Logitech 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-21

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

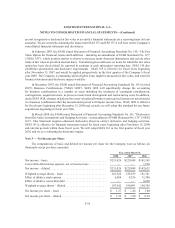

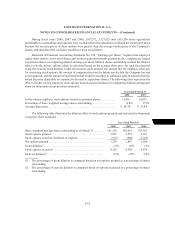

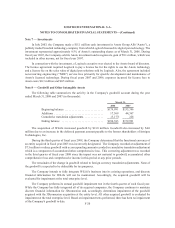

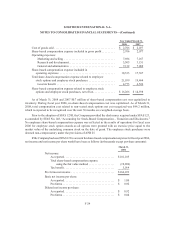

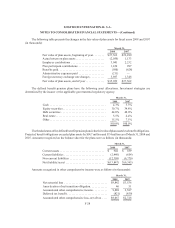

The Company’s acquired other intangible assets subject to amortization were as follows (in thousands):

March 31, 2008 March 31, 2007

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Trademark/tradename. . . $21,385 $(16,896) $ 4,489 $ 19,943 $(14,902) $ 5,041

Technology ........... 37,523 (20,911) 16,612 34,423 (21,248) 13,175

Customer contracts ..... 2,318 (1,689) 629 2,120 (1,416) 704

$61,226 $(39,496) $ 21,730 $56,486 $(37,566) $18,920

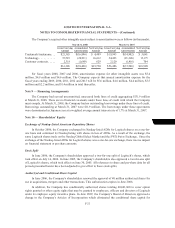

For fiscal years 2008, 2007 and 2006, amortization expense for other intangible assets was $5.4

million, $4.9 million and $4.6 million. The Company expects that annual amortization expense for the

fiscal years ending 2009, 2010, 2011, 2012 and 2013 will be $5.6 million, $4.6 million, $4.4 million, $3.5

million and $2.2 million; and $1.4 million in total thereafter.

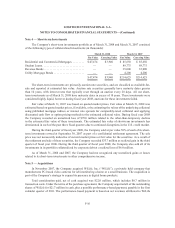

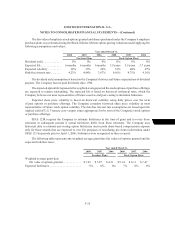

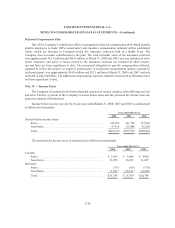

Note 9 — Financing Arrangements

The Company had several uncommitted, unsecured bank lines of credit aggregating $131.9 million

at March 31, 2008. There are no financial covenants under these lines of credit with which the Company

must comply. At March 31, 2008, the Company had no outstanding borrowings under these lines of credit.

Borrowings outstanding at March 31, 2007 were $11.9 million. The borrowings under these agreements

were denominated in Japanese yen at a weighted average annual interest rate of 1.7% at March 31, 2007.

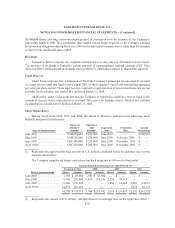

Note 10 — Shareholders’ Equity

Exchange of Nasdaq-Listed American Depositary Shares

In October 2006, the Company exchanged its Nasdaq-listed ADSs for Logitech shares on a one-for-

one basis and continued its Nasdaq listing with shares in lieu of ADSs. As a result of the exchange, the

same Logitech shares trade on the Nasdaq Global Select Market and the SWX Swiss Exchange. Since the

exchange of the Nasdaq-listed ADSs for Logitech shares was a one-for-one exchange, there was no impact

on financial statement or per share amounts.

Stock Split

In June 2006, the Company’s shareholders approved a two-for-one split of Logitech’s shares, which

took effect on July 14, 2006. In June 2005, the Company’s shareholders also approved a two-for-one split

of Logitech’s shares, which took effect on June 30, 2005. All references to share and per-share data for all

periods presented herein have been adjusted to give effect to these stock splits.

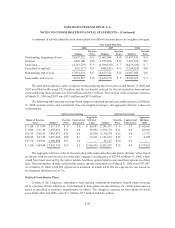

Authorized and Conditional Share Capital

In June 2006, the Company’s shareholders renewed the approval of 40 million authorized shares for

use in acquisitions, mergers and other transactions. This authorization expires in June 2008.

In addition, the Company has conditionally authorized shares totaling 60,661,860 to cover option

rights granted or other equity rights that may be granted to employees, officers and directors of Logitech

under its employee equity incentive plans. In June 2007, the Company’s Board of Directors approved a

change in the Company’s Articles of Incorporation which eliminated the conditional share capital for