North Face 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49vf corporation 2004 Annual Report

16%, driven by growth in our core (i.e., ongoing)

businesses, the full year effect of our 2003 acquisi-

tion of Nautica Enterprises, Inc. (“Nautica”) and

four acquisitions completed in 2004. We currently

expect sales growth of 6 – 8% in 2005, excluding

any additional acquisitions. On a longer-term

basis, achieving our growth target will require a

combination of core growth and acquisitions.

In our search for acquisitions, we focus on branded

apparel businesses that satisfy our strategic and

financial goals. Refer to the section titled “Strategic

Objectives” for further details.

•Operating income of 14% of sales – In recent years,

we have made progress toward this goal, as

demonstrated by attaining an operating margin

of 12.8% in 2004.

Many of our businesses currently exceed the 14%

benchmark, and nearly all of our businesses have

double digit margins. We continually evaluate our

existing businesses, which in 2004 resulted in the

decision to exit our Healthtex® and licensed Nike®

childrenswear business (“VF Playwear”) as it no

longer met our strategic and financial objectives.

We believe that our recently acquired companies

can achieve the 14% target.

The improvement in operating margins in recent

years was related, in part, to specific actions taken

to reduce our cost structure. These actions have

focused on lowering our product cost by moving

our production to lower cost locations around the

world. We will continue to pursue cost reduction

opportunities in product cost, distribution and

administrative areas.

•Return on invested capital of 17% – We believe that

a high return on capital is closely correlated with

enhancing shareholder value. We calculate return

on invested capital as follows:

Income before net interest expense,

after income taxes

Average short and long-term debt,

plus common stockholders’ equity

VF earned a 15.8% return on capital in 2004.

We expect acquisition targets will achieve returns

in line with our 17% return on capital goal.

•Debt to capital of less than 40% – To maintain a

conservative financial position, we have established

a goal of keeping our total debt to less than 40% of

our total capitalization, with capitalization defined

as our combined short and long-term debt plus

common stockholders’ equity. We would, however,

be willing to exceed this target ratio, on a short-term

basis, to support an appropriate investment opportu-

nity. Despite significant acquisition spending in the

last two years, this ratio was reduced to 28.5% at the

end of 2004. And at year-end, we reported $485.5

million in cash and equivalents, demonstrating VF’s

ability to generate strong cash flow from operations.

•Dividend payout ratio of 30% – Our target is to

return 30% of our earnings to our stockholders

through a consistent dividend policy. We have

maintained this payout ratio on a long-term basis.

VF has increased dividends paid per share each

year for the past 32 years. Our payout rate was

24.9% for 2004. In the fourth quarter of 2004,

we increased the quarterly dividend to an indicated

annual payout of $1.08 per share for 2005.

Strategic Objectives

In early 2004, we developed a growth plan that we

believe will enable VF to achieve its long-term sales

and earnings targets. Our growth strategy consists

of five drivers:

1.Build new growing lifestyle brands. Focus on

building more growing, global lifestyle brands

with an emphasis on younger consumers and

on female consumers.

2. Expand our share with winning customers. Adapt

our organizational structure to a more customer-

specific focus to more successfully expand market

share and leverage new business opportunities

with these successful retailers.

3. Stretch our brands and customers to new geographies.

Grow our international presence, particularly

in rapidly expanding economies such as those

in the Far East.

4. Fuel the growth. Leverage our supply chain and

information technology capabilities across VF

to drive costs and inventory levels lower, increase

productivity and integrate acquisitions efficiently.

5.Build new growth enablers. Support our growth

plans by identifying and developing high potential

employees and by recruiting qualified leaders with

new skill sets.

Highlights of 2004

There were several notable actions and results in 2004:

•Sales, net income, earnings per share and cash flow

were each at record levels.

•VF completed four acquisitions – Vans® brand

performance and casual footwear and apparel for

skateboarders and other action sports participants

and enthusiasts (“Vans”); Kipling® brand backpacks,

bags and accessories (“Kipling”); Napapijri® brand

premium outdoor-based sportswear (“Napapijri”);

and a 51% interest in an intimate apparel marketing

company in Mexico. These are collectively referred

to as the “2004 Acquisitions.”

•Net sales increased 16% to $6,054.5 million.

In addition to sales of the 2004 Acquisitions,

contributing to this increase were a full year of sales

of Nautica (compared with four months in the prior

year following its acquisition) and organic sales

growth in core businesses.

•Net income increased 19% to $474.7 million, and

earnings per share increased 17% to $4.21. (All per

share amounts are presented on a diluted basis.)

These increases resulted from improved operating

performance in most core businesses, plus profit

contributions from our 2004 and 2003 acquisitions

mentioned above.

•We invested $40 million in specific growth and cost

reduction initiatives that will assist VF in meeting its

long-term sales and earnings targets. This spending

was not originally planned for 2004.

•We sold our VF Playwear business, which had been

underperforming in recent years.

•Integration of our recent acquisitions is proceeding

on or ahead of schedule.

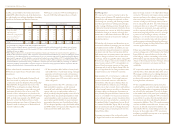

6,055

5,207 5,084

2004 2003 2002

39.8 37.4 36.0

2004 2003 2002

28.5

33.7

28.6

2004 2003 2002

sales

(Dollars in millions)

gross margin

(Percent to sales)

debt to capital ratio

(Percent)