North Face 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

vf corporation 2004 Annual Report

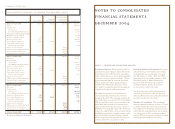

notes to consolidated

financial statements

december 2004

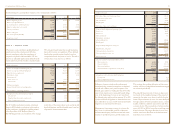

Description of Business: VF Corporation (“VF”) is a

multinational consumer apparel company based in the

United States (“U.S.”). VF, through its subsidiaries,

designs and manufactures or sources from independent

contractors a variety of apparel for all ages. VF has

significant market shares in jeanswear, sportswear,

intimate apparel and outdoor apparel marketed

primarily under VF-owned brand names. VF is

also a leader in occupational apparel and in daypacks,

backpacks and technical outdoor equipment.

VF markets these products to a broad customer

base of specialty, department and discount stores

throughout the world. VF’s ten largest customers, all

U.S.-based retailers, accounted for 38% of consolidated

2004 sales and 29% of total accounts receivable at the

end of 2004. Sales are made on an unsecured basis

under customary terms that may vary by channel of

distribution or by geographic region. VF continuously

monitors the creditworthiness of its customers and has

established internal policies regarding customer credit

limits. The breadth of product offerings, combined

with the large number and geographic diversity of its

customers, limits VF’s concentration of risks.

Fiscal Year and Basis of Presentation: VF operates

and reports using a 52/53 week fiscal year ending

on the Saturday closest to December 31 of each

year. All references to “2004”, “2003” and “2002”

relate to the fiscal years ended on January 1, 2005

(52 weeks), January 3, 2004 (52 weeks) and

January 4, 2003 (53 weeks), respectively. For

presentation purposes herein, all fiscal years

are presented as ended in December.

The financial position, results of operations and

cash flows of two businesses that were disposed

of during 2002 have been presented as discontinued

operations for all periods. See Note C.

Principles of Consolidation: The consolidated

financial statements include the accounts of VF and

its wholly-owned and majority-owned subsidiaries,

after elimination of intercompany transactions and

profits. Minority ownership interests are not signifi-

cant. Investments in 50%-owned joint ventures,

in which VF does not exercise control, are accounted

for using the equity method of accounting.

note a – significant accounting policies

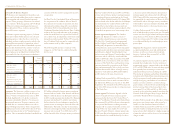

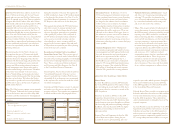

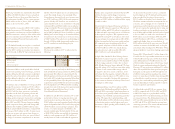

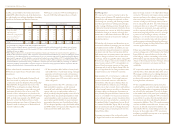

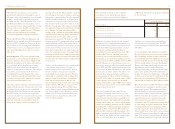

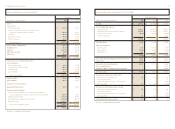

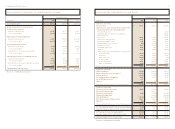

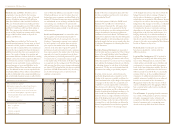

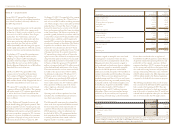

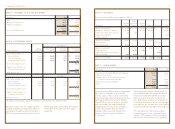

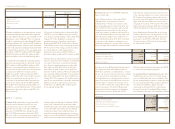

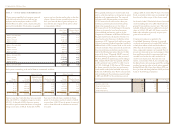

consolidated statements of common stockholders’equity

Accumulated Other

Additional Comprehensive

In thousands Common Stock Paid-in Capital Income (Loss) Retained Earnings

Balance, December 2001 $ 109,998 $ 884,638 $ (103,040) $ 1,221,200

Net loss – – – (154,543)

Cash dividends:

Common Stock – – – (106,018)

Series B Redeemable Preferred Stock – – – (2,755)

Tax benefit from Preferred Stock dividends – – – 12

Redemption of Preferred Stock – – – (5,780)

Conversion of Preferred Stock 182 – – 3,332

Purchase of treasury shares (3,000) – – (121,623)

Stock compensation plans, net 1,345 45,494 – (381)

Common Stock held in trust for

deferred compensation plans – – – (112)

Foreign currency translation – – 25,441 –

Minimum pension liability adjustment – – (126,841) –

Derivative financial instruments – – (9,461) –

Unrealized losses on marketable securities – – (240) –

Balance, December 2002 108,525 930,132 (214,141) 833,332

Net income – – – 397,933

Cash dividends:

Common Stock – – – (109,020)

Series B Redeemable Preferred Stock – – – (2,238)

Conversion of Preferred Stock 358 – – 6,556

Purchase of treasury shares (1,680) – – (59,720)

Stock compensation plans, net 943 34,858 – (333)

Common Stock held in trust for

deferred compensation plans 24 – – 1,092

Foreign currency translation – – 48,843 –

Minimum pension liability adjustment – – (32,356) –

Derivative financial instruments – – 819 –

Unrealized gains on marketable securities – – 7,380 –

Balance, December 2003 108,170 964,990 (189,455) 1,067,602

Net income – – – 474,702

Cash dividends:

Common Stock – – – (115,900)

Series B Redeemable Preferred Stock – – – (1,831)

Conversion of Preferred Stock 205 – – 3,729

Stock compensation plans, net 3,026 122,651 – (273)

Common Stock held in trust for

deferred compensation plans (13) – – (746)

Foreign currency translation – – 30,069 –

Minimum pension liability adjustment – – 41,712 –

Derivative financial instruments – – (691) –

Unrealized gains on marketable securities – – 5,294 –

Balance, December 2004 $111,388 $ 1,087,641 $ (113,071) $ 1,427,283

See notes to consolidated financial statements.