NVIDIA 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

Recently Issued Accounting Pronouncements

In July 2006, the Financial Accounting Standards Board, or FASB, issued Interpretation No. 48, or FIN 48, Accounting for

Uncertainty in Income Taxes. FIN 48 applies to all tax positions related to income taxes subject to FASB Statement 109, Accounting

for Income Taxes. Under FIN 48 a company would recognize the benefit from a tax position only if it is more−likely−than−not that the

position would be sustained upon audit based solely on the technical merits of the tax position. FIN 48 clarifies how a company would

measure the income tax benefits from the tax positions that are recognized, provides guidance as to the timing of the derecognition of

previously recognized tax benefits, and describes the methods for classifying and disclosing the liabilities within the financial

statements for any unrecognized tax benefits. FIN 48 also addresses when a company should record interest and penalties related to

tax positions and how the interest and penalties may be classified within the financial statements. Any differences between tax

liability amounts recognized in the statements of operations as a result of adoption of FIN 48 would be accounted for as a cumulative

effect adjustment to the beginning balance of retained earnings. FIN 48 is effective for fiscal years beginning after December 15,

2006. The provisions of FIN 48 will be effective as of first quarter of fiscal 2008. We believe that the cumulative effect of adoption of

FIN 48 will not result in any material change to the beginning balance of our retained earnings.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, or SFAS No. 157, Fair Value

Measurements. SFAS No. 157 establishes a framework for measuring fair value and expands disclosures about fair value

measurements. The changes to current practice resulting from the application of this Statement relate to the definition of fair value, the

methods used to measure fair value, and the expanded disclosures about fair value measurements. We are required to adopt the

provisions of SFAS No. 157 beginning with our fiscal quarter ending April 29, 2007. We do not believe the adoption of SFAS No.

157 will have a material impact on our consolidated financial position, results of operations or cash flows.

In September 2006, the Securities and Exchange Commission, or SEC, issued Staff Accounting Bulletin No. 108, or SAB No.

108, Considering the Effects of Prior Year Misstatements When Quantifying Misstatements in Current Year Financial Statements,

which provides interpretive guidance on how the effects of the carryover or reversal of prior year misstatements should be considered

in quantifying a current year misstatement. We adopted the provisions of SAB No. 108 in our fiscal year 2007. The adoption of SAB

No. 108 did not have a material impact on our consolidated financial position, results of operations or cash flows.

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, or SFAS No. 159, The Fair Value

Option for Financial Assets and Financial Liabilities.. SFAS No. 159 permits companies to choose to measure certain financial

instruments and certain other items at fair value. The standard requires that unrealized gains and losses on items for which the fair

value option has been elected be reported in earnings. We are required to adopt the provisions of SFAS No. 159 beginning with our

fiscal quarter ending April 27, 2008, although earlier adoption is permitted. We are currently evaluating the impact that SFAS No. 159

will have on our consolidated financial position, results of operations or cash flows.

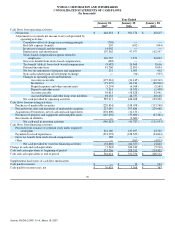

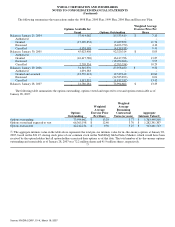

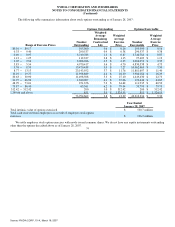

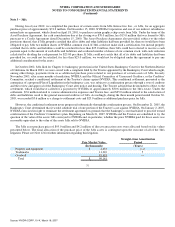

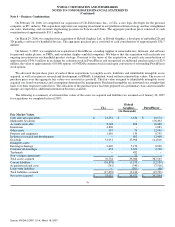

Note 2 − Stock−Based Compensation

Effective January 30, 2006, we adopted the provisions of Statement of Financial Accounting Standards No. 123(R), or SFAS No.

123(R), Share−Based Payment. SFAS No. 123(R) establishes accounting for stock−based awards exchanged for employee services.

Accordingly, stock−based compensation cost is measured at grant date, based on the fair value of the awards, and is recognized as

expense over the requisite employee service period.

Prior to the adoption of SFAS No. 123(R)

Prior to the adoption of SFAS No. 123(R), we applied Accounting Principles Board Opinion No. 25, or APB No. 25, Accounting

for Stock Issued to Employees, and related interpretations to account for our stock−based employee compensation plans. As such,

compensation expense was recorded if on the date of grant the current fair value per share of the underlying stock exceeded the

exercise price per share. We provided the disclosures required under Statement of Financial Accounting Standards No. 123, or SFAS

No. 123, Accounting for Stock−Based Compensation, as amended by SFAS No. 148, Accounting for Stock−Based Compensation −

Transition and Disclosures, in our periodic reports.

66

Source: NVIDIA CORP, 10−K, March 16, 2007