NVIDIA 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

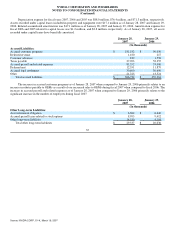

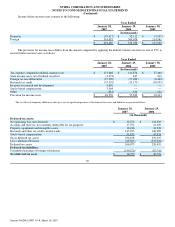

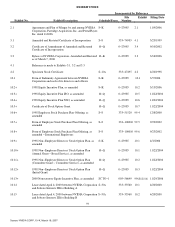

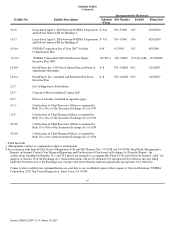

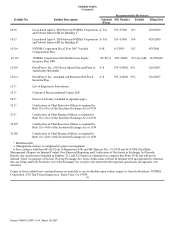

Income tax expense as a percentage of income before taxes, or our annual effective tax rate, was 9.4% in fiscal 2007, 15.6% in fiscal

2006, and 17.2% in fiscal 2005. The difference in the effective tax rates amongst the three years was primarily a result of changes in

our geographic mix of income subject to tax, with the additional change in mix in fiscal 2007 due to certain stock−based

compensation expensed for financial accounting purposes under SFAS No. 123(R), and an increase in the amount of research tax

credit benefit in fiscal 2007.

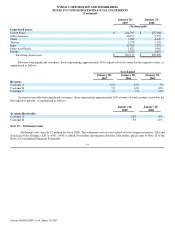

As of January 28, 2007, we had a valuation allowance of $68.6 million. Of the total valuation allowance, $3.7 million relates to

state tax attributes acquired in certain acquisitions for which realization of the related deferred tax assets was determined not likely to

be realized due, in part, to potential utilization limitations as a result of stock ownership changes, and $64.9 million relates to state

deferred tax assets that management determined not likely to be realized due, in part, to projections of future taxable income. To the

extent realization of the deferred tax assets related to certain acquisitions becomes probable, recognition of these acquired tax benefits

would first reduce goodwill to zero, then reduce other non−current intangible assets related to the acquisition to zero with any

remaining benefit reported as a reduction to income tax expense. To the extent realization of the deferred tax assets related to state tax

benefits becomes probable, we would recognize an income tax benefit in the period such asset is more likely than not to be realized.

As of January 28, 2007, with the adoption of SFAS No. 123(R), we have derecognized both deferred tax assets for the excess of

tax benefit related to stock−based compensation, reflected in our federal and state net operating loss and research tax credit

carryforwards, and the offsetting valuation allowance. Consistent with prior years, the excess tax benefit reflected in our net operating

loss and research tax credit carryforwards, in the amount of $344.9 million as of January 28, 2007, will be accounted for as a credit to

stockholders' equity, if and when realized. In determining if and when excess tax benefits have been realized, we have elected to do so

on a “with−and−without” approach with respect to such excess tax benefits. We have also elected to ignore the indirect tax effects of

stock−based compensation deductions for financial and accounting reporting purposes, and specifically to recognize the full effect of

the research tax credit in income from continuing operations.

As of January 28 2007, we had a federal net operating loss carryforward of approximately $770.5 million and cumulative state

net operating loss carryforwards of approximately $584.1 million. The federal net operating loss carryforward will expire beginning in

fiscal 2012 and the state net operating loss carryforwards will begin to expire in fiscal 2008 according to the rules of each particular

state. As of January 28, 2007 we had federal research tax credit carryforwards of approximately $129.0 million that will begin to

expire in fiscal 2008. We have other federal tax credit carryforwards of approximately $1.2 million that will begin to expire in fiscal

2011. The research tax credit carryforwards attributable to states is approximately $125.6 million, of which approximately $121.3

million is attributable to the State of California and may be carried over indefinitely, and approximately $4.3 million is attributable to

various other states and will expire beginning in fiscal 2016 according to the rules of each particular state. We have other California

state tax credit carryforwards of approximately $4.8 million that will begin to expire in fiscal 2009. Utilization of net operating losses

and tax credit carryforwards may be subject to limitations due to ownership changes and other limitations provided by the Internal

Revenue Code and similar state provisions. If such a limitation applies, the net operating loss and tax credit carryforwards may expire

before full utilization.

As of January 28, 2007, United States federal and state income taxes have not been provided on approximately $304.0 million

of undistributed earnings of non−United States subsidiaries as such earnings are considered to be permanently reinvested.

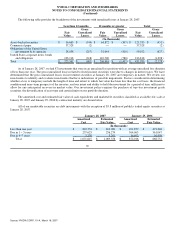

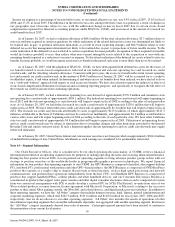

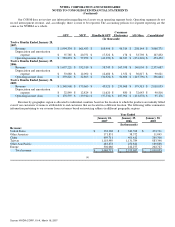

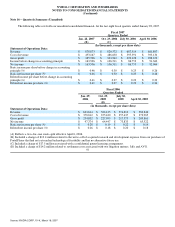

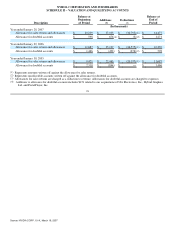

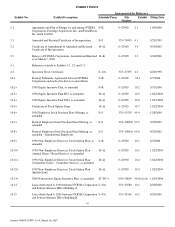

Note 14 − Segment Information

Our Chief Executive Officer, who is considered to be our chief operating decision maker, or CODM, reviews financial

information presented on an operating segment basis for purposes of making operating decisions and assessing financial performance.

During the first quarter of fiscal 2006, we reorganized our operating segments to bring all major product groups in line with our

strategy to position ourselves as the worldwide leader in programmable graphics processor technologies. We report financial

information for four product−line operating segments to our CODM: the GPU Business is composed of products that support desktop

PCs, notebook PCs, professional workstations and other GPU−based products; the MCP Business is composed of NVIDIA nForce

products that operate as a single−chip or chipset that provide system functions, such as high speed processing and network

communications, and perform these operations independently from the host CPU; our Handheld GPU Business is composed of

products that support handheld PDAs, cellular phones and other handheld devices; and our Consumer Electronics Business is

concentrated in products that support video game consoles and other digital consumer electronics devices and is composed of revenue

from our contractual arrangements with SCE to jointly develop a custom GPU for SCE's PlayStation3, revenue from sales of our

Xbox−related products, revenue from our license agreement with Microsoft Corporation, or Microsoft, relating to the successor

product to their initial Xbox gaming console, the Xbox360, and related devices, and digital media processor products. In addition to

these operating segments, we have the “All Other” category that includes human resources, legal, finance, general administration and

corporate marketing expenses, which total $242.3 million, $131.6 million and $118.0 million for fiscal years 2007, 2006 and 2005,

respectively, that we do not allocate to our other operating segments. “All Other” also includes the results of operations of other

miscellaneous operating segments that are neither individually reportable, nor aggregated with another operating segment. Revenue in

the “All Other” category is primarily derived from sales of memory. Certain prior period amounts have been restated to conform to

the presentation of our current fiscal quarter. 89

Source: NVIDIA CORP, 10−K, March 16, 2007