NVIDIA 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

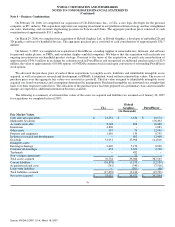

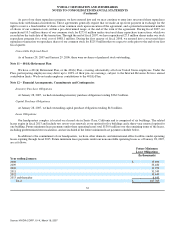

Note 4 − Business Combinations

On February 20, 2006, we completed our acquisition of ULi Electronics, Inc., or ULi, a core logic developer for the personal

computer, or PC, industry. The acquisition represents our ongoing investment in our platform solution strategy and has strengthened

our sales, marketing, and customer engineering presence in Taiwan and China. The aggregate purchase price consisted of cash

consideration of approximately $53.1 million.

On March 29, 2006, we completed our acquisition of Hybrid Graphics Ltd., or Hybrid Graphics, a developer of embedded 2D and

3D graphics software for handheld devices. The aggregate purchase price consisted of cash consideration of approximately $36.7

million.

On January 5, 2007, we completed our acquisition of PortalPlayer, a leading supplier of semiconductors, firmware, and software

for personal media players, or PMPs, and secondary display−enabled computers. We believe that the acquisition will accelerate our

ongoing investment in our handheld product strategy. Pursuant to the terms of the acquisition, we paid cash consideration of

approximately $344.9 million in exchange for common stock in PortalPlayer and recognized an additional purchase price of $2.9

million, the value of approximately 658,000 options of NVIDIA common stock issued upon conversion of outstanding PortalPlayer

stock options.

We allocated the purchase price of each of these acquisitions to tangible assets, liabilities and identifiable intangible assets

acquired, as well as in−process research and development, or IPR&D, if identified, based on their estimated fair values. The excess of

purchase price over the aggregate fair values was recorded as goodwill. The fair value assigned to identifiable intangible assets

acquired was based on estimates and assumptions determined by management. Purchased intangibles are amortized on a straight−line

basis over their respective useful lives. The allocation of the purchase price has been prepared on a preliminary basis and reasonable

changes are expected as additional information becomes available.

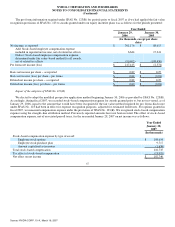

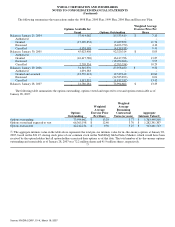

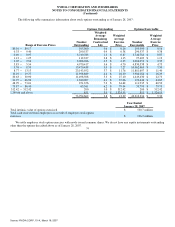

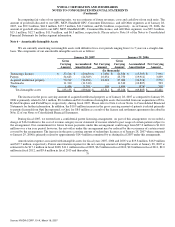

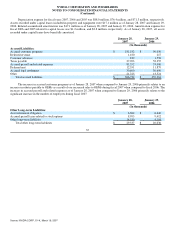

The following is a summary of estimated fair values of the assets we acquired and liabilities we assumed as of January 28, 2007

for acquisitions we completed in fiscal 2007:

ULi Hybrid

Graphics PortalPlayer

(In thousands)

Fair Market Values

Cash and cash equivalents $ 21,551 $ 1,180 $ 10,174

Marketable Securities − − 176,492

Accounts receivable 8,148 808 16,480

Inventories 4,896 − 1,883

Other assets 935 73 12,945

Property and equipment 1,010 134 9,755

In−process research and development − 602 13,400

Goodwill 31,051 27,906 114,816

Intangible assets:

Existing technology 2,490 5,179 8,900

Customer relationships 653 2,650 2,700

Trademark − 482 −

Non−compete agreements − 72 −

Total assets acquired 70,734 39,086 367,545

Current liabilities (16,878) (1,373) (12,139)

Acquisition related costs (781) (740) (7,516 )

Long−term liabilities − (301) (46 )

Total liabilities assumed (17,659) (2,414) (19,701)

Net assets acquired $ 53,075 $ 36,672 $ 347,844

76

Source: NVIDIA CORP, 10−K, March 16, 2007