North Face 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59vf corporation 2004 Annual Report

For the ratio of debt to total capital, debt is defined

as short-term and long-term borrowings, and total

capital is defined as debt plus common stockholders’

equity. Our ratio of net debt to total capital, with

net debt defined as debt less cash and equivalents,

was 17.0% at the end of 2004.

VF’s primary source of liquidity is its strong cash flow

provided by operations, which was $730.3 million

in 2004, $543.7 million in 2003 and $645.6 million

in 2002. Cash flow from operations is primarily

dependent on the level of operating income and

controlling investments in inventories and other

working capital components. Income from continuing

operations increased significantly in 2004 over 2003,

and in 2003 over 2002. The net change in working

capital components during 2004 and during 2002

resulted in $63.4 million and $50.0 million, respec-

tively, of cash provided by operations, compared with

cash usage of $6.9 million in 2003. A major reason

for the year-to-year cash impact from changes in

working capital over this three year period related

to changes in incentive compensation, as amounts

earned in a year are paid early in the following year.

Cash provided by operating activities in 2004 included

approximately $11 million of cash provided by the

2004 Acquisitions (for the periods after their acquisi-

tion), while 2003 included approximately $60 million

of cash provided by Nautica (for the period after its

acquisition). Cash provided from operations resulting

from the liquidation of VF Playwear (but excluding

proceeds from sale of the business) was approximately

$40 million during 2004 (see Note C to the

Consolidated Financial Statements).

In addition to cash flow from operations, VF is well-

positioned to finance its ongoing operations and

meet unusual circumstances that may arise. VF has a

$750.0 million unsecured committed bank facility that

expires in September 2008. This bank facility supports

a $750.0 million commercial paper program. Any

issuance of commercial paper would reduce the

amount available under the bank facility. At the end

of 2004, $738.2 million was available for borrowing

under the credit agreement, with $11.8 million of

standby letters of credit issued under the agreement.

Further, under a registration statement filed in 1994

with the Securities and Exchange Commission,

VF has the ability to offer, on a delayed or continuous

basis, up to $300.0 million of additional debt, equity

or other securities.

The principal investing and financing activities in

2004 and 2003 related to acquisitions. We paid cash

of $655.1 million and $578.0 million for acquisitions

in 2004 and 2003, respectively, net of cash balances

in the acquired companies. The acquisitions were

funded with existing VF cash balances, short-term

commercial paper borrowings and, in 2003, $292.1

million borrowed in the long-term capital markets.

All commercial paper borrowings, plus debt of

the acquired companies of $28.8 million in 2004

and $14.9 million in 2003, were repaid during

the respective years, and we ended 2004 with

$485.5 million in cash and equivalents.

In April 2004, Standard & Poor’s Ratings Services

affirmed its ‘A minus’ long-term corporate credit

and senior unsecured debt ratings for VF. Standard

& Poor’s ratings outlook is ‘stable.’ Also in April

2004, Moody’s Investors Service affirmed VF’s long-

term debt rating of ‘A3’ and short-term debt rating

of ‘Prime-2’ and continued the ratings outlook

as ‘negative’. Based on current conditions, we do

not believe that the negative outlook by Moody’s

will have a material impact on VF’s ability to issue

long or short-term debt. Existing debt agreements

do not contain acceleration of maturity clauses based

on changes in credit ratings.

Capital expenditures were $81.4 million in 2004,

compared with $86.6 million and $64.5 million in

2003 and 2002, respectively. Capital expenditures in

each of these years generally related to maintenance

spending in our worldwide manufacturing and other

facilities. We expect that capital spending could

reach $120 million in 2005, with the increase related

to distribution projects and to higher retail store

investments. Capital spending will be funded by cash

flow from operations.

As discussed in the previous section, accumulated

benefit obligations in VF’s defined benefit pension

plans exceeded the fair value of plan assets by

$213.5 million at the plans’ latest valuation date.

We believe retirement benefits are important for our

associates, and accordingly, we are committed to

maintaining a well-funded pension plan. Although

VF was not required by applicable law to make any

funding contribution to the qualified pension plan

trust in 2004, 2003 and 2002 and will not be required

to do so in 2005, we made cash contributions of

$55.0 million in each of January 2005 and 2004

and $75.0 million in 2003. These contributions were

significantly higher than our contributions of

$20.0 million in each of the prior two years. We will

continue to monitor the funded status of the plan

and evaluate future funding levels. We believe VF has

adequate liquidity to meet future funding requirements.

During 2003, VF purchased 1.7 million shares of its

Common Stock in open market transactions at a cost

of $61.4 million (average price of $36.55 per share)

and in 2002 purchased 3.0 million shares at a cost

of $124.6 million (average price of $41.54 per share).

Under its current authorization from the Board of

Directors, VF may purchase an additional 5.3 million

shares. We suspended the share repurchase program

during the second quarter of 2003 through the end

of 2004 to fund acquisition spending. Our current

intent is to repurchase 2.0 million shares during 2005

to offset dilution caused by exercises of stock options.

However, the actual number purchased during 2005

may vary depending on funding required to support

business acquisition opportunities.

Cash dividends totaled $1.05 per common share

in 2004, compared with $1.01 in 2003 and $0.97

in 2002. Our target is to pay dividends totaling

approximately 30% of our diluted earnings per share

on a long-term basis. The dividend payout rate was

24.9% in 2004 compared with payout rates of 28.0%

in 2003 and 29.9% in 2002, based on income from

continuing operations. The current indicated annual

dividend rate for 2005 is $1.08 per share.

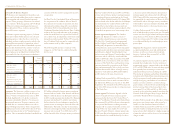

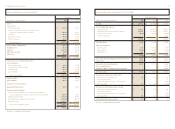

Dollars in millions 2004 2003

Working capital $1,006.4 $ 1,419.3

Current ratio 1.7 to 1 2.8 to 1

Debt to total capital 28.4%33.7%

Total Long-term Debt was relatively flat from 2003

to 2004, with $400.0 million of notes reclassified

to Current Portion of Long-term Debt based on

debt retirement schedules. Of the current portion,

$100.0 million is due on June 1, 2005 and $300.0

million is due on October 1, 2005.

Other Liabilities increased in 2004 by $17.5 million.

Included are increases of $43.6 million in liabilities

from growth in core businesses and $16.1 million in

deferred income taxes, offset by a $42.2 million reduc-

tion in our minimum pension liability. See Note N

to the Consolidated Financial Statements and the

following paragraph.

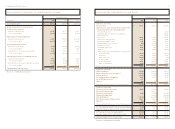

In VF’s defined benefit pension plans, accumulated

benefit obligations exceeded the fair value of plan

assets by $213.5 million at our plans’ last valuation

date. At the end of 2004, VF had a minimum pension

liability of $157.0 million (net of a prepaid pension

asset). The related charge to Accumulated Other

Comprehensive Income (Loss), net of income taxes,

was $119.1 million in 2004. Of the total minimum

pension liability, $55.0 million was recorded as a

current liability based on our contribution to the plan

in January 2005, and $102.0 million was recorded as

a long-term liability. The minimum pension liability at

the end of 2004 compares with $199.2 million at the

end of 2003 (of which $55.0 was classified as a current

liability) and a related charge to Accumulated Other

Comprehensive Income (Loss), net of income taxes,

of $160.9 million. The reduction in underfunding at

the end of 2004 resulted from growth in plan assets

and VF contributions made during the year.

Liquidity and Cash Flows

The financial condition of VF is reflected in the

following: