North Face 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

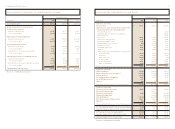

55vf corporation 2004 Annual Report

Information by Business Segment

VF’s businesses are organized into five product cate-

gories, and by brands within those product categories,

for management and internal financial reporting

purposes. These groupings of businesses are referred

to as “coalitions.” Both management and VF’s Board

of Directors evaluate operating performance at

the coalition level. These coalitions represent VF’s

reportable business segments.

For business segment reporting purposes, Coalition

Sales and Coalition Profit represent net sales and

operating expenses under the direct control of an

individual coalition, royalty income for which it has

responsibility, amortization of acquisition-related

intangible assets and its share of centralized corporate

expenses directly related to the coalition. Corporate

expenses not apportioned to the coalitions and net

interest expense are excluded from Coalition Profit.

Importantly, this basis of performance evaluation is

consistent with that used for management incentive

compensation.

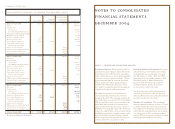

See Note R to the Consolidated Financial Statements

for composition of the coalitions. Also see Note R

for a summary of our results of operations and other

information by coalition, along with a reconciliation

of Coalition Profit to Consolidated Income from

Continuing Operations before Income Taxes. Coalition

results are not necessarily indicative of the operating

results that would have been reported had each busi-

ness coalition been an independent, stand-alone entity

during the periods presented. Further, VF’s presenta-

tion of Coalition Profit may not be comparable with

similar measures used by other companies.

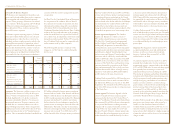

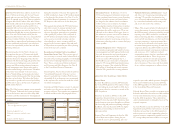

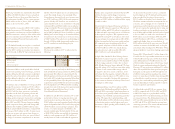

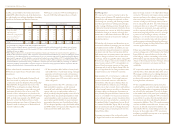

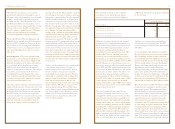

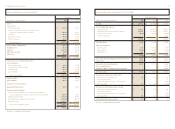

The following table presents a summary of the

changes in our Net Sales by coalition during the

last two years:

Jeanswear: The Jeanswear coalition consists of our

global jeanswear businesses, led by the Wrangler®

and Lee® brands. Overall jeanswear sales in 2004

declined slightly, with a 3% decline in domestic

jeanswear substantially offset by a 7% increase in

international jeanswear. Domestic jeanswear sales

declined due to a continued reduction in sales to

Kmart Holding Corporation, which emerged from

bankruptcy protection in 2003, lower sales of off-price

product and reduced sales of Lee® branded women’s

products. Sales in international markets benefited from

$57 million of favorable foreign currency translation.

Increased sales in Canada, Latin America and Mexico

helped to offset declines in our European businesses.

In 2003, overall jeanswear sales declined 4%. Domestic

jeanswear sales declined 7%, with the unit volume

decline related to the two bankruptcies noted in the

previous section accounting for almost all of the sales

dollar decline. The balance was due to selected price

reductions and changes in product mix. International

jeanswear sales increased 5% in 2003 due to a $72

million favorable effect of foreign currency translation.

Jeanswear Coalition Profit increased 9% in 2004 due

to lower sales of off-price products and improvements

in operating efficiencies, particularly in the United

States. Coalition Profit declined by 12% during 2003,

with two-thirds of the decline related to the bankrupt-

cies mentioned above. Coalition Profit in 2003 also

declined due to selected price decreases and a net

change in product mix (lower margin products), offset

by benefits from previous years’ restructuring actions.

Outdoor Apparel and Equipment: The Outdoor

Apparel and Equipment coalition consists of

VF’s outdoor-related businesses represented by

The North Face® brand (apparel and equipment)

and the JanSport® and Eastpak® brands (apparel

and daypacks). Acquisitions in 2004 added Vans®

brand performance and casual footwear and apparel

for skateboarders and other action sports participants

and enthusiasts, Kipling® brand backpacks, bags

and accessories and Napapijri® brand outdoor-based

sportswear, which collectively contributed $296

million to 2004 sales. Sales increased in both 2004

and 2003 in the core businesses, with unit volume

increases at The North Face resulting from strong

consumer demand for its products in the United

States and internationally. Sales in both years bene-

fited from the favorable effects of foreign currency

translation – $23 million in 2004 and $31 million

in 2003 relative to the respective prior year.

Coalition Profit increased 61% in 2004 over the prior

year and increased 34% in 2003 over 2002. About

one-half of the 2004 increase was due to the 2004

Acquisitions. The remainder of the 2004 increase and

most of the 2003 increase was due to volume increases

at The North Face.

Intimate Apparel: The Intimate Apparel coalition

consists of our global women’s intimate apparel

businesses, led by the Vanity Fair®, Lily of France®,

Vassarette® and Bestform® brands in the United States.

Sales increased 9% in 2004, with unit volume growth

in our private label business resulting from new

programs sold to a major private label customer and

unit growth in our mass market Vassarette® and

Curvation® brands. Domestic intimate apparel sales

in 2003 were flat in the department store and mass

market channels, but overall declined by 3% due to

a decrease in private label programs. International

intimate apparel sales advanced in both 2004 and

2003. During 2004, the comparison was helped by

the acquisition of a new business in Mexico in 2004

and favorable effects of foreign currency translation

of $16 million. Currency translation benefited 2003

by $25 million relative to the respective prior year.

Coalition Profit increased 37% in 2004 and declined

11% in 2003 from the respective prior year. The 2004

increase was due to higher volume and improved oper-

ating efficiencies. The decline in 2003 resulted from

lower sales volume and a $7.7 million charge related

to a withdrawal liability for a multiemployer union

pension plan.

Imagewear: The Imagewear coalition includes VF’s

occupational (industrial, career and safety) apparel

business, as well as our licensed sports apparel

business. Coalition Sales increased 6% in 2004

and declined 3% in 2003.

Occupational apparel sales increased 5% in 2004,

primarily due to higher sales of service uniforms to

governmental agencies, compared with a sales decline

of 9% in 2003. While sales of career and safety apparel

have generally been increasing in recent years,

industrial workwear has been declining since 2000.

This decline in workwear resulted from (1) workforce

reductions in the United States manufacturing sector,

which has impacted overall workwear uniform sales,

and (2) the ongoing consolidation of our industrial

laundry customers and those customers placing

greater reliance on their in-house manufacturing and

product sourcing. Sales of the licensed sports busi-

nesses grew 15% in 2004 and 16% in 2003, led by

increases in sales of products under license from the

National Football League, Major League Baseball

and Harley-Davidson Motor Company, Inc.

Coalition Profit increased 14% in 2004 due to volume

gains across most business units, offset in part by a

small loss in the distributor knitwear business.

Coalition Profit increased 18% in 2003 due to cost

reduction benefits resulting from prior years’ restruc-

turing actions, which allowed for a higher margin on

a lower sales volume, and the absence of restructuring

charges in 2003.

Outdoor

Apparel and Intimate

In millions Jeanswear Equipment Apparel Imagewear Sportswear Other

Net sales – 2002 $2,789 $ 508 $ 840 $ 752 $ – $ 195

Core businesses (122) 73 (10) (40) – (11)

Acquisitions in current year – – – 15 249 –

Disposition of VF Playwear – – – – – (31)

Net sales – 2003 2,667 581 830 727 249 153

Core businesses (5) 127 68 31 – 14

Acquisitions in prior year – – – 12 355 –

Acquisitions in current year – 296 6 – 1 –

Disposition of VF Playwear – – – – – (57)

Net sales – 2004 $2,662 $ 1,004 $ 904 $ 770 $ 605 $ 110