Logitech 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

however this benefit does not consider the impact that currency fluctuations had on our pricing strategy,

which may result in selling prices in one currency being raised or lowered to avoid disparity with U.S. dollar

prices and to respond to currency-driven competitive pricing actions.

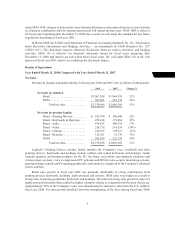

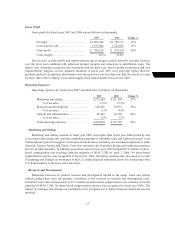

Retail Pointing Devices. Sales of our pointing devices increased 22% and units increased 14% during

fiscal year 2008 compared with fiscal year 2007. The growth was led by sales of our cordless mice which

increased 30% during the year, with units increasing 40%. Our new VX Nano Cordless Laser Mouse for

notebooks, our V220 Cordless Optical Mouse for notebooks and our V320 Cordless Mouse for notebooks

were the primary contributors to the sales growth during the year.

Retail Keyboards and Desktops. Sales of keyboards and desktops increased 23% and units increased

17% during fiscal year 2008 compared with the prior fiscal year, primarily due to strong contributions from

our new Cordless Desktop Wave and our MX 3200 Laser Cordless Desktop in our high-end category and

the Cordless Desktop EX 90 in our value segment. Our notebooks stands also continued to contribute to

our growth in this category.

Retail Audio. Our retail audio sales increased 17% in dollars and 2% in units in fiscal year 2008

compared with the prior year. The growth was primarily from sales of PC speakers, which increased 38%

with unit growth of 26%, driven by sales of our Z-5500 Digital speakers and our X-240 and Z-2300 speakers.

Sales of our Pure-Fi Anywhere speakers in the digital music category also contributed to the sales of our

audio products.

Retail Video. The Company’s video sales in dollars and units decreased 24% in fiscal year 2008

compared with fiscal year 2007, primarily due to slower than expected consumer demand in the webcam

market, particularly in our EMEA region, where video sales decreased 40% as compared with the prior

fiscal year. The decline in video sales in comparison with the prior year began in the fourth quarter of fiscal

year 2007.

Retail Gaming. Sales of retail gaming peripherals in fiscal year 2008 decreased 2% and units

decreased 17% compared with the prior fiscal year. PC gaming sales increased 3%, primarily driven by

sales of our G15 Gaming Keyboard and our G25 Racing Wheel. Console gaming sales decreased 13% and

units decreased 28% as compared with the prior fiscal year, due to a decline in sales related to peripherals

for prior generation consoles, particularly the PlayStation 2. Sales of our cordless controllers for PlayStation

3 did not offset the decline in prior generation consoles.

Retail Remotes. Remote control sales in fiscal year 2008 increased 35% and units increased 20% as

compared with fiscal year 2007. The growth was primarily attributable to sales of our new Harmony One

and our Harmony 1000 remote controls.

Retail Regional Performance. The Company’s Americas and Asia Pacific regions achieved double-

digit retail sales growth of 12% and 32% and unit growth of 8% and 13% compared with the prior fiscal

year. Growth in the Americas region was driven by solid contributions from sales of pointing devices,

remotes, keyboards and desktops. In the Asia Pacific region, all product lines except video achieved double-

digit retail sales growth. Retail sales in the EMEA region increased 8% and units increased 2%, led by sales

of remotes, audio products, pointing devices, keyboards and desktops. Sales in the EMEA region have been

disproportionately impacted by the decline in video sales, which decreased 40% compared with the prior

fiscal year. Modest sales growth in the EMEA region has hindered the Company’s overall sales growth for

each of the four quarters of fiscal year 2008. The disparity between sales growth and unit growth in all

regions was primarily due to product mix and currency fluctuations. In particular, the strengthening of the

Euro in fiscal year 2008 positively impacted the sales growth in the EMEA region; however this benefit

does not consider the impact that currency fluctuations have on the Company’s pricing strategy, which may

result in selling prices in one currency being raised or lowered to avoid disparity with U.S. dollar prices and

to respond to currency-driven competitive pricing actions.