NVIDIA 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

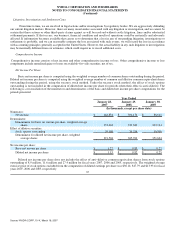

Inventories

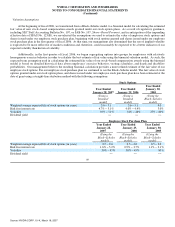

Inventory cost is computed on an adjusted standard basis, which approximates actual cost on an average or first−in, first−out

basis. Inventory costs consist primarily of the cost of semiconductors purchased from subcontractors, including wafer fabrication,

assembly, testing and packaging, manufacturing support costs, including labor and overhead associated with such purchases, final test

yield fallout, inventory provisions and shipping costs. We write down our inventory for estimated amounts related to lower of cost or

market, obsolescence or unmarketable inventory equal to the difference between the cost of inventory and the estimated market value

based upon assumptions about future demand, future product purchase commitments, estimated manufacturing yield levels and market

conditions. If actual market conditions are less favorable than those projected by management, or if our future product purchase

commitments to our suppliers exceed our forecasted future demand for such products, additional future inventory write−downs may be

required that could adversely affect our operating results. If actual market conditions are more favorable, we may have higher gross

margins when products are sold. Sales to date of such products have not had a significant impact on our gross margin. Inventory

reserves once established are not reversed until the related inventory has been sold or scrapped.

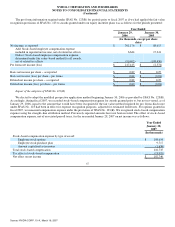

Property and Equipment

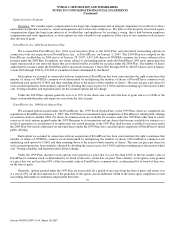

Property and equipment are stated at cost. Depreciation is computed using the straight−line method based on estimated useful

lives, generally three to five years. Depreciation expense includes the amortization of assets recorded under capital leases. Leasehold

improvements and assets recorded under capital leases are amortized over the shorter of the lease term or the estimated useful life of

the asset.

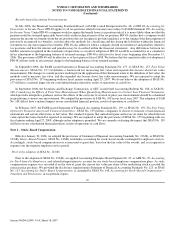

Goodwill

We account for goodwill in accordance with Statement of Financial Accounting Standards No. 142, or SFAS No. 142,

Goodwill and Other Intangible Assets. Goodwill is subject to our annual impairment test during our fourth quarter of our fiscal year,

or earlier if indicators of potential impairment exist, using a fair value−based approach. Our impairment review process compares the

fair value of the reporting unit in which the goodwill resides to its carrying value. For the purposes of completing our SFAS

No. 142 impairment test, we perform our analysis on a reporting unit basis. We utilize a two−step approach to testing goodwill for

impairment. The first step tests for possible impairment by applying a fair value−based test. In computing fair value of our reporting

units, we use estimates of future revenues, costs and cash flows from such units. The second step, if necessary, measures the amount

of such impairment by applying fair value−based tests to individual assets and liabilities. We elected to perform our annual goodwill

impairment review during the fourth quarter of each fiscal year. We completed our most recent annual impairment test during the

fourth quarter of fiscal 2007 and concluded that there was no impairment. However, future events or circumstances may result in a

charge to earnings due to the potential for a write−down of goodwill in connection with such tests.

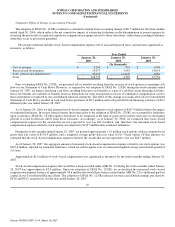

Concentration of Credit Risk

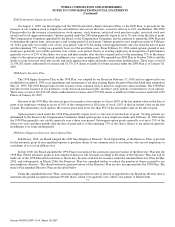

Financial instruments that potentially subject us to concentrations of credit risk consist primarily of cash equivalents,

marketable securities and trade accounts receivable. Our investment policy requires the purchase of top−tier investment grade

securities, the diversification of asset type and certain limits on our portfolio duration. All marketable securities are held in our name,

managed by several investment managers and held by one major financial institution under a custodial arrangement. One customer

accounted for approximately 18% of our accounts receivable balance at January 28, 2007. We perform ongoing credit evaluations of

our customers' financial condition and maintain an allowance for potential credit losses. This allowance consists of an amount

identified for specific customers and an amount based on overall estimated exposure. Our overall estimated exposure excludes

amounts covered by credit insurance and letters of credit. 63

Source: NVIDIA CORP, 10−K, March 16, 2007