North Face 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95vf corporation 2004 Annual Report

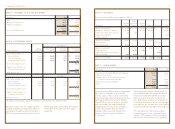

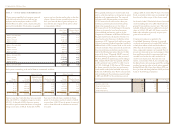

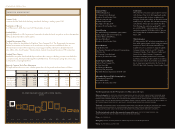

note q – income taxes

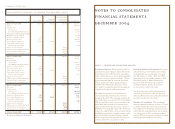

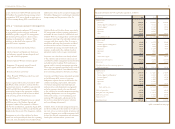

The provision for Income Taxes was computed based on the following amounts of Income from Continuing

Operations before Income Taxes and Cumulative Effect of a Change in Accounting Policy:

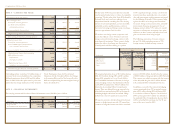

The reasons for the difference between income taxes computed by applying the statutory federal income tax

rate for continuing operations and income tax expense in the financial statements are as follows:

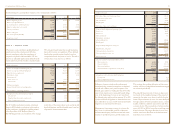

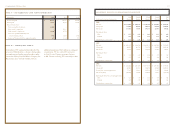

Deferred income tax assets and liabilities consist of the following:

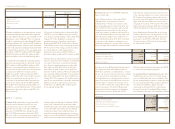

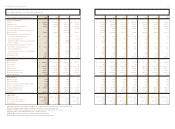

As of the end of 2004, VF has not provided deferred

U.S. income taxes on $318.0 million of undistributed

earnings of international subsidiaries where such

earnings are considered to be permanently invested.

Such undistributed earnings would become taxable

in the United States if it becomes advantageous for

business, tax or foreign exchange reasons to remit

foreign cash balances to the United States. VF has

undertaken initiatives resulting in a reduced effective

tax rate on earnings of one of VF’s foreign subsidiaries.

The income tax benefit from this tax status was

$16.5 million ($0.15 per diluted share) in 2004,

$10.8 million ($0.10 per share) in 2003 and $13.3

million ($0.12 per share) in 2002. The tax status

providing this benefit is scheduled to expire at the

end of 2009.

VF has $190.2 million of foreign operating loss carry-

forwards expiring $6.9 million in 2005, $17.5 million

in 2006, $9.5 million in 2007, $1.0 million in 2008

and $4.2 million in 2009, with the remainder having

an unlimited carryforward life. A valuation allowance

has been provided where it is more likely than not,

based on an evaluation of currently available informa-

tion, that the deferred tax assets relating to those loss

carryforwards will not be realized. Interest income in

2003 included $5.7 million related to settlement of

federal income tax issues.

The American Jobs Creation Act of 2004 (“the Act”)

was signed into law in late 2004. The Act contains

a temporary incentive for repatriation of foreign

earnings during 2005 at a 5.25% effective income

The provision for Income Taxes for continuing operations consists of:

In thousands 2004 2003 2002

Current:

Federal $ 170,649 $ 132,160 $ 95,738

Foreign 38,703 29,912 28,935

State 11,895 7,540 1,778

221,247 169,612 126,451

Deferred, primarily federal 16,172 30,961 70,849

$ 237,419 $ 200,573 $ 197,300

In thousands 2004 2003 2002

Domestic $ 545,516 $ 459,507 $ 439,744

Foreign 166,604 138,999 121,984

$ 712,120 $ 598,506 $ 561,728

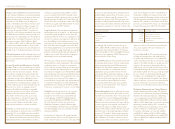

In thousands 2004 2003 2002

Tax at federal statutory rate $ 249,242 $ 209,477 $ 196,605

State income taxes, net of federal tax benefit 5,525 7,459 9,918

Foreign operating losses with no current benefit 7,276 2,476 7,531

Foreign rate differences (18,311) (9,674) (16,989)

Change in valuation allowance (6,297) (3,068) (6,115)

Other, net (16) (6,097) 6,350

$ 237,419 $ 200,573 $ 197,300

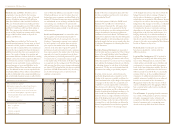

In thousands 2004 2003

Deferred income tax assets:

Employee benefits $50,126 $ 41,993

Inventories 19,036 22,280

Other accrued expenses 162,584 159,663

Minimum pension liability 73,985 99,425

Operating loss carryforwards 110,446 91,720

Foreign currency translation –26,214

416,177 441,295

Valuation allowance (67,475) (67,810)

Deferred income tax assets 348,702 373,485

Deferred income tax liabilities:

Depreciation 34,346 39,636

Intangible assets 158,841 87,538

Other 64,262 36,047

Deferred income tax liabilities 257,449 163,221

Net deferred income tax assets $91,253 $ 210,264

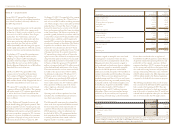

Amounts included in Consolidated Balance Sheets:

Current assets $99,338 $ 92,828

Current liabilities (4,468) –

Noncurrent assets 12,476 117,436

Noncurrent liabilities(16,093) –

$91,253 $ 210,264