North Face 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

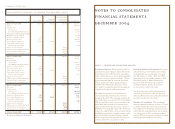

65vf corporation 2004 Annual Report

This Statement also requires us to reevaluate

goodwill and indefinite-lived intangible assets in

all business units at least annually or more frequently

if there is an indication of possible impairment.

For 2004 and 2003, the indicated fair value of the

goodwill and indefinite-lived intangible assets in

the respective business units exceeded the carrying

amount of those assets. In 2002, we determined

that $2.3 million of goodwill in our VF Playwear

business unit was impaired and, accordingly,

recorded an impairment charge for that amount.

We recorded Property, Plant and Equipment and

Intangible Assets acquired in our 2004 Acquisitions

and in our 2003 acquisition of Nautica at the fair

value of those assets. We engage an independent

valuation firm to assist us in assigning fair values to

our acquired Intangible Assets and, as necessary,

other assets.

•Pension obligations – VF sponsors defined benefit

pension plans as a key retirement benefit for most

domestic employees. Since pension obligations will

ultimately be settled far in the future, determination

of accumulated and projected pension benefit

liabilities and of our annual pension expense is

subject to assumptions and estimation. The principal

assumptions are summarized in Note N to the

Consolidated Financial Statements. We review

these assumptions annually and modify them based

on current rates and trends. Actual results may vary

from the actuarial assumptions used.

One of the critical assumptions used in the actuarial

model is the discount rate. The discount rate is used

to estimate the present value of our accumulated

and projected benefit obligations at each valuation

date. We evaluate our discount rate assumption

each year and adjust it as necessary based on current

market interest rates. For our September 30, 2004

valuation, we decided, in consultation with our

independent actuary, to refine our approach for

selecting a discount rate. We changed to a method

of estimating our discount rate based on matching

high quality corporate bond yields to the expected

benefit payments and duration of obligations for

participants in our pension plans. Previously, we

had estimated our discount rate by reference to the

Moody’s Aa bond index. This change was prompted

by a significant change in the composition of bonds

in the Moody’s Aa bond index during 2004,

resulting in (1) a yield for the revised index differing

significantly from other high quality bond indices

and (2) the index becoming less reflective of our

expected pension payments. We believe our 2004

discount rate of 6.10% appropriately reflects current

market conditions and the long-term nature of

projected benefit payments to participants of our

pension plans. Further, the discount rate for our

plans may be higher than rates used for plans at

some other companies because of our plans’ higher

percentage of females with a longer life expectancy

and higher percentage of inactive participants with

vested benefits who will not begin receiving benefits

for many years.

Another critical assumption of the actuarial model

is the expected long-term rate of return on

investment assets in our pension trust. Because

the rate of return is a long-term assumption,

it generally does not change each year. This rate,

determined in consultation with our independent

actuary, is based on several factors, including the

plan’s mix of investment assets, historic and

projected market returns on those assets and current

market conditions. We had been using an 8.75%

return assumption during 2003 and 2002, which

was less than our actual compounded annual return

over the preceding 15 years. Based on a current

evaluation of the factors mentioned above, our

investment return assumption was reduced to

8.50% for 2004 and 2005.

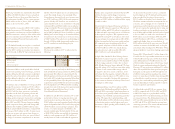

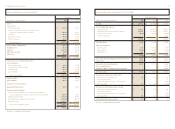

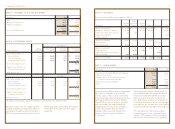

The sensitivity of changes in these valuation

assumptions on our annual pension expense

and on our plans’ projected benefit obligations

(“PBO”), all other factors being equal, is illustrated

by the following:

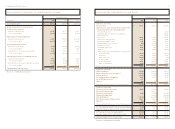

Increase (Decrease) in

Dollars in millions Pension Expense PBO

0.50% decrease in discount rate $14$78

0.50% increase in discount rate (13) (73)

0.50% decrease in expected investment return 4

0.50% increase in expected investment return (4)

Differences between actual results and actuarial

assumptions are accumulated and amortized over

future periods. During the last several years, actual

results have differed significantly from actuarial

assumptions, resulting in $267.7 million of

accumulated net unrecognized losses at our 2004

valuation date. These accumulated losses arose

because (1) our pension plan liabilities increased

substantially as a result of the overall decline in the

discount rate from 8.00% in 2000 to 6.10% in 2004

and (2) although our actual investment return on

pension plan assets exceeded the actuarially assumed

rate in 2003 and 2004, significant investment losses

were incurred in 2002 and 2001 due to the overall

decline in the securities markets. Our policy is to

amortize these unrecognized gains and losses to

pension expense, as follows: amounts totaling less

than 10% of the lower of investment assets or PBO

at the beginning of the year are not amortized;

amounts totaling 10% to 20% of PBO are amortized

over 10 years; and amounts in excess of 20% of PBO

are amortized over five years.

The cost of pension benefits earned by our

employees (commonly called “service cost”) has

averaged $19.7 million per year over the last three

years. However, pension expense recognized in our

financial statements has significantly exceeded the

average annual service cost. Our recorded pension

expense for continuing operations was $57.8 million

(including a $7.1 million partial plan curtailment

charge) in 2004, compared with $55.7 million in

2003 and $26.2 million in 2002 (including a $2.4

million curtailment charge). Both the 2004 and the

2003 expense were higher than the average annual

service cost because those years included a

significant cost component for amortization of

accumulated net unrecognized losses. For 2005,

our pension expense is expected to be approximately

$44 million.

Our accumulated benefit obligations exceeded the

fair value of plan assets at our most recent valuation

date. Accordingly, we have recorded a minimum

pension liability of $157.0 million (net of a prepaid

pension asset). The amount of the liability, along

with the related charge to Common Stockholders’

Equity, could change significantly in future years

depending on securities market fluctuations

affecting actual earnings of the pension plan assets,

interest rates and the level of VF contributions to

the plan. To improve the funded status of the plan,

we have increased our level of contributions to the

plan, with cash contributions of $55.0 million in

January 2005 and 2004 and $75.0 million in 2003.

Effective December 31, 2004, VF’s domestic defined

benefit plans were amended to close the existing

plans to new entrants. The amendments did not

affect the benefits of current plan participants or

their accrual of future benefits. Domestic employees

hired after that date, plus employees at recently

acquired businesses not covered by those plans,

will participate in a new defined contribution

arrangement with VF contributing amounts based

on a percentage of eligible compensation. Funds

contributed under this new arrangement will be

invested as directed by the participants. This new

defined contribution feature will not have an impact

on the 2005 expense for our defined benefit pension

plans. Over a period of years, however, the expense

of our defined benefit plans is expected to decline