NVIDIA 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other Issues Identified. We also identified instances where stock option grants did not comply with applicable terms and conditions

of the stock plans from which the grants were issued. For example, two grants were made to officers of NVIDIA by the chief

executive officer under delegated authority; however, under the terms of the applicable plan, the option grant should have been made

by our Board or the Compensation Committee. There were also instances where (1) option grants were made to a small group of

employees who joined NVIDIA pursuant to a business combination, and to a few other employees in certain instances, with stated

exercise prices below the fair market value of our common stock on the actual measurement date of the related grants; and (2) option

grants were made to a few individuals who were contractors rather than employees, without recording the appropriate accounting

charges. In addition, the Audit Committee did not find any evidence that these violations were committed for improper purposes.

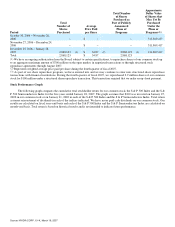

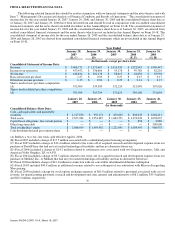

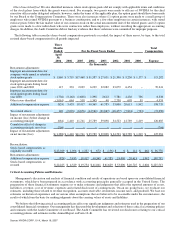

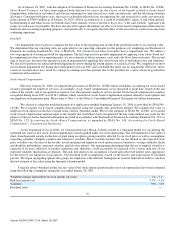

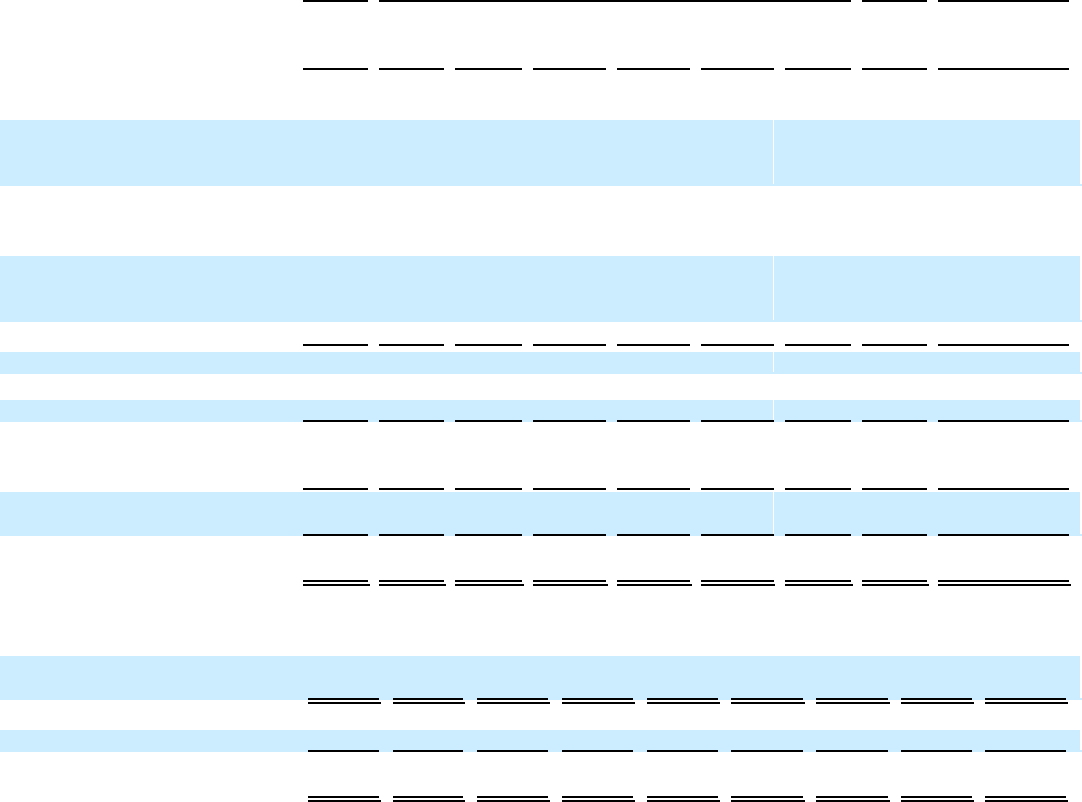

The following table reconciles share−based compensation previously recorded, the impact of these errors, by type, to the total

restated share−based compensation for all periods impacted:

Three

Months

Ended For the Fiscal Years Ended Total

Compensation

April

30,

2006 2006 2005 2004 2003 2002 2001 2000 Expense

(In thousands)

Restatement adjustments:

Improper measurement dates for

company−wide annual or retention

stock option grants $ 1,860 $ 5,719 $17,468 $ 31,387 $ 27,051 $ 21,390 $ 9,230 $ 1,177 $ 115,282

Improper measurement dates for

stock option grants during fiscal

years 2001 and 2002 115 233 2,039 6,239 32,082 23,079 6,454 − 70,241

Improper measurement dates for

stock option grants during fiscal

year 2000 (1,738) (3,163) (1,608) 1,398 2,612 5,781 4,230 726 8,238

Other issues identified (1,061) 644 518 1,345 40 2,750 699 39 4,974

Additional compensation expense (824) 3,433 18,417 40,369 61,785 53,000 20,613 1,942 198,735

Tax related effects 140 (2,023) (6,676) (14,580) (21,887) (18,477) (7,824) (723) (72,050)

Impact of restatement adjustments

on income (loss) before change in

accounting principle (684) 1,410 11,741 25,789 39,898 34,523 12,789 1,219 126,685

Cumulative effect of change in

accounting principle, net of tax (704) − − − − − − − (704)

Impact of restatement adjustments

on net income (loss) $ (1,388) $ 1,410 $11,741 $ 25,789 $ 39,898 $ 34,523 $12,789 $ 1,219 $ 125,981

Reconciliation:

Stock−based compensation, as

originally recorded $ 23,049 $ 1,096 $ 1,337 $ 672 $ (156) $ 6 $ 112 $ 662 $ 26,778

Restatement adjustments:

Additional compensation expense (824) 3,433 18,417 40,369 61,785 53,000 20,613 1,942 198,735

Stock−based compensation, as

restated $ 22,225 $ 4,529 $ 19,754 $ 41,041 $ 61,629 $ 53,006 $ 20,725 $ 2,604 $ 225,513

Critical Accounting Policies and Estimates

Management's discussion and analysis of financial condition and results of operations are based upon our consolidated financial

statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The

preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets,

liabilities, revenue, cost of revenue, expenses and related disclosure of contingencies. On an on−going basis, we evaluate our

estimates, including those related to revenue recognition, accounts receivable, inventories, income taxes, and goodwill. We base our

estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the

results of which form the basis for making judgments about the carrying values of assets and liabilities.

We believe the following critical accounting policies affect our significant judgments and estimates used in the preparation of our

consolidated financial statements. Our management has discussed the development and selection of these critical accounting policies

and estimates with the Audit Committee of our Board. The Audit Committee has reviewed our disclosures relating to our critical

accounting policies and estimates in this Annual Report on Form 10−K.

Source: NVIDIA CORP, 10−K, March 16, 2007