NVIDIA 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

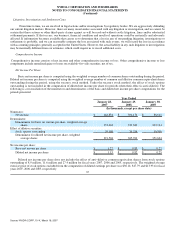

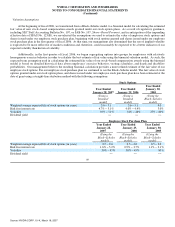

Advertising Expenses

We expense advertising costs in the period in which they are incurred. Advertising expenses for fiscal years 2007, 2006, and

2005 were $14.8 million, $9.2 million, and $15.2 million, respectively.

Rent Expense

We recognize rent expense on a straight−line basis over the lease period and have accrued for rent expense incurred, but not

paid.

Product Warranties

We generally offer limited warranty to end−users that range from one to three years for products in order to repair or replace

products for any manufacturing defects or hardware component failures. Cost of revenue includes the estimated cost of product

warranties that are calculated at the point of revenue recognition. Under limited circumstances, we may offer an extended limited

warranty to customers for certain products.

Foreign Currency Translation

We use the United States dollar as our functional currency for all of our subsidiaries. Foreign currency monetary assets and

liabilities are remeasured into United States dollars at end−of−period exchange rates. Non−monetary assets and liabilities, including

inventories, prepaid expenses and other current assets, property and equipment, deposits and other assets and equity, are remeasured at

historical exchange rates. Revenue and expenses are remeasured at average exchange rates in effect during each period, except for

those expenses related to the previously noted balance sheet amounts, which are remeasured at historical exchange rates. Gains or

losses from foreign currency remeasurement are included in “Other income (expense), net” and to date have not been significant. The

aggregate exchange gain (loss) included in determining net income was $(0.5) million in fiscal 2007, $0.01 million in fiscal 2006 and

$0.04 million in fiscal 2005.

Cash and Cash Equivalents

We consider all highly liquid investments purchased with an original maturity of three months or less at the time of purchase to

be cash equivalents. As of January 28, 2007, our cash and cash equivalents were $544.4 million, which includes $467.2 million

invested in money market funds.

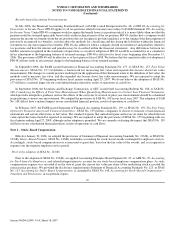

Marketable Securities

We account for our investment instruments in accordance with Statement of Financial Accounting Standards No. 115, or SFAS

No. 115, Accounting for Certain Investments in Debt and Equity Securities. All of our cash equivalents and marketable securities are

treated as “available−for−sale” under SFAS No. 115. Cash equivalents consist of financial instruments which are readily convertible

into cash and have original maturities of three months or less at the time of acquisition. Marketable securities consist primarily of

highly liquid investments with a maturity of greater than three months when purchased and some equity investments. We classify our

marketable securities at the date of acquisition in the available−for−sale category as our intention is to convert them into cash for

operations. These securities are reported at fair value with the related unrealized gains and losses included in accumulated other

comprehensive income (loss), a component of stockholders' equity, net of tax. We follow the guidance provided by Emerging Issues

Task Force Issue No. 03−01, The Meaning of Other−Than−Temporary Impairment and Its Application to Certain Investments, in

order to assess whether our investments with unrealized loss positions are other than temporarily impaired. Realized gains and losses

on the sale of marketable securities are determined using the specific−identification method.

62

Source: NVIDIA CORP, 10−K, March 16, 2007