NVIDIA 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

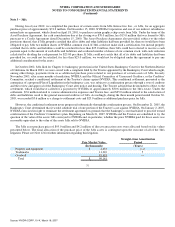

2000 Nonstatutory Equity Incentive Plan

On August 1, 2000, our Board approved the 2000 Nonstatutory Equity Incentive Plan, or the 2000 Plan, to provide for the

issuance of our common stock to employees and affiliates who are not directors, executive officers or 10% stockholders. The 2000

Plan provides for the issuance of nonstatutory stock options, stock bonuses, restricted stock purchase rights, restricted stock unit

awards and stock appreciation rights. Options granted under the 2000 plan generally expire in six to 10 years from the date of grant.

The Compensation Committee appointed by the Board, or the Compensation Committee, has the authority to amend the 2000 Plan and

to determine the option term, exercise price and vesting period of each grant. Options granted to new employees prior to February

10, 2004, generally vest ratably over a four−year period, with 25% becoming vested approximately one year from the date of grant

and the remaining 75% vesting on a quarterly basis over the next three years. From February 10, 2004, initial options granted to new

employees generally vest ratably quarterly over a three−year period. Grants to existing employees in recognition of performance

generally vest as to 25% of the shares two years and three months after the date of grant and as to the remaining 75% of the shares

subject to the option in equal quarterly installments over a nine month period. We amended our 2000 Plan in October 2006 to add the

ability to issue restricted stock unit awards and stock appreciation rights and make certain other modifications. There were a total of

21,939,202 shares authorized for issuance and 18,776,119 shares available for future issuance under the 2000 Plan as of January 28,

2007.

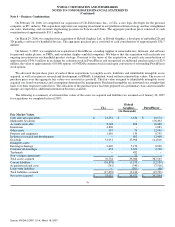

1998 Equity Incentive Plan

The 1998 Equity Incentive Plan, or the 1998 Plan, was adopted by our Board on February 17, 1998 and was approved by our

stockholders on April 6, 1998 as an amendment and restatement of our then existing Equity Incentive Plan which had been adopted on

May 21, 1993. The 1998 Plan provides for the issuance of our common stock to directors, employees and consultants. The 1998 Plan

provides for the issuance of stock bonuses, restricted stock purchase rights, incentive stock options or nonstatutory stock options.

There were a total of 110,094,385 shares authorized for issuance and 2,570,982 shares available for future issuance under the 1998

Plan as of January 28, 2007.

Pursuant to the 1998 Plan, the exercise price for incentive stock options is at least 100% of the fair market value on the date of

grant or for employees owning in excess of 10% of the voting power of all classes of stock, 110% of the fair market value on the date

of grant. For nonstatutory stock options, the exercise price must be no less than 85% of the fair market value on the date of grant.

Option grants issued under the 1998 Plan generally expire in six to ten years from the date of grant. Vesting periods are

determined by the Board or the Compensation Committee. Initial option grants to new employees made after February 10, 2004 under

the 1998 Plan generally vest ratably quarterly over a three year period. Subsequent option grants generally vest up to 25% of the

shares two years and three months after the date of grant and as to the remaining 75% of the shares subject to the option in quarterly

installments over a nine month period.

1998 Non−Employee Directors' Stock Option Plan

In February 1998, our Board adopted the 1998 Non−Employee Directors' Stock Option Plan, or the Directors' Plan, to provide

for the automatic grant of non−qualified options to purchase shares of our common stock to our directors who are not employees or

consultants of us or of an affiliate of us.

In July 2000, the Board amended the 1998 Plan to incorporate the automatic grant provisions of the Directors' Plan into the

1998 Plan. Future automatic grants to non−employee directors will be made according to the terms of the Directors' Plan, but will be

made out of the 1998 Plan until such time as shares may become available for issuance under the amended Directors' Plan. In May

2002, and subsequently in March 2006, the Directors' Plan was amended further to reduce the number of shares granted to our

non−employee directors. The altered automatic grant provisions of the Directors' Plan are also incorporated into the 1998 Plan. The

terms of the amended Directors' Plan are described below.

Under the amended Directors' Plan, each non−employee director who is elected or appointed to our Board for the first time is

automatically granted an option to purchase 90,000 shares, which vests quarterly over a three−year period, or Initial Grant.

71

Source: NVIDIA CORP, 10−K, March 16, 2007