Public Storage 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2001 Annual Report

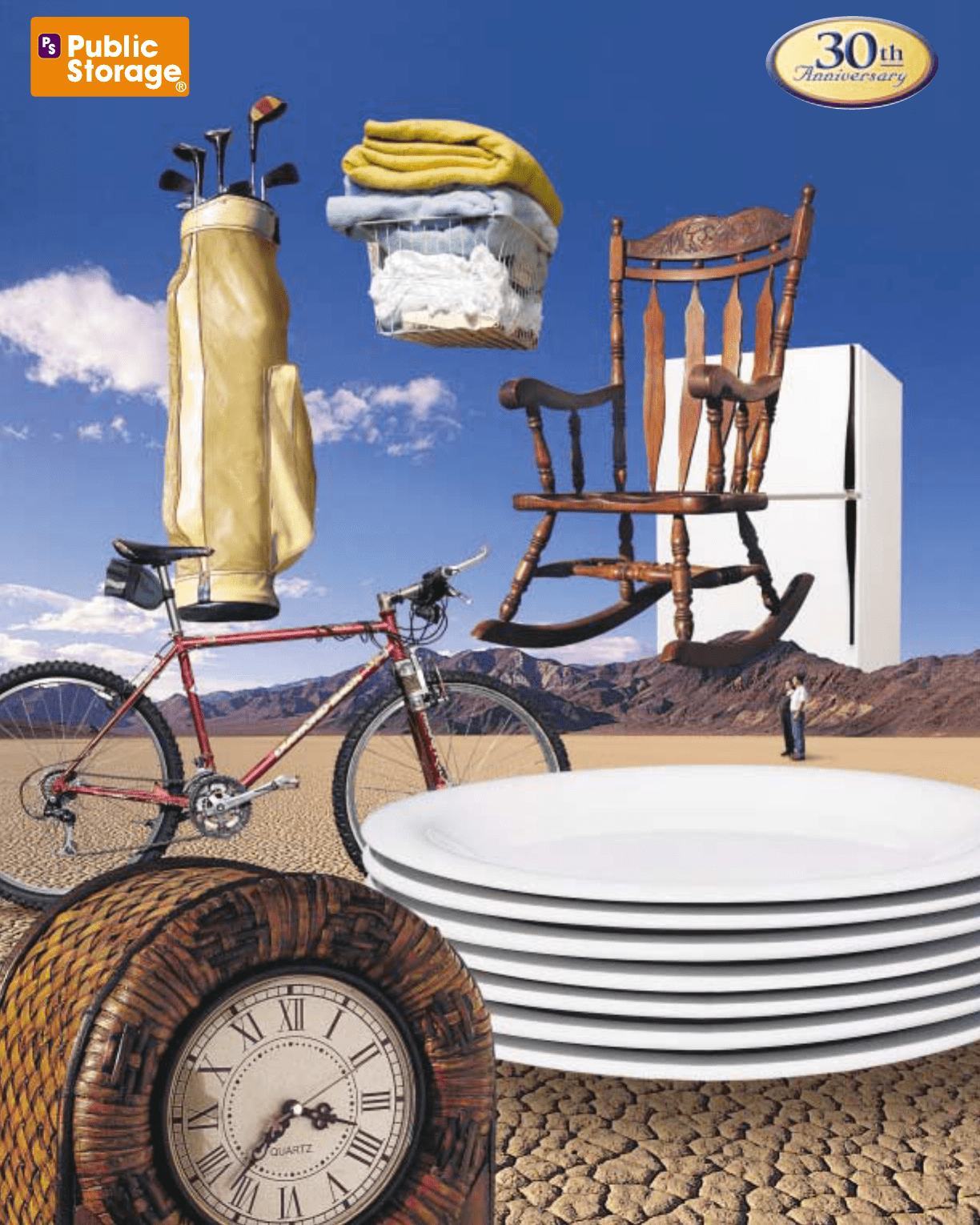

No matter how BIG the stor-

age problem appears . . .

No matter how BIG the stor-

age problem appears . . .

Table of contents

-

Page 1

2 0 0 1 A n n u al Re p o rt No matter how BIG the storage problem appears ... -

Page 2

...We've had t he solut ions f or 30 years. -

Page 3

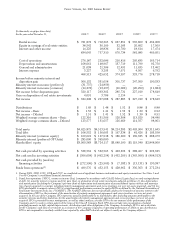

... Revenues: Rental income Equity in earnings of real estate entities Interest and other income Expenses: Cost of operations Depreciation and amortization General and administrative Interest expense Income before minority interest and disposition gain Minority interest in income (preferred) Minority... -

Page 4

... truck rentals, storage containers and selling moving and storage supplies from retail stores at our properties. Our seasoned property management system, in conjunction with our national reservation center, enables our ancillary businesses to generate additional consumer contact and to cross-market... -

Page 5

... customer perception of our marketing and management abilities, increase reservation agent productivity and lower operating costs. A significant advantage of the WebChamp information system is that agents in our national reservation center will now have real time information about unit availability... -

Page 6

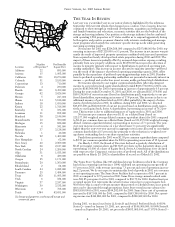

...RI 2 CT NJ 13 40 DE 4 MD 38 NY 36 NV 22 CA 301 UT 6 OH 31 VA 37 NC 24 SC 24 AZ 15 AL 22 HI 5 TX 163 LA 11 GA 62 FL 141 Properties (December 31, 2001) Location Number of Properties(1) Net Rentable Square Feet Alabama Arizona California Colorado Connecticut Delaware Florida Georgia Hawaii... -

Page 7

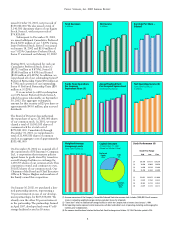

...Annual Realized Rent Per Occupied Square Foot Same Store Facilities (2) $11.85 $9.84 $9.22 $10.26 $10.73 Net Operating Income (3) Same Store Facilities (2) In Millions $417 $349 $324 $367 $381 1997 1998 1999 2000 2001 1997 1998 1999 2000 2001 1997 1998 1999 2000 2001 Weighted Average Occupancy... -

Page 8

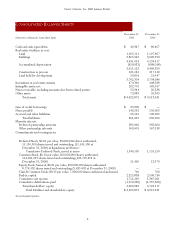

... in real estate entities Intangible assets, net Notes receivable, including amounts due from related parties Other assets Total assets Liabilities and Shareholders' Equity Line of credit borrowings Notes payable Accrued and other liabilities Total liabilities Minority interest: Preferred partnership... -

Page 9

... 31, 2001 2001 2000 1999 Revenues: Rental income: Self-storage facilities Commercial properties Containerized storage facilities Equity in earnings of real estate entities Interest and other income Expenses: Cost of operations: Storage facilities Commercial properties Containerized storage... -

Page 10

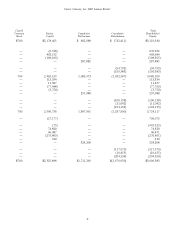

...635.602 shares) Issuance of Common Stock (498,451 shares) Repurchase of Common Stock (3,491,600 shares) Issuance costs: Preferred operating partnership units (Note 8) Net income Distributions to shareholders: Preferred Stock Equity Stock, Series A Common Stock ($1.48 per share) Balances at December... -

Page 11

P UBLIC S TORAGE , I NC . 2001 A NNUAL R EPORT Class B Common Stock Paid-in Capital Cumulative Net Income Cumulative Distributions Total Shareholders' Equity $700 $2,178,465 $ 802,088 $ (742,411) $3,119,340 - - - - - - 700 700 700 (9,318) 402,152 (108,106) - - - 2,463,193 113,... -

Page 12

... from the issuance of common stock Repurchase of the Company's common stock Redemption of preferred stock Repurchase of preferred partnership units Principal payments on notes payable Borrowings on Line of Credit Distributions paid to shareholders Distributions paid to minority interests Investment... -

Page 13

... in real estate entities Acquisition of minority interest in exchange for common stock Distributions payable Cumulative distributions paid Issuance of Common Stock: In connection with business combinations To acquire minority interests Issuance of equity stock, Series A in connection with special... -

Page 14

...Business Public Storage, Inc. (the "Company") is a California corporation, which was organized in 1980. We are a fully integrated, selfadministered and self-managed real estate investment trust ("REIT") whose principal business activities include the acquisition, development, ownership and operation... -

Page 15

...notes receivable are secured by real estate facilities that we believe are valued in excess of the related note receivable. Accounts receivable are not a significant portion of total assets and are comprised of a large number of individual customers. Real Estate Facilities Real estate facilities are... -

Page 16

... require companies to recognize expense for stock-based awards based on their fair value at date of grant. Statement No. 123 allows companies to continue to follow existing accounting rules (fair value method under APB 25) provided that pro-forma disclosures are made of what net income and earnings... -

Page 17

... to goods stored by tenants in our self-storage facilities and which owned, and continues to own, 301,032 shares of the Company's common stock. This acquisition was completed in order to provide an additional source of operating income for the Company. Prior to December 31, 2001, PS Insurance was... -

Page 18

...) PS Insurance Acquisition Partnership Acquisitions Storage Trust Merger Total 2001 business combinations: Goodwill Other assets Accrued and other liabilities $26,993 4,538 (6,993) $24,538 $ - - - - $ - - - - $ 26,993 4,538 (6,993) $ 24,538 $ $ 2000 business combinations: Real estate... -

Page 19

... Property acquisitions - merger with Storage Trust Transfers to land held for development Newly developed facilities opened for operations Ending balance Land held for development: Beginning balance Acquisitions Transfers from construction in process Dispositions Ending balance Total real estate... -

Page 20

... our commercial property operations into an entity now known as PS Business Parks, Inc., a REIT traded on the American Stock Exchange, and an operating partnership controlled by PS Business Parks, Inc. (collectively, the REIT and the operating partnership are referred to as "PSB"). The Company and... -

Page 21

... ($31.50), the shares and units had a market value of approximately $400.8 million. At December 31, 2001, PSB owned and operated 14.8 million net rentable square feet of commercial space located in nine states. PSB also manages the commercial space owned by the Company and the Consolidated Entities... -

Page 22

... a result of business combinations whereby the Company eliminated approximately $14,393,000 of Other Investments. During 2000, we disposed of other investments for total proceeds of $47,875,000. We recorded a net gain of $280,000 as "Gain on the disposition of real estate and real estate investments... -

Page 23

... of the notes, the notes provide for the prepayment of principal subject to the payment of penalties, which exceed this negative spread. Accordingly, prepayment of the notes at this time would not be economically practicable. Mortgage notes payable are secured by 24 real estate facilities having an... -

Page 24

... O preferred units are convertible into shares of 9.125% Series O Cumulative Preferred Stock of the Company. Other Partnership Interests: Other partnership interests included in minority interest consists of the following: (In thousands) Description Minority interest in income at December 31, 2001... -

Page 25

... investor and B. Wayne Hughes ("Mr. Hughes"), chairman and chief executive officer of the Company, to develop approximately $100 million of self-storage facilities and to purchase $100 million of the Company's Equity Stock, Series AAA (see Note 9). At December 31, 2001, the Consolidated Development... -

Page 26

... holders of all outstanding series of preferred stock (voting as a single class without regard to series) will have the right to elect two additional members to serve on the Company's Board of Directors until events of default have been cured. At December 31, 2001, there were no dividends in arrears... -

Page 27

... of the Company's common stock on the open market or in privately negotiated transactions. On March 4, 2000, the Board of Directors increased the authorized number of shares which the Company could repurchase to 15,000,000. On March 15, 2001, the Board of Directors increased the authorized number of... -

Page 28

... the year ended December 31, 2001. Equity Stock The Company is authorized to issue up to 200,000,000 shares of Equity Stock. The Articles of Incorporation provide that the Equity Stock may be issued from time to time in one or more series and gives the Board of Directors broad authority to fix the... -

Page 29

... characterization of dividends for Federal income tax purposes is made based upon earnings and profits of the Company, as defined by the Internal Revenue Code. Distributions declared by the Board of Directors (including distributions to the holders of preferred stock) in 2001 were characterized as... -

Page 30

...875 cash. In March 2001, the Company repurchased 2,619,893 shares of common stock from a limited liability company of which a director of the Company is a controlling member for an aggregate of $68,064,820 cash. In each transaction, the purchase price approximated market value as of the date of each... -

Page 31

...the date of grant. The 1996 Plan and the 2000 Plan also provide for the grant of restricted stock to officers, key employees and service providers on terms determined by an authorized committee of the Board of Directors; no shares of restricted stock have been granted. In connection with the Storage... -

Page 32

..., the Financial Accounting Standards Board issued Statement No. 131, "Disclosures about Segments of an Enterprise and Related Information" ("FAS 131"), which establishes standards for the way that public business enterprises report information about operating segments. This statement is effective... -

Page 33

... properties Rental revenue Equity in earnings - commercial property operations Equity in earnings - Depreciation (commercial properties) Commercial properties segment revenues Other items not allocated to segments Equity in earnings - general and administrative and other Interest and other income... -

Page 34

...in our consolidated financial statements, for approximately $155 million in cash, representing the amount necessary to provide the investor with an internal rate of return of 11.5% since inception of the partnership. The Development Joint Venture completed and opened 47 storage facilities from April... -

Page 35

... supersedes SFAS 121, and the accounting and reporting provisions of APB Opinion No. 30, "Reporting the Results of Operations" for a disposal of a segment of a business. SFAS 144 is effective for fiscal years beginning after December 15, 2001, with earlier application encouraged. The Company expects... -

Page 36

...024 1,249 860 325 $11,997 Legal Proceedings In February 2000, a lawsuit was filed against the Company. The plaintiffs in this case are suing the Company on behalf of a purported class of California resident property managers who claim that they were not compensated for all the hours they worked. The... -

Page 37

... . 2001 A NNUAL R EPORT REPORT OF INDEPENDENT AUDITORS The Board of Directors and Shareholders Public Storage, Inc. We have audited the accompanying consolidated balance sheets of Public Storage, Inc. as of December 31, 2001 and 2000, and the related consolidated statements of income, shareholders... -

Page 38

... have elected to be treated as "taxable REIT subsidiaries" of Public Storage for federal income tax purposes since January 1, 2001. A taxable REIT subsidiary is a fully taxable corporation and is limited in its ability to deduct interest payments made to us. In addition, we will be subject to a 100... -

Page 39

... many of our properties are located is significant and has affected the occupancy levels, rental rates and operating expenses of some of our properties. Any increase in availability of funds for investment in real estate may accelerate competition. Further development of self-storage facilities may... -

Page 40

... as well as national, state, and local laws and regulations including, without limitation, those governing real estate investment trusts; the acceptance by consumers of the containerized storage concept; the impact of general economic conditions upon rental rates and occupancy levels at the Company... -

Page 41

... of PS Business Parks, Inc. Major elements of these strategies are as follows: • We will continue to focus upon enhancing the operating performance of our existing traditional self-storage properties, primarily through increases in revenues achieved through the telephone reservation center and... -

Page 42

... storage business, and the acquisition of additional real estate investments during 1999, 2000 and 2001. The impact of these items was offset partially by an increased allocation of income to minority interests (as a result of the issuance of preferred operating partnership units, referred... -

Page 43

... Group Acquired Facilities Expansion Facilities Developed Facilities Disposed Facilities Total net operating income Depreciation Operating Income Number of self-storage facilities (at end of period): Net rentable square feet (at end of period): Year Ended December 31, 2001 2000 Percentage Change... -

Page 44

... to 88.9% at February 28, 2001. (b) Realized annual rent per square foot is computed by dividing rental income, including late charges and administrative fees, by the weighted average occupied square footage for the period. As indicated on the "Self-storage operations" table above, the Consistent... -

Page 45

..., price and location preferences and also informs the customer of other products and services provided by the Company and its subsidiaries. Self-storage operations - acquired facilities: As of December 31, 2001, we had 267 facilities with 14,897,000 net rentable square feet that we acquired... -

Page 46

... real estate, we are unable to pre-lease our newly developed facilities due to the nature of our tenants. Accordingly, at the time a newly developed facility first opens for operation the facility is entirely vacant generating no rental income. It takes approximately 24 months for a newly developed... -

Page 47

... storage operations: In August 1996, Public Storage Pickup & Delivery ("PSPUD"), a subsidiary of the Company, made its initial entry into the containerized storage business through its acquisition of a single facility operator located in Irvine, California. At December 31, 2001, PSPUD operated... -

Page 48

..., depreciation expense for 2001 and 2000 includes $1,049,000 and $450,000, respectively, (none in 1999) with respect to real estate facilities. Rental and other income includes monthly rental charges to customers for storage of the containers and service fees charged for pickup and delivery of... -

Page 49

... 31, 2001, the 11 limited partnerships own a total of 114 self-storage facilities, all of which we manage, and PSB owns and operates 14.8 million net rentable square feet of commercial space. The following table sets forth the significant components of equity in earnings of real estate entities... -

Page 50

...the earnings of PS Business Parks, Inc., a publicly traded real estate investment trust (American Stock Exchange symbol "PSB") organized by the Company on January 2, 1997. As of December 31, 2001, we owned 5,418,273 common shares and 7,305,355 operating partnership units (units which are convertible... -

Page 51

... for each year principally consists of state income taxes, investor relation expenses, certain overhead cost associated with the acquisition and development of real estate facilities, and overhead cost associated with the containerized storage business. The increase in 2000 as compared to 1999 is... -

Page 52

... statement relating to the April 19, 2002 acquisition by the Company of all of the remaining limited partnership interest not currently owned by the Company in PS Partners V, Ltd., a partnership which is consolidated with the Company. Minority interest in income for the year ended December 31, 2001... -

Page 53

... square feet) of the 1,384 storage facilities (herein referred to as "Same Store" storage facilities). The 945 facilities represent a consistent pool of properties which have been operated under the "Public Storage" name, at a stabilized level, by the Company since January 1, 1994. From time to time... -

Page 54

...in 1999. Rental income does not include retail sales or truck rental income generated at the facilities. 2. Cost of operations consists of the following: 2001 Payroll expense Property taxes Repairs and maintenance Advertising Telephone reservation center costs Utilities Management, office, insurance... -

Page 55

... to adjust our marketing activities, and are currently reducing rental rates charged to new incoming tenants in an effort to increase our occupancy levels. Same-Store Operating Trends by Region (Dollar amounts in thousands, except weighted average amounts) Northern California % change from prior... -

Page 56

...31, 2001 2000 1999 Net cash provided by operating activities Allocable to minority interests (Preferred Units) Allocable to minority interests (common equity) Cash from operations allocable to our shareholders Capital improvements to maintain our facilities: Storage facilities Commercial properties... -

Page 57

... limited exceptions, on the taxable income that is distributed to our shareholders, provided that at least 90% of our taxable income is so distributed to our shareholders prior to filing of the Company's tax return. We have satisfied the REIT distribution requirement since 1980. During 2001, we paid... -

Page 58

... of Cumulative Preferred Stock, Series A, will be approximately $150.6 million. During 2001, we paid distributions totaling $31.7 million with respect to our Preferred Partnership Units. We estimate the annual distributions requirements with respect to the preferred partnership units outstanding at... -

Page 59

... issuance of our 7.625% Cumulative Preferred Stock, Series T. We recently mailed an information statement relating to the April 19, 2002 acquisition by the Company of all of the 55,150 limited partnership units that it did not own in PS Partners V, Ltd., a partnership which is consolidated with the... -

Page 60

... of land held for development with total costs of approximately $30,001,000 at December 31, 2001. Stock repurchase program: The Company's Board of Directors has authorized the repurchase from time to time of up to 25,000,000 shares of the Company's common stock on the open market or in privately... -

Page 61

... Public Storage, Inc. has paid quarterly distributions to its shareholders since 1981, its first full year of operations. Overall distributions on Common Stock and Class B Common Stock for 2001 amounted to $193.1 million and $11.5 million, respectively, which includes a special distribution... -

Page 62

...23.188 21.125 24.125 26.060 29.150 32.480 2001 The following table sets forth the high and low sales prices of the Depositary Shares Each Representing 1/1,000 of a Share of Equity Stock, Series A on the New York Stock Exchange composite tapes for the applicable periods. Range Year Quarter High Low... -

Page 63

2 0 0 1 A n n u al Re p o rt No matter how BIG the storage problem appears ... -

Page 64

...We've had t he solut ions f or 30 years. -

Page 65

...year director was elected to the board. Real Estate Division W. David Ristig President James F. Fitzpatrick VP-Development Frank Hallford VP-Construction DM GC RM Divisional Manager General Counsel Regional Manager SVP Senior Vice President VP Vice President Professional Services Transfer Agent... -

Page 66

Public Storage, Inc. 701 Western Avenue Glendale, California 91201 (818) 244-8080 Address Correction Requested www.publicstorage.com PRESORTED STANDARD U.S. POSTAGE PAID EQUISERVE We will n o t fo rg e t 513-AR-02