North Face 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83vf corporation 2004 Annual Report

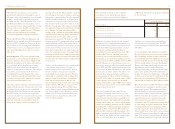

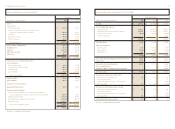

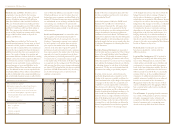

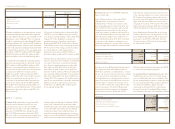

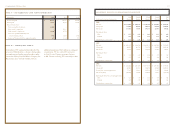

In thousands 2004 2003

Accounts receivable, net $4,363 $ 12,958

Inventories –35,082

Property, plant and equipment, net 6,249 14,305

Other, primarily deferred income taxes 4,181 7,521

$14,793 $ 69,866

Accounts payable $–$ 11,162

Accrued liabilities 15,129 7,274

$15,129 $ 18,436

Activity in the restructuring accruals for the 2003 acquisitions is summarized as follows:

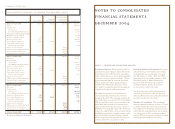

note c – discontinued operations and assets held for sale

At the end of 2004, Accrued Liabilities related primarily to expected losses on formerly occupied leased premises.

note d – accounts receivable

note e – inventories

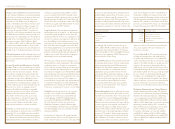

In 2001, management announced a plan to exit

the Private Label knitwear business and the Jantzen

swimwear business. The Jantzen® trademarks and

certain other assets of this swimwear business were

sold in 2002 for $24.0 million. Liquidation of the

Private Label knitwear business and of the remaining

Jantzen inventories and other assets was completed

during 2002. Both the Private Label knitwear

and the Jantzen businesses are accounted for as

discontinued operations in accordance with FASB

Statement No. 144, Accounting for the Impairment or

Disposal of Long-Lived Assets. Accordingly, the results

of operations and cash flows of these businesses are

separately presented as discontinued operations in

the accompanying financial statements. Summarized

operating results for these discontinued businesses

for 2002 were net sales of $98.0 million; income

before taxes of $13.5 million (including gain

on disposal of $1.4 million); income taxes of

$5.2 million; and income of $8.3 million.

VF’s children’s playwear business (“VF Playwear”)

consisted of the Healthtex® and licensed Nike®

apparel products. Certain assets of VF Playwear

were sold in May 2004 for cash and notes totaling

$17.1 million. VF Playwear retained all inventories

and other working capital and continued to ship

products through the end of the third quarter.

Under the sale agreement, VF agreed to purchase

$150.0 million of branded childrenswear from the

purchaser over a 10 year period for sale in its

outlet stores. Due to this ongoing involvement,

VF Playwear does not qualify for treatment as a

discontinued operation. VF Playwear contributed

sales of $87.1 million, $144.0 million and

$175.5 million and operating losses of $(14.0)

million, $(7.7) million and $(3.2) million in 2004,

2003 and 2002, respectively. Operating results include

net charges of $9.5 million related to the disposal

of the business in 2004 and a $2.3 million goodwill

impairment charge in 2002.

Assets and liabilities of VF Playwear included in

the respective captions of the Consolidated Balance

Sheets are summarized as follows:

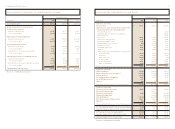

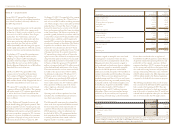

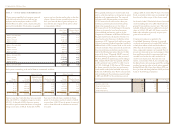

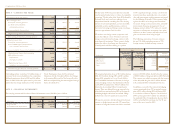

Facilities Lease

In thousands Severance Exit Costs Termination Total

Accrual for 2003 acquisitions $ 6,564 $ 403 $ 13,603 $ 20,570

Cash payments (520) – (655) (1,175)

Balance, December 2003 6,044 403 12,948 19,395

Additional accrual 3,682 – – 3,682

Write-off of assets –(376) – (376)

Cash payments (4,322) (27) (12,948) (17,297)

Balance, December 2004 $5,404 $ – $ – $ 5,404

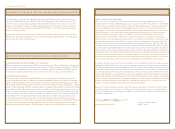

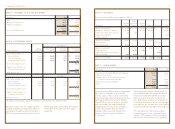

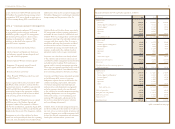

In thousands 2004 2003

Trade $ 758,882 $ 646,332

Other 53,490 53,300

Total accounts receivable 812,372 699,632

Less allowance for doubtful accounts 60,790 65,769

$ 751,582 $ 633,863

In thousands 2004 2003

Finished products $ 744,517 $ 714,867

Work in process 99,669 91,593

Materials and supplies 129,062 126,525

$ 973,248 $ 932,985

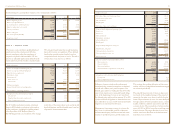

Facilities Lease

In thousands Severance Exit Costs Termination Total

Accrual for 2004 acquisitions $ 24,562 $ 811 $ 1,593 $ 26,966

Cash payments (20,667) – (176) (20,843)

Balance, December 2004 $3,895 $ 811 $ 1,417 $ 6,123

VF completed two other acquisitions during 2003

for a total consideration of $3.7 million. Contingent

consideration of up to $1.3 million related to one

of these acquisitions is payable if certain sales targets

are achieved over each of the years through 2006.

Accordingly, in each of 2004 and 2003, $0.3 million

of contingent consideration was earned and

capitalized as additional licensing intangible assets.

Pro forma operating results for prior periods are

not presented due to immateriality.

VF accrued various restructuring charges in

connection with the 2003 and 2004 acquisitions.

Remaining cash payments related to these actions

will be substantially completed during 2005.

Activity in the restructuring accruals for the 2004

Acquisitions is summarized as follows: