NVIDIA 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

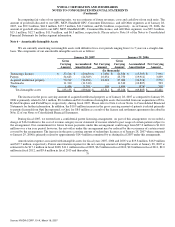

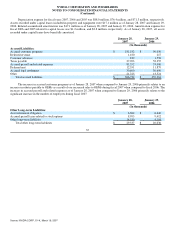

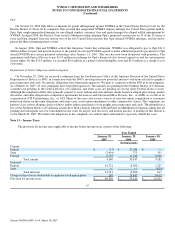

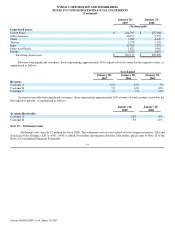

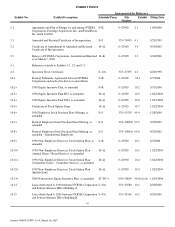

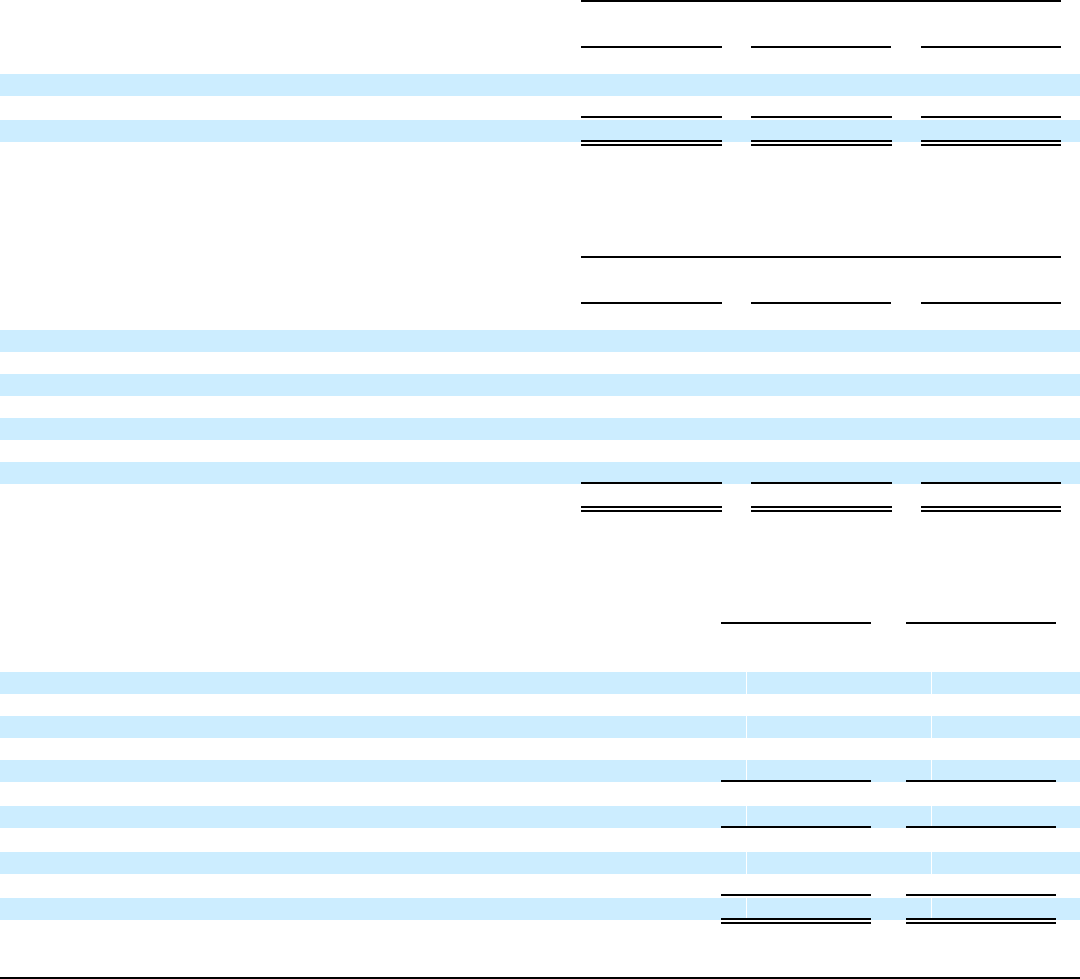

Income before income taxes consists of the following:

Year Ended

January 28,

2007 January 29,

2006 January 30,

2005

(In thousands)

Domestic $ (19,617) $ 52,112 $ (7,537)

Foreign 514,097 304,676 114,565

$ 494,480 $ 356,788 $ 107,028

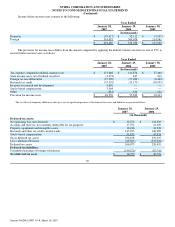

The provision for income taxes differs from the amount computed by applying the federal statutory income tax rate of 35% to

income before income taxes as follows:

Year Ended

January 28,

2007 January 29,

2006 January 30,

2005

(In thousands)

Tax expense computed at federal statutory rate $ 173,068 $ 124,876 $ 37,460

State income taxes, net of federal tax effect (1,372) 847 219

Foreign tax rate differential (97,390) (57,286) (8,462)

Research tax credit (35,359) (13,175) (10,935)

In−process research and development 4,690 −− −−

Stock−based compensation 3,564 −− −−

Other (851) 350 131

Provision for income taxes $ 46,350 $ 55,612 $ 18,413

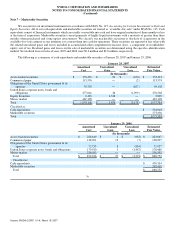

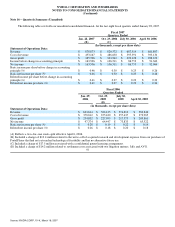

The tax effect of temporary differences that gives rise to significant portions of the deferred tax assets and liabilities are presented below:

January 28,

2007 January 29,

2006

(In thousands)

Deferred tax assets:

Net operating loss carryforwards $ 23,272 $ 134,385

Accruals and reserves, not currently deductible for tax purposes 17,702 16,109

Property, equipment and intangible assets 16,436 16,928

Research and other tax credit carryforwards 145,393 146,089

Stock−based compensation 31,835 45,924

Gross deferred tax assets 234,638 359,435

Less valuation allowance (68,563) (233,016)

Deferred tax assets 166,075 126,419

Deferred tax liabilities:

Unremitted earnings of foreign subsidiaries (149,276) (85,716)

Net deferred tax asset $ 16,799 $ 40,703

88

Source: NVIDIA CORP, 10−K, March 16, 2007