NVIDIA 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

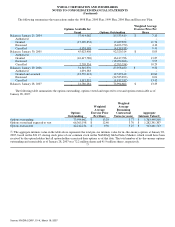

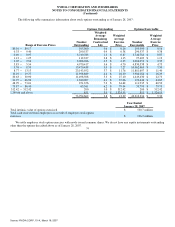

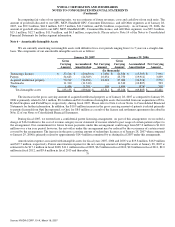

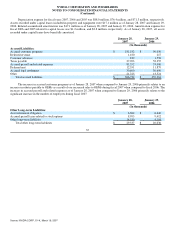

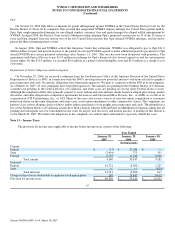

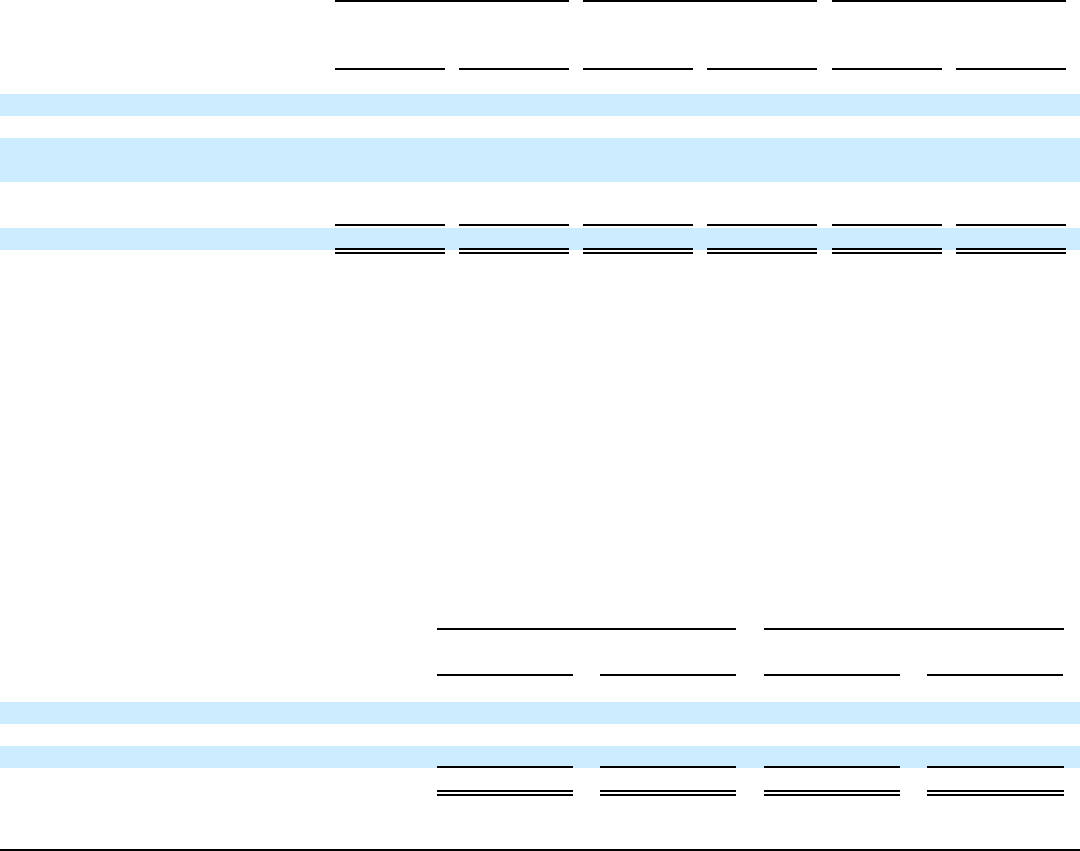

The following table provides the breakdown of the investments with unrealized losses at January 28, 2007:

Less than 12 months 12 months or greater Total

Fair

Value

Gross

Unrealized

Losses Fair

Value

Gross

Unrealized

Losses Fair

Value

Gross

Unrealized

Losses

(In thousands)

Asset−backed securities $ 56,663 $ (144) $ 64,872 $ (307) $ 121,535 $ (451)

Commercial paper 37,528 (2) −− −− 37,528 (2)

Obligations of the United States

government & its agencies 28,058 (217) 31,044 (410) 59,102 (627)

United States corporate notes, bonds

and obligations 103,118 (318) 110,700 (780) 213,818 (1,098)

Total $ 225,367 $ (681) $ 206,616 $ (1,497) $ 431,983 $ (2,178)

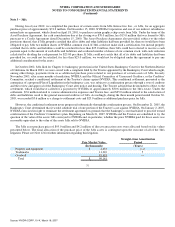

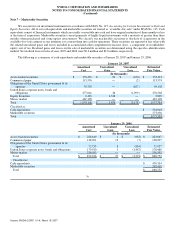

As of January 28, 2007, we had 87 investments that were in an unrealized loss position with an average unrealized loss duration

of less than one year. The gross unrealized losses related to fixed income securities were due to changes in interest rates. We have

determined that the gross unrealized losses on investment securities at January 28, 2007 are temporary in nature. We review our

investments to identify and evaluate investments that have indications of possible impairment. Factors considered in determining

whether a loss is temporary include the length of time and extent to which fair value has been less than the cost basis, the financial

condition and near−term prospects of the investee, and our intent and ability to hold the investment for a period of time sufficient to

allow for any anticipated recovery in market value. Our investment policy requires the purchase of top−tier investment grade

securities, the diversification of asset type and certain limits on our portfolio duration.

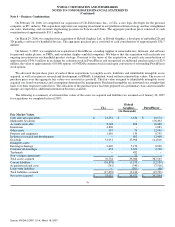

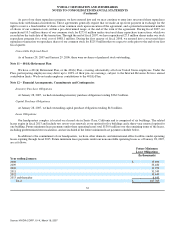

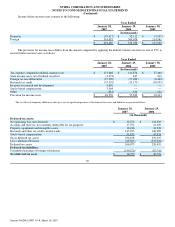

The amortized cost and estimated fair value of cash equivalents and marketable securities classified as available−for−sale at

January 28, 2007 and January 29, 2006 by contractual maturity are shown below.

All of our marketable securities are debt instruments with the exception of $5.8 million of publicly traded equity securities at

January 28, 2007.

January 28, 2007 January 29, 2006

Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value

(In thousands)

Less than one year $ 810,754 $ 810,081 $ 491,259 $ 491,246

Due in 1 − 5 years 257,623 256,274 364,065 361,047

Due in 6−7 years 3,238 3,201 16,692 16,459

Total $ 1,071,615 $ 1,069,556 $ 872,016 $ 868,752

80

Source: NVIDIA CORP, 10−K, March 16, 2007