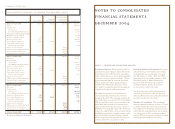

North Face 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89vf corporation 2004 Annual Report

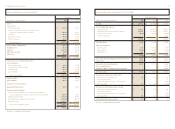

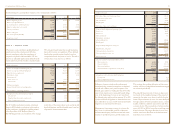

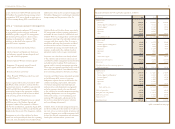

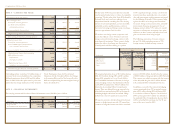

Dollars in thousands 2004 2003

Fair value of plan assets, beginning of year $ 647,723 $ 519,013

Actual return on plan assets 68,583 86,290

VF contributions 57,947 77,481

Benefits paid (40,447) (35,061)

Fair value of plan assets, end of year 733,806 647,723

Projected benefit obligations, beginning of year 957,437 797,173

Service cost 22,470 18,475

Interest cost 59,272 53,883

Plan amendments 25,783 501

Partial plan curtailment (3,188) –

Actuarial (gain) loss (14,897) 122,466

Benefits paid (40,447) (35,061)

Projected benefit obligations, end of year 1,006,430 957,437

Funded status, end of year (272,624) (309,714)

Unrecognized net actuarial loss267,727 321,375

Unrecognized prior service cost 32,642 17,919

Pension asset, net $27,745 $ 29,580

Amounts included in Consolidated Balance Sheets:

Noncurrent assets $46,960 $ 17,919

Current liabilities (55,000) (55,000)

Noncurrent liabilities (158,521) (193,614)

Accumulated other comprehensive income (loss) 194,306 260,275

$27,745 $ 29,580

Assumptions used to determine benefit obligations:

Discount rate 6.10%6.00%

Rate of compensation increase 3.75%3.75%

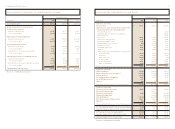

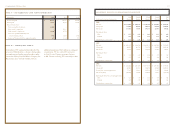

Dollars in thousands 2004 2003 2002

Service cost – benefits earned during the year $ 22,470 $ 18,475 $ 18,240

Interest cost on projected benefit obligations 59,272 53,883 51,734

Expected return on plan assets (59,728) (48,225) (50,433)

Curtailment charge 7,100 – 2,388

Amortization of:

Prior service cost 3,960 3,138 4,243

Actuarial loss 24,697 28,425 1,370

Total pension expense 57,771 55,696 27,542

Amount allocable to discontinued operations –– 1,317

Pension expense – continuing operations $ 57,771 $ 55,696 $ 26,225

Assumptions used to determine pension expense:

Discount rate 6.00%6.75%7.50%

Expected long-term return on plan assets 8.50%8.75%8.75%

Rate of compensation increase 3.75%4.00%4.00%

The $7.1 million partial pension plan curtailment

charge in 2004 related to reductions in the number

of plan participants, including $2.9 million related

to the disposition of VF Playwear (Note C).

The following provides a reconciliation of the changes

in fair value of the pension plans’ assets and projected

benefit obligations, and their funded status, based on

a September 30 measurement date:

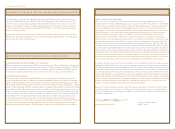

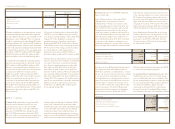

note n – benefit plans

VF sponsors a noncontributory qualified defined

benefit pension plan covering most full-time

domestic employees other than employees of

companies acquired in 2004 and 2003. VF also

sponsors an unfunded supplemental defined benefit

pension plan that provides benefits computed under

VF’s principal benefit plan that exceed limitations

imposed by income tax regulations. These defined

benefit plans provide pension benefits based on

compensation levels and years of service. The effect

of these plans on income was as follows:

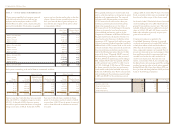

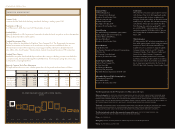

In thousands 2004 2003 2002

Balance, beginning of year $ 28,852 $ 25,782 $ 21,698

Balances of acquired businesses 347 ––

Accrual for products sold during the year 10,788 10,597 8,548

Repair or replacement costs incurred (6,840) (8,552) (5,293)

Currency translation 1,022 1,025 829

Balance, end of year 34,169 28,852 $ 25,782

Less current portion (Note K) 7,193 8,426

Long-term accrual $ 26,976 $ 20,426

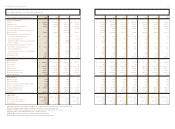

Differences between actual results and amounts

determined using actuarial assumptions are deferred

and will affect future years’ pension expense. Net

deferred gains and losses totaling less than 10% of the

lower of investment assets or projected benefit obliga-

tions at the beginning of a year are not amortized.

Net deferred gains and losses that represent 10 to 20%

of projected benefit obligations are amortized over ten

years, while those in excess of 20% of projected benefit

obligations are amortized over five years.

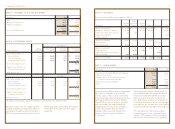

Management’s investment strategy is to invest the

plan’s assets in a diversified portfolio of domestic

and international equity, fixed income and real estate

securities to provide long-term growth in plan assets.

This strategy, the resulting allocation of plan assets

and the selection of independent investment managers

are reviewed periodically.

The expected long-term rate of return on plan assets

was based on the weighted average of the expected

returns for the major asset classes in which the plan

invests. Expected returns by asset class were developed

through analysis of historical market returns, current

market conditions, inflation expectations and other

economic factors. The assumed rate of return on plan

assets of 8.50% in 2004 is lower than actual long-term

historical returns. The target allocation by asset class,

and the actual asset allocations at the latest measure-

ment dates, were as follows:

Activity relating to accrued product warranty costs is summarized as follows: