North Face 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91vf corporation 2004 Annual Report

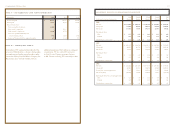

Preferred Stock consists of 25,000,000 authorized

shares at $1 par value.

Series A Preferred Stock: At the end of 2004,

2,000,000 shares are designated as Series A

Preferred Stock, of which none has been issued.

Each outstanding share of Common Stock has one

Series A Preferred Stock purchase right attached.

The rights become exercisable ten days after an

outside party acquires, or makes an offer for, 15% or

more of the Common Stock. Once exercisable, each

right will entitle its holder to buy 1/100 share of

Series A Preferred Stock for $175. If VF is involved

in a merger or other business combination or an

outside party acquires 15% or more of the Common

Stock, each right will be modified to entitle its holder

(other than the acquirer) to purchase common stock

of the acquiring company or, in certain circumstances,

VF Common Stock having a market value of twice

the exercise price of the right. In some circumstances,

rights other than those held by an acquirer may be

exchanged for one share of VF Common Stock. The

rights, which expire in January 2008, may be redeemed

at $0.01 per right prior to their becoming exercisable.

Series B Redeemable Preferred Stock: At the end

of 2004, 2,105,263 shares are designated as 6.75%

Series B Redeemable Preferred Stock, which were

purchased by the ESOP in 1990. (See Note N.)

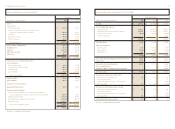

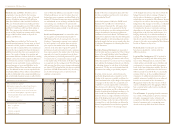

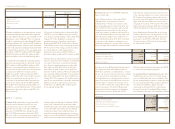

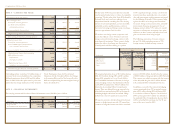

Changes in shares of Preferred Stock outstanding

are summarized as follows:

Common Stock outstanding is net of shares held

in treasury, and in substance retired. There were

1,098,172 treasury shares at the end of 2004,

1,297,953 treasury shares at the end of 2003 (after

retirement of 32,000,000 shares during the year)

and 32,233,996 treasury shares at the end of 2002.

The excess of the cost of treasury shares acquired over

the $1 per share stated value of Common Stock is

charged to Retained Earnings. In addition, 256,088

shares of VF Common Stock at the end of 2004,

242,443 shares at the end of 2003 and 266,146 shares

at the end of 2002 were held in trust for deferred

compensation plans. These additional shares are

treated for financial reporting purposes as treasury

shares at a cost of $9.2 million, $8.4 million and $9.3

million at the end of 2004, 2003 and 2002, respectively.

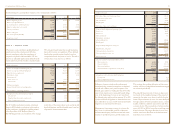

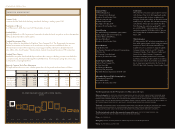

note o – capital

VF makes contributions to the plan sufficient to meet

the minimum funding requirements under applicable

laws, plus additional amounts as recommended by VF’s

independent actuary. Although VF was not required

to make a contribution to the plan during 2005 under

applicable regulations, VF contributed $55.0 million to

its qualified pension plan in January 2005. Estimated

future benefit payments, including benefits attributable

to estimated future employee service, are approximately

$42 million in 2005, $43 million in 2006, $46 million

in 2007, $48 million in 2008, $51 million in 2009

and $312 million for the years 2010 through 2014.

Accumulated benefit obligations earned through the

respective measurement dates for these plans totaled

$947.3 million in 2004 and $896.3 million in 2003.

The excess of accumulated benefit obligations over

the sum of the fair value of plan assets and previously

accrued pension liabilities (“minimum pension

liability”) was $157.0 million in 2004 and $199.2

million in 2003. The offset to this minimum pension

liability is recorded, after income tax effect, as a

component of Accumulated Other Comprehensive

Income (Loss). At the end of both 2004 and 2003,

$55.0 million of the minimum pension liability was

classified as a current liability because VF contributed

that amount to the pension plan in early 2005 and

2004, respectively.

VF sponsors an Employee Stock Ownership Plan

(“ESOP”) as part of a 401(k) savings plan covering

most domestic salaried employees. Cash contributions

made by VF to the 401(k) plan are based on a

specified percentage of employee contributions.

By the end of 2002, all VF stock had been allocated

to the ESOP accounts of the participating employees.

VF also sponsors other savings and retirement plans

for certain domestic and foreign employees.

Expense for these plans totaled $7.0 million in

2004, $6.5 million in 2003 and $7.1 million in 2002.

VF participates in multiemployer retirement benefit

plans for certain of its union employees. Contributions

are made to these plans in amounts provided by

the collective bargaining agreements and totaled

$0.1 million in 2004, $0.2 million in 2003 and

$0.6 million in 2002. If there were a significant

reduction in union employees, VF may be required to

pay a potential withdrawal liability if the respective

plans were underfunded at the time of withdrawal.

During 2003, VF recognized a $7.7 million expense

when it was determined that a probable withdrawal

liability existed due to reductions in union-based

employment. An additional $1.0 million expense

was recognized during 2004.

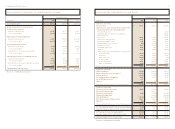

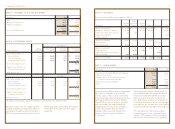

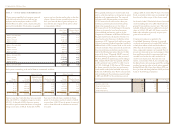

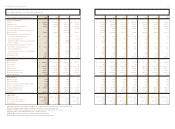

September 30

Target Allocation 2004 2003

Equity securities 65%71%61%

Fixed income securities 30 21 31

Real estate securities 588

Total 100%100%100%

2004 2003 2002

Balance, beginning of year 971,250 1,195,199 1,477,930

Conversion to Common Stock (127,436) (223,949) (113,527)

Redemption of Preferred Stock ––(169,204)

Balance, end of year 843,814 971,250 1,195,199

Each share of Series B Redeemable Preferred Stock

has a redemption value and liquidation value of

$30.88 plus cumulative accrued dividends, is convert-

ible into 1.6 shares of Common Stock and is entitled

to two votes per share along with the Common

Stock. Dividends are accrued and paid in cash each

quarter. The trustee for the ESOP may convert the

preferred shares to Common Stock at any time or

may cause VF to redeem the preferred shares under

certain circumstances. The Series B Redeemable

Preferred Stock also has preference in liquidation

over all other stock issues. By the end of 2002,

all Preferred Stock had been allocated to the ESOP

accounts of the participating employees.

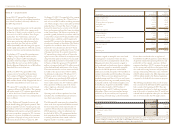

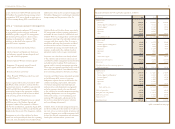

Accumulated Other Comprehensive Income: Other

comprehensive income consists of certain changes

in assets and liabilities that are not included in Net

Income under generally accepted accounting principles

but are instead reported within a separate component

of Common Stockholders’ Equity. Amounts

comprising Accumulated Other Comprehensive

Income (Loss) in the Consolidated Balance Sheets,

net of related income taxes, are summarized as follows:

In thousands 2004 2003

Foreign currency translation $(1,816) $(31,885)

Minimum pension liability adjustment (119,138) (160,850)

Derivative financial instruments (5,141) (4,450)

Unrealized gains on marketable securities 13,024 7,730

$(113,071) $(189,455)