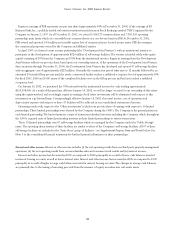

• We will continue to focus on improving the operations of the containerized storage operations. At December 31, 2001,

37 of the 55 facilities operated by PSPUD are operated in owned facilities, substantially all of which are facilities that

combine containerized storage and traditional self-storage. These owned facilities have replaced facilities which were

previously leased from third parties reducing third party lease expense. We believe that these facilities may offer efficiencies

and a more effective method to meet customers’ needs than a stand-alone containerized storage facility. The Company and

PSPUD at December 31, 2001 are developing three additional facilities which will replace three of the 18 existing leased

facilities. The Company currently has no plans to replace the 15 leased facilities that will remain after completion of the three

remaining planned combination facilities.

• Through our investment in PS Business Parks, Inc., we will continue to participate in the growth of this company’s investment

in approximately 14.8 million net rentable square feet of commercial space at December 31, 2001.