NVIDIA 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

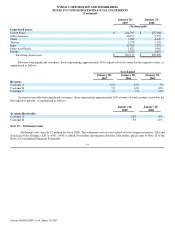

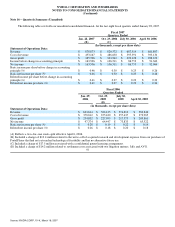

Rent expense for the years ended January 28, 2007, January 29, 2006 and January 30, 2005 was $32.6 million, $29.5 million,

and $28.0 million, respectively.

Litigation

3dfx

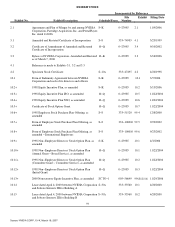

On December 15, 2000, NVIDIA Corporation and one of our indirect subsidiaries entered into an agreement to purchase certain

graphics chip assets from 3dfx which closed on April 18, 2001.

In May 2002, we were served with a California state court complaint filed by the landlord of 3dfx's San Jose, California

commercial real estate lease, CarrAmerica. In December 2002, we were served with a California state court complaint filed by the

landlord of 3dfx's Austin, Texas commercial real estate lease, Carlyle Fortran Trust. The landlords' complaints both asserted claims

for, among other things, interference with contract, successor liability and fraudulent transfer and seek to recover, among other things,

amounts owed on their leases with 3dfx in the aggregate amount of approximately $15 million. In October 2002, 3dfx filed for chapter

11 bankruptcy protection in the United States Bankruptcy Court for the Northern District of California. The landlords' actions were

subsequently removed to the United States Bankruptcy Court for the Northern District of California and consolidated, for purposes of

discovery, with a complaint filed by the Trustee in the 3dfx bankruptcy case. Upon motion by NVIDIA in 2005, the District Court

withdrew the reference to the Bankruptcy Court and the landlord actions were removed to the United States District Court for the

Northern District of California. On November 10, 2005, the District Court granted our motion to dismiss the landlords' respective

amended complaints and allowed the landlords to have until February 4, 2006 to amend their complaints. The landlords re−filed

claims against NVIDIA in early February 2006, and NVIDIA again filed motions requesting the District Court to dismiss all such

claims. The District Court took both motions under submission. On September 29, 2006, the court dismissed the CarrAmerica action

in its entirety and without leave to amend. The court found, among other things, that CarrAmerica lacks standing to bring the lawsuit

and that such standing belongs exclusively to the bankruptcy trustee. On October 27, 2006, CarrAmerica filed a notice of appeal from

that order. On December 15, 2006, the District Court also dismissed the Carlyle complaint in its entirety, finding that Carlyle lacked

standing to pursue some of its claims, and that certain other claims were substantively unmeritorious. NVIDIA has filed motions to

recover its litigation costs and attorneys fees against both Carlyle and Carr. Those motions are currently scheduled for hearing in early

April, 2007.

In March 2003, we were served with a complaint filed by the Trustee appointed by the Bankruptcy Court to represent the interests

of the 3dfx bankruptcy estate. The Trustee's complaint asserts claims for, among other things, successor liability and fraudulent

transfer and seeks additional payments from us. On October 13, 2005, the Court held a hearing on the Trustee's motion for summary

adjudication. On December 23, 2005, the Court issued its ruling denying the Trustee's Motion for Summary Adjudication in all

material respects and holding that NVIDIA is prevented from disputing that the value of the 3dfx transaction to NVIDIA was less than

$108.0 million. The Court expressly denied the Trustee's request to find that the value of the 3dfx assets conveyed to NVIDIA were at

least $108.0 million. In early November 2005, after many months of mediation, NVIDIA and the Official Committee of Unsecured

Creditors, or the Creditors' Committee, reached a conditional settlement of the Trustee's claims against NVIDIA. This conditional

settlement, presented as the centerpiece of a proposed Plan of Liquidation in the bankruptcy case, was subject to a confirmation

process through a vote of creditors and the review and approval of the Bankruptcy Court after notice and hearing. The Trustee advised

that he intended to object to the settlement, which would have called for a payment by NVIDIA of approximately $30.6 million to the

3dfx estate. Under the settlement, $5.6 million related to various administrative expenses and Trustee fees, and $25.0 million related to

the satisfaction of debts and liabilities owed to the general unsecured creditors of 3dfx. Accordingly, during the three month period

ended October 30, 2005, we recorded $5.6 million as a charge to settlement costs and $25.0 million as additional purchase price for

3dfx.

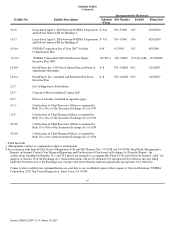

However, the conditional settlement never progressed substantially through the confirmation process. On December 21, 2005, the

Bankruptcy Court determined that it would schedule trial of one portion of the Trustee's case against NVIDIA. On January 2, 2007,

NVIDIA exercised its right to terminate the settlement agreement on grounds that the bankruptcy court had failed to proceed toward

confirmation of the Creditors' Committee's plan. 85

Source: NVIDIA CORP, 10−K, March 16, 2007