NVIDIA 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

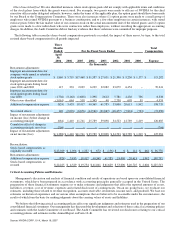

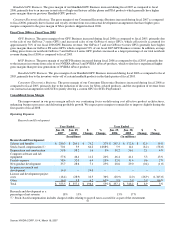

Sales, general and administrative expenses increased $91.4 million, or 45%, from fiscal 2006 to fiscal 2007 primarily due to a

$40.7 million increase in stock−based compensation resulting from our adoption of SFAS No. 123(R) during the first quarter of fiscal

2007 and a $30.7 million increase in salaries and benefits related to 201 additional personnel. Legal and accounting fees increased by

$7.2 million primarily due to our internal review of historical stock option granting practices and the restatement of prior year

financial results. Advertising and promotions increased by $14.1 million due to travel and other employee costs associated with our

international expansion. These increases were offset by a decrease of $2.9 million in other expenses related to reimbursement from

collection settlements.

Sales, general and administrative expenses decreased $2.1 million, or 1%, from fiscal 2005 to fiscal 2006 primarily due to a a

$17.2 million decrease in advertising and promotion costs, primarily associated with a reduction in certain marketing programs,

tradeshow expenses, new product launches and customer samples, other marketing costs, travel related and employee recruitment

expenses. In addition, stock−based compensation expense decreased by $5.9 million and depreciation and amortization decreased by

$4.5 million. These decreases were offset by a $13.9 million increase in salaries and benefits related to 122 additional personnel and a

$6.1 million increase in legal expenses primarily due to certain insurance reimbursements that we received during fiscal 2005 that

reduced this expense, and increased litigation activity during fiscal 2006 related to 3dfx Interactive, Inc., or 3dfx, and American Video

Graphics, LP, or AVG. In addition there were increases of $2.9 million in facility expense due primarily to the expansion of our

international sites and $2.6 million in other general and administrative expenses, offset by a reduction in bad debt expense.

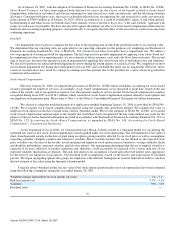

Operating Expenses

We anticipate that our operating expenses will be relatively flat in the first quarter of fiscal 2008. We believe that even with the

additional expense from our acquisition of PortalPlayer, we may be able to keep operating expenses flat as we focus on expense

controls and restrict headcount additions in the first quarter of fiscal 2008 as compared to the fourth quarter of fiscal 2007.

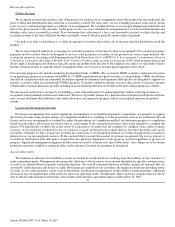

In−process research and development

In connection with our acquisition of Hybrid Graphics in March 2006 and PortalPlayer in January 2007, we wrote−off $0.6

million and $13.4 million, respectively, of IPR&D, that had not yet reached technological feasibility and had no alternative future use.

In accordance with SFAS No. 2, Accounting for Research and Development Costs, as clarified by FIN 4, Applicability of SFAS No. 2

to Business Combinations Accounted for by the Purchase Method an interpretation of SFAS No. 2, amounts assigned to IPR&D

meeting the above−stated criteria must be charged to expense as part of the allocation of the purchase price.

Settlement Costs

Settlement costs were $14.2 million for fiscal 2006. The settlement costs are associated with two litigation matters, 3dfx and

AVG. AVG is settled. For further information about the 3dfx matter, please refer to Note 12 of the Notes to Consolidated Financial

Statements.

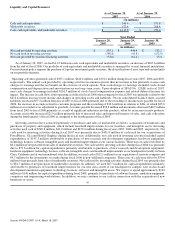

Interest Income and Interest Expense

Interest income consists of interest earned on cash, cash equivalents and marketable securities. Interest income increased from

$20.7 million to $41.8 million from fiscal 2006 to fiscal 2007 primarily due to the result of higher average balances of cash, cash

equivalents and marketable securities and higher interest rates in fiscal 2007 when compared to fiscal 2006. Interest income increased

from $11.4 million to $20.7 million from fiscal 2005 to fiscal 2006 primarily due to the result of higher average balances of cash, cash

equivalents and marketable securities and higher interest rates in fiscal 2006 when compared to fiscal 2005.

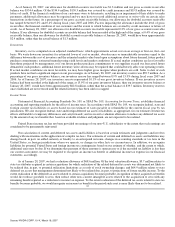

Other Income (Expense), net

Other income and expense primarily consists of realized gains and losses on the sale of marketable securities. There were no

significant changes in other income from fiscal 2006 to fiscal 2007. However, other income decreased by $1.1 million from fiscal

2005 to fiscal 2006 primarily due to the liquidation of marketable securities during fiscal 2006 in order to obtain the cash needed for

the repatriation of certain foreign earnings under the American Jobs Creation Act of 2004.

Income Taxes

We recognized income tax expense of $46.4 million, $55.6 million and $18.4 million during fiscal years 2007, 2006 and 2005,

respectively. Income tax expense as a percentage of income before taxes, or our annual effective tax rate, was 9.4% in fiscal 2007,

15.6% in fiscal 2006, and 17.2% in fiscal 2005.

The difference in the effective tax rates amongst the three years was primarily a result of changes in our geographic mix of

income subject to tax, with the additional change in mix in fiscal 2007 due to certain stock−based compensation expensed for financial

accounting purposes under SFAS No. 123(R) and an increase in the research tax credit benefit in fiscal 2007.

Please refer to Note 13 of the Notes to Consolidated Financial Statements for further information regarding the components of our

income tax expense. 44

Source: NVIDIA CORP, 10−K, March 16, 2007