NVIDIA 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

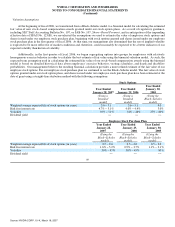

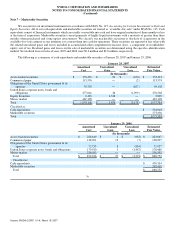

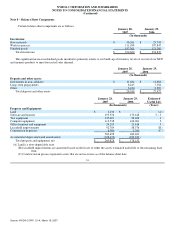

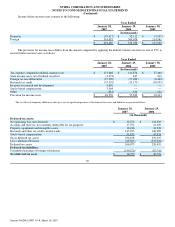

Note 7 − Marketable Securities

We account for our investment instruments in accordance with SFAS No. 115, Accounting for Certain Investments in Debt and

Equity Securities. All of our cash equivalents and marketable securities are treated as “available−for−sale” under SFAS No. 115. Cash

equivalents consist of financial instruments which are readily convertible into cash and have original maturities of three months or less

at the time of acquisition. Marketable securities consist primarily of highly liquid investments with a maturity of greater than three

months when purchased and some equity investments. We classify our marketable securities at the date of acquisition in the

available−for−sale category as our intention is to convert them into cash for operations. These securities are reported at fair value with

the related unrealized gains and losses included in accumulated other comprehensive income (loss), a component of stockholders'

equity, net of tax. Realized gains and losses on the sale of marketable securities are determined using the specific−identification

method. Net realized losses for fiscal years 2007 and 2006 were $0.2 million and $2.8 million, respectively.

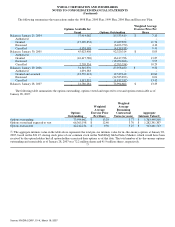

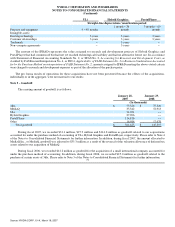

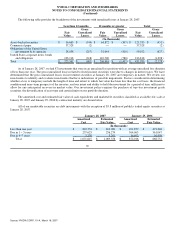

The following is a summary of cash equivalents and marketable securities at January 28, 2007 and January 29, 2006:

January 28, 2007

Amortized

Cost Unrealized

Gain Unrealized

Loss Estimated

Fair Value

(In thousands)

Asset−backed securities $ 153,471 $ 92 $ (450) $ 153,113

Commercial paper 113,576 −− (2) 113,574

Obligations of the United States government & its

agencies 59,729 −− (627) 59,102

United States corporate notes, bonds and

obligations 277,641 26 (1,099) 276,568

Equity Securities 2,491 3,338 −− 5,829

Money market 467,198 −− −− 467,198

Total $ 1,074,106 $ 3,456 $ (2,178) $ 1,075,384

Classified as:

Cash equivalents $ 501,948

Marketable securities 573,436

Total $ 1,075,384

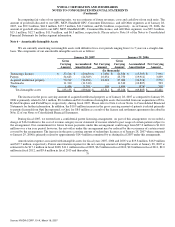

January 29, 2006

Amortized

Cost Unrealized

Gain Unrealized

Loss Estimated

Fair Value

(In thousands)

Asset−backed securities $ 224,649 $ 1 $ (983) $ 223,667

Commercial paper 138,091 13 (7) 138,097

Obligations of the United States government & its

agencies 72,753 8 (834) 71,927

United States corporate notes, bonds and obligations 179,930 5 (1,467) 178,468

Money market 256,593 −− −− 256,593

Total $ 872,016 $ 27 $ (3,291) $ 868,752

Classified as:

Cash equivalents $ 470,334

Marketable securities 398,418

Total $ 868,752

79

Source: NVIDIA CORP, 10−K, March 16, 2007