Public Storage 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

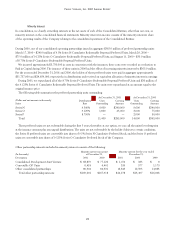

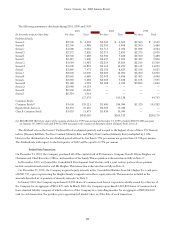

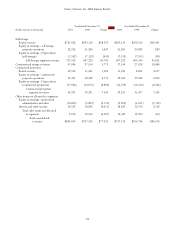

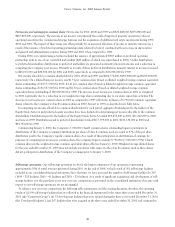

Year Ended December 31, Year Ended December 31,

(Dollar amounts in thousands)

2001 2000 Change 2000 1999 Change

Reconciliation of Net Income by Segment:

Self-storage

Storage properties $ 492,451 $ 442,648 $ 49,803 $ 442,648 $ 408,138 $ 34,510

Depreciation and amortization –

self-storage (158,476) (141,425) (17,051) (141,425) (131,118) (10,307)

Equity in earnings – storage

property operations 22,912 21,265 1,647 21,265 20,382 883

Equity in earnings –

depreciation (storage) (7,562) (7,153) (409) (7,153) (7,591) 438

Total self-storage segment

income 349,325 315,335 33,990 315,335 289,811 25,524

Containerized storage

Containerized storage 4,682 116 4,566 116 (2,481) 2,597

Depreciation (6,900) (5,251) (1,649) (5,251) (4,915) (336)

Total containerized storage

segment loss (2,218) (5,135) 2,917 (5,135) (7,396) 2,261

Commercial properties

Commercial properties 8,558 7,515 1,043 7,515 5,378 2,137

Depreciation and amortization –

commercial properties (2,685) (2,291) (394) (2,291) (1,686) (605)

Equity in earnings – commercial

property operations 51,335 42,562 8,773 42,562 35,623 6,939

Equity in earnings – depreciation

(commercial properties) (17,534) (14,672) (2,862) (14,672) (12,130) (2,542)

Total commercial property

segment income 39,674 33,114 6,560 33,114 27,185 5,929

Other items not allocated to segments

Equity in earnings – general and

administrative and other (10,609) (5,893) (4,716) (5,893) (4,101) (1,792)

Interest and other income 14,225 18,836 (4,611) 18,836 16,700 2,136

General and administrative (21,038) (21,306) 268 (21,306) (12,491) (8,815)

Interest expense (3,227) (3,293) 66 (3,293) (7,971) 4,678

Minority interest in income (46,015) (38,356) (7,659) (38,356) (16,006) (22,350)

Gain on disposition of real estate 4,091 3,786 305 3,786 2,154 1,632

Total other items not allocated

to segments (62,573) (46,226) (16,347) (46,226) (21,715) (24,511)

Total consolidated company

net income $ 324,208 $ 297,088 $ 27,120 $ 297,088 $ 287,885 $ 9,203

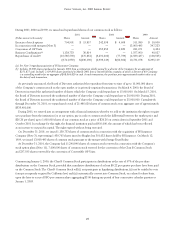

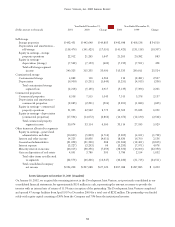

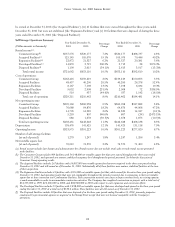

Note 13 — Events Subsequent to December 31, 2001 (Unaudited)

On January 16, 2002, we acquired the remaining interest in the Development Joint Venture, not previously consolidated in our

consolidated financial statements, for approximately $155 million in cash, representing the amount necessary to provide the

investor with an internal rate of return of 11.5% since inception of the partnership. The Development Joint Venture completed

and opened 47 storage facilities from April 1997 to December 2000 for a total cost of $232 million. The partnership was funded

solely with equity capital consisting of 30% from the Company and 70% from the institutional investor.