Logitech 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-31

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

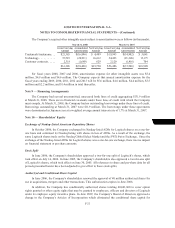

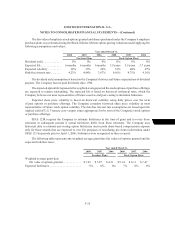

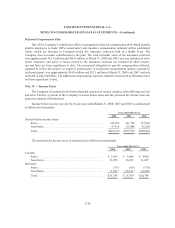

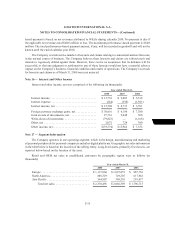

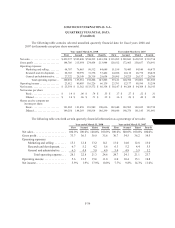

The difference between the provision for income taxes and the expected tax provision at the statutory

income tax rate is reconciled below (in thousands):

Year ended March 31,

2008 2007 2006

Expected tax provision at statutory income tax rates ........... $22,339 $21,722 $17,838

Income taxes at different rates ............................. 12,245 10,194 12,870

Research and development tax credits ....................... (1,572) (1,868) (140)

Other ................................................. (1,224) (4,339) (1,819)

Total provision for income taxes ........................... $31,788 $25,709 $28,749

The Company has negotiated a tax holiday on certain earnings in China which is effective from

January 2006 through December 2010. The tax holiday represents a tax exemption aimed to attract foreign

technological investment in China. The tax holiday decreased income tax expense by approximately $1.5

million and $2.5 million for fiscal years 2008 and 2007. The benefit of the tax holiday on net income per

share (diluted) was approximately $0.01 in both fiscal years.

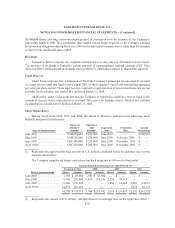

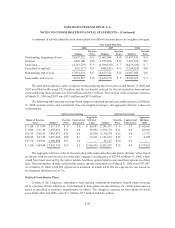

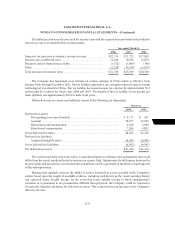

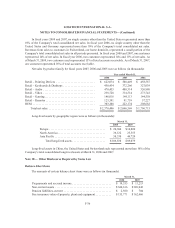

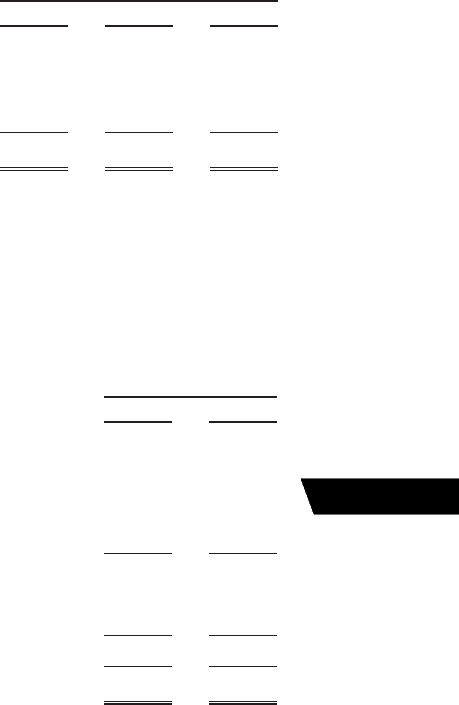

Deferred income tax assets and liabilities consist of the following (in thousands):

March 31,

2008 2007

Deferred tax assets:

Net operating loss carry forwards ................................. $ 4,171 $ 457

Accruals..................................................... 29,977 32,856

Depreciation and amortization.................................... 6,630 5,999

Share-based compensation....................................... 7,504 4,033

Gross deferred tax assets............................................ 48,282 43,345

Deferred tax liabilities:

Acquired intangible assets....................................... (6,992) (4,981)

Gross deferred tax liabilities......................................... (6,992) (4,981)

Net deferred tax assets.............................................. $41,290 $38,364

The current and deferred tax provision is calculated based on estimates and assumptions that could

differ from the actual results reflected in income tax returns filed. Adjustments for differences between the

tax provisions and tax returns are recorded when identified, which is generally in the third or fourth quarter

of the subsequent year.

Management regularly assesses the ability to realize deferred tax assets recorded in the Company’s

entities based upon the weight of available evidence, including such factors as the recent earnings history

and expected future taxable income. In the event that future taxable income is below management’s

estimates or is generated in tax jurisdictions different than projected, the Company could be required to

increase the valuation allowance for deferred tax assets. This would result in an increase in the Company’s

effective tax rate.