NVIDIA 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

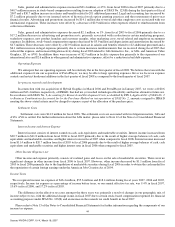

As of January 28, 2007, with the adoption of Statement of Financial Accounting Standards No. 123(R), or SFAS No. 123(R),

Share Based Payment, we have derecognized both deferred tax assets for the excess of tax benefit related to stock−based

compensation, reflected in our federal and state net operating loss and research tax credit carryforwards, and the offsetting valuation

allowance. Consistent with prior years, the excess tax benefit reflected in our net operating loss and research tax credit carryforwards,

in the amount of $344.9 million as of January 28, 2007, will be accounted for as a credit to stockholders' equity, if and when realized.

In determining if and when excess tax benefits have been realized, we have elected to do so on a “with−and−without” approach with

respect to such excess tax benefits. We have also elected to ignore the indirect tax effects of stock−based compensation deductions for

financial and accounting reporting purposes, and specifically to recognize the full effect of the research tax credit in income from

continuing operations.

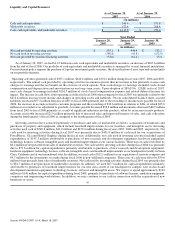

Goodwill

Our impairment review process compares the fair value of the reporting unit in which the goodwill resides to its carrying value.

We determined that our reporting units are equivalent to our operating segments for the purposes of completing our Statement of

Financial Accounting Standards No. 142, or SFAS No. 142, Goodwill and Other Intangible Assets, impairment test. We utilize a

two−step approach to testing goodwill for impairment. The first step tests for possible impairment by applying a fair value−based test.

In computing fair value of our reporting units, we use estimates of future revenues, costs and cash flows from such units. The second

step, if necessary, measures the amount of such an impairment by applying fair value−based tests to individual assets and liabilities.

We elected to perform our annual goodwill impairment review during the fourth quarter of each fiscal year. We completed our most

recent annual impairment test during the fourth quarter of fiscal 2007 and concluded that there was no impairment. However, future

events or circumstances may result in a charge to earnings in future periods due to the potential for a write−down of goodwill in

connection with such tests.

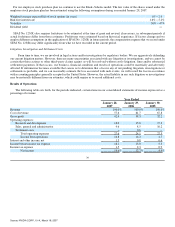

Stock−based Compensation

Effective January 30, 2006, we adopted the provisions of SFAS No. 123(R) which establishes accounting for stock−based

awards exchanged for employee services. Accordingly, stock−based compensation cost is measured at grant date, based on the fair

value of the awards, and is recognized as expense over the requisite employee service period. Stock−based compensation expense

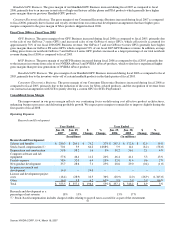

recognized during fiscal 2007 was $116.7 million, which consisted of stock−based compensation expense related to stock options and

our employee stock purchase plan. Please refer to Note 2 of the Notes to Consolidated Financial Statements for further information.

We elected to adopt the modified prospective application method beginning January 30, 2006 as provided by SFAS No.

123(R). We recognize stock−based compensation expense using the straight−line attribution method. We estimate the value of

employee stock options on the date of grant using a lattice−binomial model. Prior to the adoption of SFAS No. 123(R), we recorded

stock−based compensation expense equal to the amount that would have been recognized if the fair value method was used, for the

purpose of the pro forma financial information provided in accordance with Statement of Financial Accounting Standards No. 123, or

SFAS No. 123, Accounting for Stock−Based Compensation, as amended by SFAS No. 148, Accounting for Stock−Based

Compensation − Transition and Disclosures.

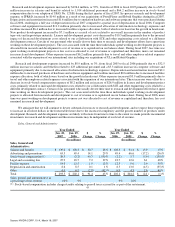

At the beginning of fiscal 2006, we transitioned from a Black−Scholes model to a binomial model for calculating the

estimated fair value of new stock−based compensation awards granted under our stock option plans. The determination of fair value of

share−based payment awards on the date of grant using an option−pricing model is affected by our stock price as well as assumptions

regarding a number of highly complex and subjective variables. These variables include, but are not limited to, the expected stock

price volatility over the term of the awards, actual and projected employee stock option exercise behaviors, vesting schedules, death

and disability probabilities, expected volatility and risk−free interest. Our management determined that the use of implied volatility is

expected to be more reflective of market conditions and, therefore, could reasonably be expected to be a better indicator of our

expected volatility than historical volatility. The risk−free interest rate assumption is based upon observed interest rates appropriate

for the term of our employee stock options. The dividend yield assumption is based on the history and expectation of dividend

payouts. We began segregating options into groups for employees with relatively homogeneous exercise behavior in order to calculate

the best estimate of fair value using the binomial valuation model.

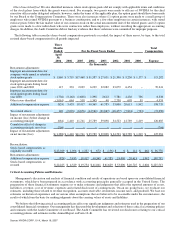

Using the lattice−binomial model, the fair value of the stock options granted under our stock option plans have been estimated

using the following assumptions during the year ended January 28, 2007:

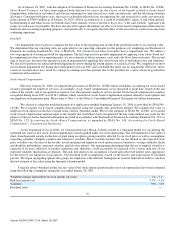

Weighted average expected life of stock options (in years) 3.6 − 5.1

Risk free interest rate 4.7% − 5.1%

Volatility 39% − 51%

Dividend yield −−

38

Source: NVIDIA CORP, 10−K, March 16, 2007