NVIDIA 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

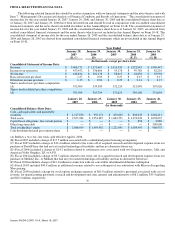

As of January 28, 2007, our allowance for doubtful accounts receivable was $1.3 million and our gross accounts receivable

balance was $534.4 million. Of the $534.4 million, $150.3 million was covered by credit insurance and $19.8 million was covered by

letters of credit. If the financial condition of our customers were to deteriorate, resulting in an impairment of their ability to make

payments, additional allowances may be required and we may have to record additional reserves or write−offs on certain sales

transactions in the future. As a percentage of our gross accounts receivable balance, our allowance for doubtful accounts receivable

has ranged between 0.2% and 0.4% during fiscal years 2007 and 2006. Factors impacting the allowance include the level of gross

receivables, the financial condition of our customers and the extent to which balances are covered by credit insurance or letters of

credit. As of January 28, 2007, our allowance for doubtful accounts receivable represented 0.2% of our gross accounts receivable

balance. If our allowance for doubtful accounts receivable balance had been recorded at the high end of the range, at 0.4% of our gross

receivable balance, then our allowance for doubtful accounts receivable balance at January 28, 2007, would have been approximately

$2.4 million, rather than the actual balance of $1.3 million.

Inventories

Inventory cost is computed on an adjusted standard basis; which approximates actual cost on an average or first−in, first−out

basis. We write down our inventory for estimated lower of cost or market, obsolescence or unmarketable inventory equal to the

difference between the cost of inventory and the estimated market value based upon assumptions about future demand, future product

purchase commitments, estimated manufacturing yield levels and market conditions. If actual market conditions are less favorable

than those projected by management, or if our future product purchase commitments to our suppliers exceed our forecasted future

demand for such products, additional future inventory write−downs may be required that could adversely affect our operating results.

If actual market conditions are more favorable, we may have higher gross margins when products are sold. Sales to date of such

products have not had a significant impact on our gross margin. As of January 28, 2007, our inventory reserve was $39.7 million. As a

percentage of our gross inventory balance, our inventory reserve has ranged between 8.9% and 15.9% during fiscal years 2007 and

2006. As of January 28, 2007, our inventory reserve represented 10.1% of our gross inventory balance. If our inventory reserve

balance had been recorded at the high end of the range, at 15.9% of our gross inventory balance, then our inventory reserve balance at

January 28, 2007, would have been approximately $62.8 million, rather than the actual balance of $39.7 million. Inventory reserves

once established are not reversed until the related inventory has been sold or scrapped.

Income Taxes

Statement of Financial Accounting Standards No. 109, or SFAS No. 109, Accounting for Income Taxes, establishes financial

accounting and reporting standards for the effect of income taxes. In accordance with SFAS No. 109, we recognize federal, state and

foreign current tax liabilities or assets based on our estimate of taxes payable or refundable in the current fiscal year by tax

jurisdiction. We also recognize federal, state and foreign deferred tax assets or liabilities, as appropriate, for our estimate of future tax

effects attributable to temporary differences and carryforwards; and we record a valuation allowance to reduce any deferred tax assets

by the amount of any tax benefits that, based on available evidence and judgment, are not expected to be realized.

United States income tax has not been provided on earnings of our non−U.S. subsidiaries to the extent that such earnings are

considered to be permanently reinvested.

Our calculation of current and deferred tax assets and liabilities is based on certain estimates and judgments and involves

dealing with uncertainties in the application of complex tax laws. Our estimates of current and deferred tax assets and liabilities may

change based, in part, on added certainty or finality to an anticipated outcome, changes in accounting standards or tax laws in the

United States, or foreign jurisdictions where we operate, or changes in other facts or circumstances. In addition, we recognize

liabilities for potential United States and foreign income tax contingencies based on our estimate of whether, and the extent to which,

additional taxes may be due. If we determine that payment of these amounts is unnecessary or if the recorded tax liability is less than

our current assessment, we may be required to recognize an income tax benefit or additional income tax expense in our financial

statements, accordingly.

As of January 28, 2007, we had a valuation allowance of $68.6 million. Of the total valuation allowance, $3.7 million relates to

state tax attributes acquired in certain acquisitions for which realization of the related deferred tax assets was determined not likely to

be realized due, in part, to potential utilization limitations as a result of stock ownership changes, and $64.9 million relates to state

deferred tax assets that management determined not likely to be realized due, in part, to projections of future taxable income. To the

extent realization of the deferred tax assets related to certain acquisitions becomes probable, recognition of these acquired tax benefits

would first reduce goodwill to zero, then reduce other non−current intangible assets related to the acquisition to zero with any

remaining benefit reported as a reduction to income tax expense. To the extent realization of the deferred tax assets related to state tax

benefits becomes probable, we would recognize an income tax benefit in the period such asset is more likely than not to be realized.

37

Source: NVIDIA CORP, 10−K, March 16, 2007