NVIDIA 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

Cumulative Effect of Change in Accounting Principle

The adoption of SFAS No. 123(R) resulted in a cumulative benefit from accounting change of $0.7 million for the three months

ended April 30, 2006, which reflects the net cumulative impact of estimating forfeitures in the determination of period expense by

reversing the previously recognized cumulative compensation expense related to those forfeitures, rather than recording forfeitures

when they occur as previously permitted.

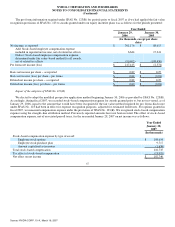

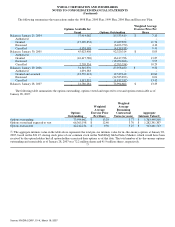

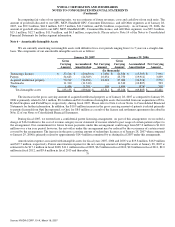

The income statement includes stock−based compensation expense, net of associated payroll taxes, and amounts capitalized as

inventory, as follows:

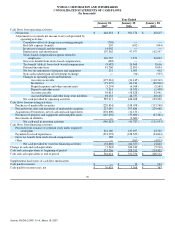

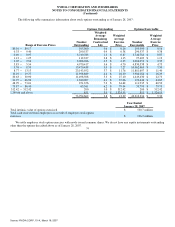

Year Ended

January 28, January 29, January 30,

2007 2006 2005

(In thousands)

Cost of revenue $ 8,200 $ 829 $ 1,998

Research and development 70,077 5,943 14,074

Sales, general and administrative 38,458 (2,243) 3,682

Total $ 116,735 $ 4,529 $ 19,754

Prior to adopting SFAS No. 123(R), we presented all tax benefits resulting from the exercise of stock options as operating cash

flows in our Statement of Cash Flows. However, as required by our adoption of SFAS No. 123(R) during the twelve months ended

January 28, 2007, we began classifying cash flows resulting from gross tax benefits as a part of cash flows from financing activities.

Gross tax benefits are realized tax benefits from tax deductions for exercised options in excess of cumulative compensation cost for

those instruments recognized in our consolidated financial statements. The effect of this change in classification on our Consolidated

Statement of Cash Flows resulted in cash used from operations of $0.2 million and cash provided from financing activities of $0.2

million for the year ended January 28, 2007.

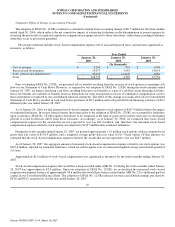

As of January 29, 2006, we had unearned stock−based compensation related to stock options of $167.9 million before the impact

of estimated forfeitures. In our pro forma footnote disclosures prior to the adoption of SFAS No. 123(R), we accounted for forfeitures

upon occurrence. SFAS No. 123(R) requires forfeitures to be estimated at the time of grant and revised if necessary in subsequent

periods if actual forfeitures differ from those estimates. Accordingly, as of January 30, 2006, we estimated that stock−based

compensation expense for the awards that are not expected to vest was $32.4 million, and, therefore, the unearned stock−based

compensation expense related to stock options was adjusted to $135.5 million after estimated forfeitures.

During the twelve months ended January 28, 2007, we granted approximately 11.9 million stock options with an estimated total

grant−date fair value of $138.4 million, and a weighted average grant−date fair value of $11.78 per option. Of this amount, we

estimated that the stock−based compensation expense related to the awards that are not expected to vest was $26.7 million.

As of January 28, 2007, the aggregate amount of unearned stock−based compensation expense related to our stock options was

$167.6 million, adjusted for estimated forfeitures, which we will recognize over an estimated weighted average amortization period of

2.0 years.

Approximately $1.6 million of stock−based compensation was capitalized as inventory for the twelve months ending January 28,

2007.

Stock−based compensation expense that would have been recorded under APB No. 25 during the twelve months ended January

28, 2007 was approximately $3.0 million. Upon our adoption of SFAS No. 123(R), we reclassified the unearned stock−based

compensation expense balance of approximately $3.6 million that would have been recorded under APB No. 25 to additional paid−in

capital in our Consolidated Balance Sheet. The adoption of SFAS No. 123(R) reduced our basic and diluted earnings per share by

$0.28 and $0.25, respectively, for the year ended January 28, 2007.

68

Source: NVIDIA CORP, 10−K, March 16, 2007