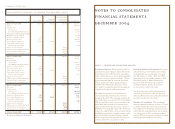

North Face 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57vf corporation 2004 Annual Report

Sportswear: The Sportswear coalition consists of our

Nautica® fashion sportswear, John Varvatos® luxury

apparel and accessories and Earl Jean® fashion jeans

brands, all acquired as part of the Nautica acquisition

in August 2003. Both Coalition Sales and Coalition

Profit include a full year of operating results for 2004,

compared with only four months in 2003. On a

comparable full year basis and as anticipated at the

time of the acquisition, unit sales for the Nautica®

brand declined slightly due to fewer department store

doors. Unit sales also declined at Earl Jean but

advanced at John Varvatos. Also on a comparable full

year basis, Coalition Profit for the Nautica® brand

increased due to improved retail performance resulting

in fewer markdowns and returns, cost reductions,

the exit of an unprofitable product line and other

operating efficiencies.

The operating plan for the Nautica business at

the acquisition date was to (1) restore and rebuild

the brand’s image, (2) stabilize its men’s wholesale

sportswear business by designing product that was

consistent with the brand’s image, (3) grow the other

core businesses, including men’s jeans, retail and

licensing, and (4) exit underperforming businesses.

Several management team changes were made to

drive the needed changes in the business. The 2004

product lines were returned to the more classic

Nautica® brand styling, and we made substantial

progress toward achieving each of the four operating

objectives set forth above. We believe that Nautica

is positioned for growth and increased profitability

in 2005, and we expect another year of significant

growth in John Varvatos.

Other: The Other business segment consists primarily

of VF Playwear. Trademarks and certain operating

assets of this business unit were sold in May 2004.

Inventories and other retained assets were liquidated

during the remainder of the year. The segment loss

in 2004 included net charges of $9.5 million related

to the disposal of this business. See Note C to the

consolidated financial statements for a summary of

VF Playwear’s sales and losses for the three years.

This segment also includes the VF Outlet business

unit, which consists of company-operated retail

outlet stores in the United States that sell a broad

selection of products, primarily excess quantities

of first quality VF products. Sales and profit of

non-VF products (primarily hosiery, underwear

and accessories to provide a broader selection

of merchandise to attract consumer traffic) are

reported in this business segment. Sales and profit

of VF products are reported as part of the operating

results of the respective coalitions.

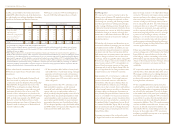

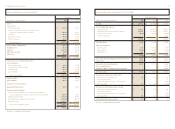

Reconciliation of Coalition Profit to Consolidated

Income before Income Taxes: There are two types of

costs necessary to reconcile total Coalition Profit, as

discussed in the preceding paragraphs, to Consolidated

Income from Continuing Operations before Income

Taxes. These costs, discussed below, are Interest

and Corporate and Other Expenses. See Note R

to the Consolidated Financial Statements.

Interest Expense, Net, was discussed in the previous

“Consolidated Statements of Income” section.

Interest is excluded from Coalition Profit because

substantially all of our financing costs are managed

at the corporate office and are not under the control

of coalition management.

Corporate and Other Expenses consists of corporate

and similar costs that are not apportioned to the

operating coalitions. These expenses are summarized

as follows and discussed in the paragraphs below:

•Information Systems – Included are costs of our

U.S.-based management information systems and

of our centralized shared services center. Operating

costs of information systems and shared services

are charged to the coalitions based on utilization

of those services, such as minutes of computer

processing time, number of transactions or number

of users. However, costs to develop new computer

applications that will be used across VF are not

allocated to the coalitions. The biggest factor in

the information systems cost increase in 2004 was

$8.3 million of consulting, severance and asset

write-downs related to outsourcing certain of our

information technology needs to a major third party

service provider.

•Corporate Headquarters’ Costs – Headquarters’

costs include compensation and benefits of corpo-

rate management and staff, legal and professional

fees, and administrative and general expenses,

which are not apportioned to the coalitions.

Costs increased in 2004 primarily due to a

$15.0 million increase in incentive compensation

related to VF’s strong 2004 financial performance

relative to its targets. Also included in 2004 was

$5.8 million of consulting and research expenses

related to VF’s growth and cost saving initiatives.

•Trademark Maintenance and Enforcement – Legal

and other costs of registering, maintaining and

enforcing VF’s portfolio of trademarks, plus

costs of licensing administration, are controlled

by a centralized trademark and licensing staff

and are not allocated to the coalitions.

•Other – This category includes (1) adjustments to

convert the earnings of certain business units using

the FIFO inventory valuation method for internal

reporting to the LIFO method for consolidated

financial reporting, (2) other consolidating adjust-

ments and (3) miscellaneous costs that result from

corporate programs or corporate-managed deci-

sions that are not allocated to the business units

for internal management reporting. In 2002, this

category included a special $8.0 million incentive

compensation payment covering most employees

and an increase of $3.7 million in worker’s

compensation expense based on consultation with

our independent adviser. These charges were

retained in corporate for internal management

reporting and not apportioned to the coalitions

due to the nature of these items and the inability

of our coalition management to influence them.

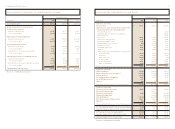

analysis of financial condition

Balance Sheets

Accounts Receivable increased in 2004 primarily

due to the 2004 Acquisitions. The number of days’

sales outstanding increased slightly in 2004 due to

longer terms offered to customers at certain of the

2004 Acquisitions.

Inventories increased in 2004 due to the 2004

Acquisitions. Inventory levels at core businesses

declined 3% from the end of 2003. Inventories have

been declining in recent years through more efficient

sales forecasting and production planning techniques.

In addition, sales near the end of 2004 were higher

than forecasted, resulting in inventory levels

below expectations.

Property, Plant and Equipment declined in 2004

because depreciation expense during the year

exceeded the sum of capital spending and assets

acquired as part of the 2004 Acquisitions. Intangible

Assets and Goodwill each increased in 2004 due

to the 2004 Acquisitions. See Notes B, F, G and H

to the Consolidated Financial Statements.

Deferred Income Taxes, recorded as noncurrent assets,

declined in 2004 due to the inclusion of $85.6 million

of noncurrent deferred income tax credits arising

from the 2004 Acquisitions. These deferred tax

credits related primarily to Intangible Assets of the

acquired companies.

Accounts Payable increased in 2004 due to the 2004

Acquisitions and growth in our businesses. Accrued

Liabilities increased due to the 2004 Acquisitions

and an increase in accrued compensation related to

increased incentive compensation payable based on

VF’s strong 2004 performance relative to its targets.

In millions 2004 2003 2002

Information systems $137.1 $ 125.1 $ 126.4

Less costs apportioned to segments (108.4) (102.1) (101.1)

28.7 23.0 25.3

Corporate headquarters’ costs 69.6 46.7 47.5

Trademark maintenance and enforcement 12.9 10.3 11.3

Other (2.0) 1.5 19.4

Corporate and Other Expenses $109.2 $ 81.5 $ 103.5