NVIDIA 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In October 2002, 3dfx filed for Chapter 11 bankruptcy protection in the United States Bankruptcy Court for the Northern District

of California. In March 2003, we were served with a complaint filed by the Trustee appointed by the Bankruptcy Court which sought,

among other things, payments from us as additional purchase price related to our purchase of certain assets of 3dfx. In early

November 2005, after many months of mediation, NVIDIA and the Official Committee of Unsecured Creditors, or the Creditors'

Committee, reached a conditional settlement of the Trustee's claims against NVIDIA. This conditional settlement, presented as the

centerpiece of a proposed Plan of Liquidation in the bankruptcy case, was subject to a confirmation process through a vote of creditors

and the review and approval of the Bankruptcy Court after notice and hearing. The Trustee advised that he intended to object to the

settlement, which would have called for a payment by NVIDIA of approximately $30.6 million to the 3dfx estate. Under the

settlement, $5.6 million related to various administrative expenses and Trustee fees, and $25.0 million related to the satisfaction of

debts and liabilities owed to the general unsecured creditors of 3dfx. Accordingly, during the three month period ended October 30,

2005, we recorded $5.6 million as a charge to settlement costs and $25.0 million as additional purchase price for 3dfx.

However, the conditional settlement never progressed substantially through the confirmation process. On December 21, 2005, the

Bankruptcy Court determined that it would schedule trial of one portion of the Trustee's case against NVIDIA. On January 2, 2007,

NVIDIA exercised its right to terminate the settlement agreement on grounds that the bankruptcy court had failed to proceed toward

confirmation of the Creditors' Committee's plan. Beginning on March 21, 2007, NVIDIA and the Trustee are scheduled to try the

question of the value of the assets 3dfx conveyed to NVIDIA and, in particular, whether the price NVIDIA paid for those assets was

reasonably equivalent to the value of the assets 3dfx sold to NVIDIA.

Please refer to Note 12 of the Notes to Consolidated Financial Statements for further information regarding this litigation.

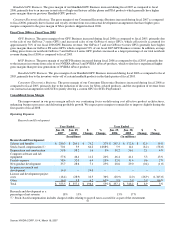

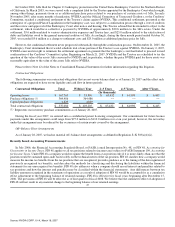

Contractual Obligations

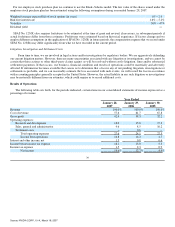

The following summarizes our contractual obligations that are not on our balance sheet as of January 28, 2007 and the effect such

obligations are expected to have on our liquidity and cash flow in future periods:

Contractual Obligations Total Within 1 Year 2−3 Years 4−5 Years After 5 Years

(In thousands)

Operating leases $ 167,765 $ 33,890 $ 65,432 $ 61,998 $ 6,445

Purchase obligations (1) 364,486 364,486 −− −− −−

Capital purchase obligations 4,829 4,829

Total contractual obligations $ 537,080 $ 403,205 $ 65,432 $ 61,998 $ 6,445

(1) Represents our inventory purchase commitments as of January 28, 2007.

During the fiscal year 2007, we entered into a confidential patent licensing arrangement. Our commitment for future license

payments under this arrangement could range from $97.0 million to $110.0 million over a ten year period; however, the net outlay

under this arrangement may be reduced by the occurrence of certain events covered by the arrangement.

Off−Balance Sheet Arrangements

As of January 28, 2007, we had no material off−balance sheet arrangements as defined in Regulation S−K 303(a)(4)(ii).

Recently Issued Accounting Pronouncements

In July 2006, the Financial Accounting Standards Board, or FASB, issued Interpretation No. 48, or FIN 48, Accounting for

Uncertainty in Income Taxes. FIN 48 applies to all tax positions related to income taxes subject to FASB Statement 109, Accounting

for Income Taxes. Under FIN 48 a company would recognize the benefit from a tax position only if it is more−likely−than−not that the

position would be sustained upon audit based solely on the technical merits of the tax position. FIN 48 clarifies how a company would

measure the income tax benefits from the tax positions that are recognized, provides guidance as to the timing of the derecognition of

previously recognized tax benefits, and describes the methods for classifying and disclosing the liabilities within the financial

statements for any unrecognized tax benefits. FIN 48 also addresses when a company should record interest and penalties related to

tax positions and how the interest and penalties may be classified within the financial statements. Any differences between tax

liability amounts recognized in the statements of operations as a result of adoption of FIN 48 would be accounted for as a cumulative

effect adjustment to the beginning balance of retained earnings. FIN 48 is effective for fiscal years beginning after December 15,

2006. The provisions of FIN 48 will be effective as of first quarter of fiscal 2008. We believe that the cumulative effect of adoption of

FIN 48 will not result in any material change to the beginning balance of our retained earnings.

47

Source: NVIDIA CORP, 10−K, March 16, 2007