NVIDIA 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

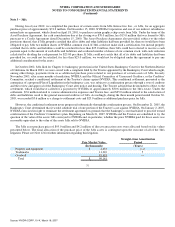

On August 1 each year, each non−employee director is automatically granted an option to purchase 30,000 shares, or Annual

Grant. These Annual Grants will begin vesting on the second anniversary of the date of the grant and vest quarterly during the next

year. The Annual Grants will be fully vested on the third anniversary of the date of the grant, provided that the director attended at

least 75% of the meetings during the year following the date of the grant.

On August 1 of each year, each non−employee director who is a member of a committee of the Board, except for the

Nominating and Corporate Governance Committee, will automatically be granted an option to purchase 10,000 shares, or the

Committee Grant. The Committee Grants vests in full on the first anniversary of the date of the grant, provided that the director has

attended at least 75% of the meetings during the year following the date of the grant. Directors who were members of two committees,

Messrs. Cox, Gaither and Jones, waived their grant of an additional 10,000 shares for being a member of a second committee in

fiscal 2005 and 2006.

If a non−employee director fails to attend at least 75% of the regularly scheduled meetings during the year following the grant

of an option, rather than vesting as described previously, the Committee Grants will vest annually over four years following the date

of grant at the rate of 10% per year for the first three years and 70% for the fourth year, and the Annual Grants will vest 30% upon the

three−year anniversary of the grant date and 70% for the fourth year, such that in each case the entire option will become fully vested

on the four−year anniversary of the date of the grant. For Annual Grants and Committee Grants, if the person has not been serving on

the Board or committee since a prior year's annual meeting, the number of shares granted will be reduced pro rata for each full quarter

prior to the date of grant during which such person did not serve in such capacity.

The Compensation Committee administers the amended Directors' Plan. A total of 1,200,000 shares have been authorized and

issued under the amended Directors' Plan of which none is available for future issuance as of January 28, 2007. As described above,

future grants to non−employee directors will be made out of the 1998 Plan.

1998 Employee Stock Purchase Plan

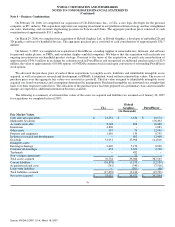

In February 1998, our Board approved the 1998 Employee Stock Purchase Plan, or the Purchase Plan. In June 1999, the

Purchase Plan was amended to increase the number of shares reserved for issuance automatically each year at the end of our fiscal

year for the next 10 years (commencing at the end of fiscal 2000 and ending 10 years later in 2009) by an amount equal to 2% of the

outstanding shares on each such date, including on an as−if−converted basis preferred stock and convertible notes, and outstanding

options and warrants, calculated using the treasury stock method; provided that the maximum number of shares of common stock

available for issuance from the Purchase Plan could not exceed 52,000,000 shares. The number of shares will no longer be increased

annually as we reached the maximum permissible number of shares at the end of fiscal 2006. There are a total of 52,000,000 shares

authorized for issuance. At January 28, 2007, 18,857,690 shares have been issued under the Purchase Plan and 33,142,310 shares are

available for future issuance.

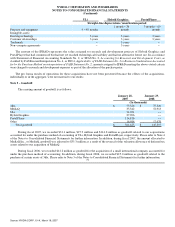

The Purchase Plan is intended to qualify as an “employee stock purchase plan” under Section 423 of the Internal Revenue

Code. Under the Purchase Plan, the Board has authorized participation by eligible employees, including officers, in periodic offerings

following the adoption of the Purchase Plan. Under the Purchase Plan, separate offering periods shall be no longer than 27 months.

Under the current offering adopted pursuant to the Purchase Plan, each offering period is 24 months, which is divided into four

purchase periods of 6 months.

Employees are eligible to participate if they are employed by us or an affiliate of us as designated by the Board. Employees

who participate in an offering may have up to 10% of their earnings withheld pursuant to the Purchase Plan up to certain

limitations and applied on specified dates determined by the Board to the purchase of shares of common stock. The Board may

increase this percentage at its discretion, up to 15%. The price of common stock purchased under the Purchase Plan will be equal to

the lower of the fair market value of the common stock on the commencement date of each offering period and the purchase date of

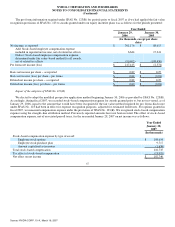

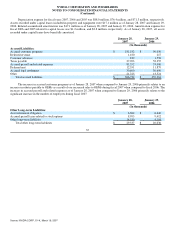

each offering period at 85% at the fair market value of the common stock on the relevant purchase date. During fiscal 2007, 2006 and

2005, employees purchased approximately 3.8 million, 3.6 million, and 4.0 million shares with weighted−average prices of $6.42,

$5.59, and $4.36 per share, respectively, and grant−date fair values of $3.64, $1.70, and $1.57 per share, respectively. Employees may

end their participation in the Purchase Plan at any time during the offering period, and participation ends automatically on termination

of employment with us and in each case their contributions are refunded.

72

Source: NVIDIA CORP, 10−K, March 16, 2007