NVIDIA 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

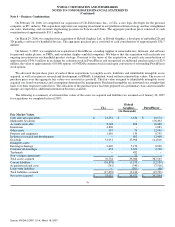

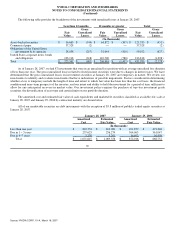

In computing fair value of our reporting units, we use estimates of future revenues, costs and cash flows from such units. The

amount of goodwill allocated to our GPU, MCP, Handheld GPU, Consumer Electronics, and All Other segments as of January 28,

2007, was $99.3 million, $46.2 million, $137.7 million, $11.9 million, and $6.3 million, respectively. As of January 29, 2006, the

amount of goodwill allocated to our GPU, MCP, Handheld GPU, Consumer Electronics, and All Other segments, was $99.3 million,

$15.1 million, $12.7 million, $11.9 million, and $6.3 million, respectively. Please refer to Note 14 of the Notes to Consolidated

Financial Statements for further segment information.

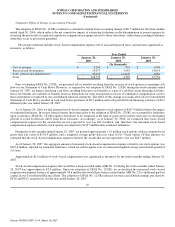

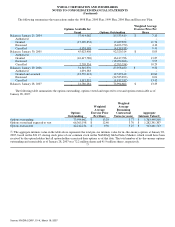

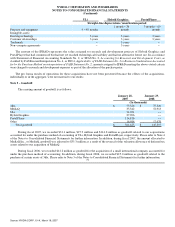

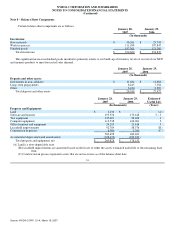

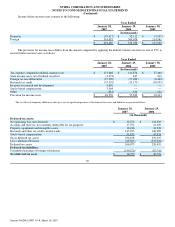

Note 6 − Amortizable Intangible Assets

We are currently amortizing our intangible assets with definitive lives over periods ranging from 1 to 5 years on a straight−line

basis. The components of our amortizable intangible assets are as follows:

January 28, 2007 January 29, 2006

Gross

Carrying

Amount Accumulated

Amortization Net Carrying

Amount

Gross

Carrying

Amount Accumulated

Amortization Net Carrying

Amount

(In thousands)

Technology licenses $ 37,516 $ (20,480) $ 17,036 $ 21,586 $ (13,595) $ 7,991

Patents 34,623 (24,569) 10,054 23,750 (19,911) 3,839

Acquired intellectual property 50,212 (31,894) 18,318 27,086 (24,516) 2,570

Trademarks 11,310 (11,310) − 11,310 (10,807) 503

Other 1,494 (1,391) 103 1,494 (976) 518

Total intangible assets $ 135,155 $ (89,644) $ 45,511 $ 85,226 $ (69,805) $ 15,421

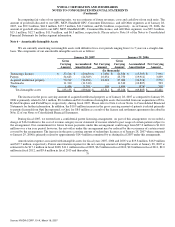

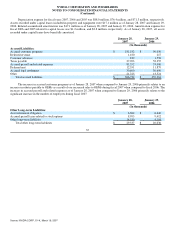

The increase in the gross carrying amount of acquired intellectual property as of January 28, 2007 as compared to January 29,

2006 is primarily related to $3.1 million, $8.4 million and $11.6 million of intangible assets that resulted from our acquisitions of ULi,

Hybrid Graphics and PortalPlayer, respectively, during fiscal 2007. Please refer to Note 4 of our Notes to Consolidated Financial

Statements for further information. In addition, the $10.9 million increase in the gross carrying amount of patents is related primarily

to patents licensed from Opti Incorporated, or Opti, for $8.0 million as a result of the license and settlement agreements described in

Note 12 of our Notes to Consolidated Financial Statements.

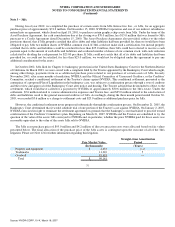

During fiscal 2007, we entered into a confidential patent licensing arrangement. As part of this arrangement, we recorded a

charge of $16.0 million to the cost of revenue category in our statement of income related to past usage of certain patents subject to

the arrangement. Our commitment for future license payments under this arrangement could range from $97.0 million to $110.0

million over a ten year period; however, the net outlay under this arrangement may be reduced by the occurrence of certain events

covered by the arrangement. The increase in the gross carrying amount of technology licenses as of January 28, 2007 when compared

to January 29, 2006 is primarily related to approximately $14.4 million committed by us during fiscal 2007 under this arrangement.

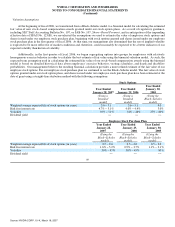

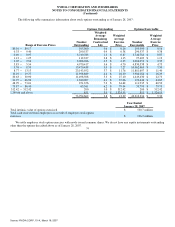

Amortization expense associated with intangible assets for fiscal years 2007, 2006 and 2005 was $19.8 million, $16.9 million

and $19.7 million, respectively. Future amortization expense for the net carrying amount of intangible assets at January 28, 2007 is

estimated to be $17.1 million in fiscal 2008, $11.1 million in fiscal 2009, $6.9 million in fiscal 2010, $2.8 million in fiscal 2011, $2.0

million in fiscal 2012, and $5.6 million in fiscal 2013 and thereafter.

78

Source: NVIDIA CORP, 10−K, March 16, 2007