North Face 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101vf corporation 2004 Annual Report

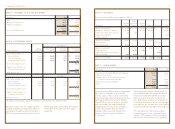

note t – earnings per share

note u – financial instruments

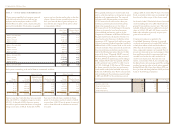

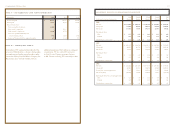

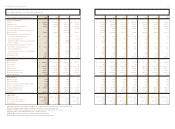

In thousands, except per share amounts 2004 2003 2002

Basic earnings per share:

Income from continuing operations $ 474,702 $ 397,933 $ 364,428

Less Preferred Stock dividends

and redemption premium 1,832 2,238 8,523

Income available for Common Stock $ 472,870 $ 395,695 $ 355,905

Weighted average Common Stock outstanding 109,872 107,713 109,167

Basic earnings per share from continuing operations $4.30 $ 3.67 $ 3.26

Diluted earnings per share:

Income from continuing operations $ 474,702 $ 397,933 $ 364,428

Increased ESOP expense if Preferred Stock

were converted to Common Stock –– 652

Income available for Common Stock and dilutive securities $ 474,702 $ 397,933 $ 363,776

Weighted average Common Stock outstanding 109,872 107,713 109,167

Effect of dilutive securities:

Preferred Stock 1,406 1,674 2,103

Stock options and other 1,452 936 1,066

Weighted average Common Stock

and dilutive securities outstanding 112,730 110,323 112,336

Diluted earnings per share from continuing operations $4.21 $ 3.61 $ 3.24

Outstanding options to purchase 5.0 million shares of

Common Stock were excluded from the computation

of diluted earnings per share in 2003 and 5.6 million

shares in 2002 because the option exercise prices were

greater than the average market price of the Common

Stock. Earnings per share for Discontinued

Operations, for the Cumulative Effect of a Change

in Accounting Policy and for Net Income (Loss) in

2002 are computed using the same weighted average

shares described above.

The fair value of VF’s long-term debt was estimated

based on quoted market prices or values of comparable

borrowings. The fair value of the Series B Redeemable

Preferred Stock was based on a valuation by an

independent financial consulting firm. The carrying

amounts of cash and equivalents, accounts receivable,

marketable securities and life insurance contracts,

short-term borrowings and foreign currency exchange

contracts approximates their fair value.

VF monitors net foreign currency exposures and

may in the ordinary course of business enter into

foreign currency forward exchange contracts with

major financial institutions. These contracts hedge

against the effects of exchange rate fluctuations

on anticipated cash flows relating to a portion

of VF’s significant foreign currency cash flows for

inventory purchases and production costs, product

sales and intercompany royalty payments anticipated

for the following 12 months. Other contracts hedge

against the effects of exchange rate fluctuations

on specific foreign currency transactions, primarily

intercompany financing arrangements. Use of

hedging contracts allows VF to reduce its overall

exposure to exchange rate movements since gains

and losses on these contracts will offset losses and

gains on the transactions being hedged.

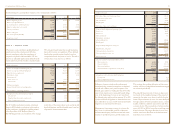

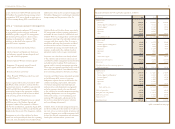

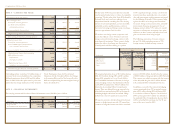

The following summarizes, by major currency,

the net U.S. dollar equivalent amount of VF’s

foreign currency forward exchange contracts:

VF recognized net pretax losses of $8.8 million during

2004, $15.8 million during 2003 and $0.3 million

during 2002, primarily in Cost of Goods Sold in

the Consolidated Statements of Income, for foreign

currency hedging contracts that had matured. At the

end of 2004, net pretax losses of $11.7 million were

deferred in Accumulated Other Comprehensive

Income. These net deferred losses are expected to be

reclassified into earnings during 2005 at the time the

underlying hedged transactions are realized. Hedge

ineffectiveness was not significant in any period.

VF may also enter into derivative financial instrument

contracts to hedge interest rate risks. VF entered into

a contract to hedge the interest rate risk for a notional

amount of $150.0 million shortly before the issuance

of $300.0 million of long-term debt in 2003 (Note L).

This contract was settled concurrent with the issuance

of the debt, with the gain of $3.5 million deferred

in Accumulated Other Comprehensive Income.

In addition, as a result of the interest rate hedging

contract mentioned above, VF recognized a pretax

gain of $0.1 million during 2004 and during 2003

as a reduction of Interest Expense. At the end of

2004, a pretax gain of $3.3 million was deferred in

Accumulated Other Comprehensive Income, which

will be reclassified into earnings over the 30 year

term of the notes issued in 2003.

2004 2003

Notional Value – Fair Value – Notional Value – Fair Value –

In thousands Bought (Sold) Asset (Liability) Bought (Sold) Asset (Liability)

European euro $(210,914) $ (9,877) $(73,439) $ (8,189)

Mexican peso 76,925 2,788 69,762 208

Canadian dollar (39,463) (2,842) (25,980) (1,302)

Other 8,465 – (11,928) –

$(9,931) $(9,283)

The carrying amount and fair value of financial instrument assets (liabilities) are as follows:

2004 2003

In thousands Carrying Amount Fair Value Carrying Amount Fair Value

Long-term debt $(957,871) $ (1,027,331) $(957,527) $ (1,038,544)

Series B Redeemable Preferred Stock (26,053) (74,769) (29,987) (66,169)