North Face 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

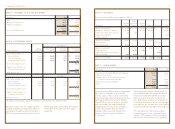

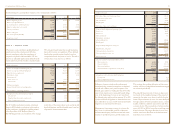

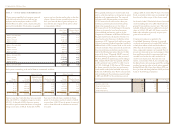

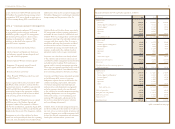

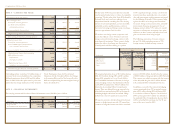

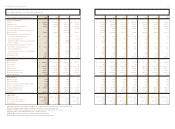

In thousands 2004 2003 2002

Coalition sales:

Jeanswear $2,661,946 $ 2,666,815 $ 2,788,486

Outdoor Apparel and Equipment 1,003,851 580,663 508,020

Intimate Apparel 903,552 830,225 839,786

Imagewear 769,552 727,223 751,893

Sportswear 604,879 248,967 –

Other 110,756 153,566 195,338

Consolidated net sales $6,054,536 $ 5,207,459 $ 5,083,523

Coalition profit:

Jeanswear $ 452,160 $ 415,572 $ 472,816

Outdoor Apparel and Equipment 154,256 95,720 71,447

Intimate Apparel 118,733 86,671 97,675

Imagewear 116,123 101,475 85,934

Sportswear 59,745 35,215 –

Other (10,727) (4,770) 1,288

Total coalition profit 890,290 729,883 729,160

Corporate and other expenses (109,234) (81,465) (103,504)

Interest, net (68,936) (49,912) (63,928)

Consolidated income from continuing operations

before income taxes $ 712,120 $ 598,506 $ 561,728

Coalition assets:

Jeanswear $1,075,739 $ 1,002,910 $ 1,052,447

Outdoor Apparel and Equipment 414,343 217,473 147,990

Intimate Apparel 345,292 332,754 331,528

Imagewear 288,537 304,927 310,882

Sportswear 135,394 205,450 –

Other 76,979 111,705 124,391

Total coalition assets 2,336,284 2,175,219 1,967,238

Cash and equivalents 485,507 514,785 496,367

Intangible assets and goodwill 1,671,114 1,019,606 473,355

Deferred income taxes 111,814 208,391 258,589

Corporate assets 399,559 327,551 307,602

Consolidated assets $5,004,278 $ 4,245,552 $ 3,503,151

97vf corporation 2004 Annual Report

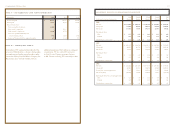

From an organizational standpoint, VF’s businesses

are segregated by product categories and brands

within those product categories. For management

and internal reporting purposes, these business

groupings are designated as “coalitions.” These

coalitions, as described below, represent VF’s

reportable business segments:

•Jeanswear: Jeanswear and related products

•Outdoor Apparel and Equipment: Outerwear

and adventure apparel, footwear, daypacks and

bags, and technical equipment

•Intimate Apparel: Women’s intimate apparel

•Imagewear: Occupational apparel, licensed

sports apparel and distributor knitwear

•Sportswear: Fashion sportswear

•Other: Primarily VF Playwear, which was sold

in 2004 (Note C)

Business segment information presented for 2003

and 2002 has been restated to conform with this

organizational structure. In addition, segment profit

in 2003 and 2002 has been restated to include

restructuring charges in the appropriate coalition.

Previously, these expenses had not been included

in the operating results of the business units.

The Vans, Kipling and Napapijri businesses acquired

in 2004 are part of the Outdoor Apparel and

Equipment coalition. The operations of Nautica,

John Varvatos and Earl Jean, acquired in August 2003,

comprise the Sportswear coalition, except that the golf

apparel product line is part of the Imagewear coalition.

Management at each of the coalitions has direct

control over and responsibility for their sales, operating

income and assets, hereinafter termed Coalition Sales,

Coalition Profit and Coalition Assets, respectively.

VF management evaluates operating performance

and makes decisions based on Coalition Sales and

Coalition Profit. Accounting policies used for internal

management reporting at the individual coalitions are

consistent with those stated in Note A, except as

stated below and except that inventories are valued

on a first-in, first-out basis. Common costs such

as information processing, retirement benefits and

insurance are allocated to the coalitions based on

appropriate metrics such as usage or employment.

Corporate costs other than costs directly related

to the coalitions and net interest expense are not

controlled by coalition management and are therefore

excluded from the Coalition Profit performance

measure used for internal management reporting.

These items are separately presented in the reconcili-

ation of Coalition Profit to Consolidated Income

from Continuing Operations before Income Taxes.

Corporate and Other Expenses (presented separately

in the following table) consists of corporate

headquarters expenses that are not allocated to the

coalitions (including compensation and benefits

of corporate management and staff, legal and

professional fees, and administrative and general)

and other expenses related to but not allocated

to the coalitions for internal management reporting

(including development costs for management

information systems, costs of maintaining and

enforcing VF’s trademarks, adjustments for the

last-in, first-out method of inventory valuation

and consolidating adjustments).

Coalition Assets, for internal management purposes,

are those used directly in the operations of each busi-

ness unit, such as accounts receivable, inventories and

property. Corporate assets include investments held

in trusts for deferred compensation and retirement

benefit plans and information systems assets.

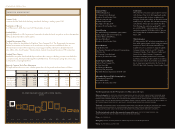

tax rate. At the end of 2004, VF had approximately

$375 million of accumulated foreign earnings subject

to repatriation. If VF were to decide to remit some or

all of these earnings during 2005, it would result in an

additional one-time income tax expense ranging up to

$16 million. Management is evaluating its unremitted

foreign earnings and the provisions of the Act.

Financial information for VF’s reportable segments is as follows:

(table continued on next page)

note r – business segment information