NVIDIA 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

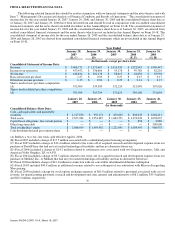

Restatement

On November 29, 2006, we restated our previously−issued financial statements for fiscal years 2004 through 2006, and for the

first quarter of fiscal 2007, together with selected financial statement items for earlier years, to correct errors related to accounting for

stock−based compensation expense. In June 2006, the Audit Committee of the Board of NVIDIA, or the Audit Committee, began a

review of our stock option practices based on the results of an internal review voluntarily undertaken by management. The Audit

Committee, with the assistance of outside legal counsel, completed its review on November 13, 2006 when the Audit Committee

reported its findings to our Board of Directors, or the Board. The review covered option grants to all employees, directors and

consultants for all grant dates during the period from our initial public offering in January 1999 through June 2006. Based on the

findings of the Audit Committee and our internal review, we identified a number of occasions on which we used an incorrect

measurement date for financial accounting and reporting purposes. These errors resulted primarily from our use during our fiscal years

2000, 2001 and 2002, of certain date selection methods discussed below which resulted in employees receiving options with stated

exercise prices lower than the market prices as measured based upon the actual grant dates. We ceased using such practices beginning

in our fiscal year 2003. The Audit Committee found that, beginning in our fiscal year 2003, we improved our stock option grant

processes and have generally granted and priced our employee stock options in an objective and consistent manner since that time.

However, for one Company−wide annual stock option grant we made in fiscal 2004, we did not finalize the number of options

allocated to each employee as of the stated grant date in May 2003, which resulted in stock−based compensation charges due to the

change in the measurement date to the date the grants were finalized. The Audit Committee's review did not identify any additional

stock−based compensation charges from measurement date issues subsequent to that fiscal 2004 grant.

As a result of the measurement date errors identified from the Audit Committee's review, through January 29, 2006, we recorded

aggregate non−cash stock−based compensation charges of $127.4 million, net of related tax effects. The errors resulted in after−tax

charges of $1.4 million and $11.7 million for our fiscal years 2006 and 2005, respectively. Additionally, the cumulative effect of the

related after−tax charges for periods prior to our fiscal year ended January 30, 2005 was $114.2 million. These additional stock−based

compensation expense charges were non−cash and had no impact on our reported revenue, cash, cash equivalents or marketable

securities for each of the restated periods. These charges were based primarily on Accounting Principles Board Opinion No. 25, or

APB No. 25, Accounting for Stock Issued to Employees (intrinsic value−based) charges and associated payroll taxes of $199.6 million

on a pre−tax basis, which were amortized over the vesting term of the stock options in accordance with Financial Accounting

Standards Board Interpretation No. 28, or FIN 28, Accounting for Stock Appreciation Rights and Other Variable Stock Option or

Award Plans. We amortized a substantial portion of these charges to expense during our fiscal years 2000 to 2006.

The types of errors we identified generally fell into the following categories:

Improper Measurement Dates for Company−Wide Annual or Retention Stock Option Grants. We determined that, in

connection with certain annual or retention stock option grants that we made to employees during our fiscal years 2000, 2001, 2002,

2003 and 2004, the final number of shares that an individual employee was entitled to receive was not determined and/or the proper

approval of the related stock option grant had not been given until after the stated grant date. Therefore, the measurement date for such

options for accounting purposes was actually subsequent to the stated grant date, resulting in new measurement dates for the related

options.

Improper Measurement Dates for Stock Option Grants during Fiscal Years 2001 and 2002. In connection with stock option

grants that we made to newly−hired employees (and, to a much lesser degree, retention grants to existing employees) during fiscal

years 2001 and 2002, our practice was to grant stock options with an exercise price based upon the lowest closing price of our

common stock in the last few days of the month of hire or the last few days of any subsequent month in the quarter of hire. The

selection of the grant date of the related option grants would be made at the end of the fiscal quarter and was based on achieving the

lowest exercise price for the affected employees. As a result of these practices, the measurement date for such options for accounting

purposes was actually subsequent to the stated grant date, resulting in new measurement dates for the related options.

Improper Measurement Dates for Stock Option Grants during Fiscal Year 2000. In connection with certain stock option grants

to newly−hired employees (and, to a much lesser degree, retention grants to existing employees) during a portion of fiscal year 2000,

our practice was to delay the selection of the related grant dates until the end of a two−month period in the fiscal quarter during which

the employees who received the grants began their employment with NVIDIA. As a result of this practice, the exercise price of the

related option grants was not determined until subsequent to the stated grant date. We also determined that, during fiscal year 2000,

we generally set the grant date and exercise price of employee option grants for new hires and promotions at the lowest price of the

last few business days of the month of their hire or promotion (or of the following month in certain two−month periods that were

chosen for an indeterminate reason). As a result of these practices, the measurement date for such options for accounting purposes was

actually subsequent to the stated grant date, resulting in new measurement dates for the related options. In addition, we also

determined that the exercise price or the number of options to be granted had not been determined, or the proper approval had not been

given, for various other miscellaneous option grants during fiscal year 2000 until after the stated grant date − resulting in new

measurement dates for accounting purposes for the related options.

34

Source: NVIDIA CORP, 10−K, March 16, 2007