Logitech 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-9

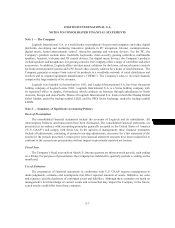

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The Company has contractual agreements with certain of its customers that contain terms allowing

price protection credits to be issued for customers’ on-hand or in transit new inventory if the Company,

in its sole discretion, lowers the price of the product. The estimated costs of price protection programs

are recorded as a reduction of revenue at the time of sale based on planned price reductions, units held by

qualifying customers and historical trends by customer and by product.

The Company regularly evaluates the adequacy of its accruals for product returns, cooperative

marketing arrangements, customer incentive programs and price protection. When the variables used

to estimate these costs change, or if actual costs differ significantly from the estimates, the Company

recognizes adjustments to recorded costs in the period of change. If, at any future time, the Company

becomes unable to reasonably estimate these costs, recognition of revenue may be deferred until products

are sold to end-users.

The Company’s shipping and handling costs are included in cost of sales in the accompanying

Consolidated Statements of Income for all periods presented.

Research and Development Costs

Costs related to research, design and development of products, which consist primarily of personnel,

product design and infrastructure expenses, are charged to research and development expense as they are

incurred.

Advertising Costs

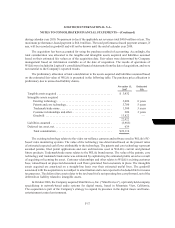

Advertising costs are expensed as incurred and amounted to $188.5 million, $169.8 million and $144.2

million in fiscal years 2008, 2007 and 2006. Advertising costs are recorded as either a marketing and selling

expense or a deduction from revenue. Advertising costs reimbursed by the Company to a customer must

have an identifiable benefit and an estimable fair value in order to be classified as an operating expense. If

these criteria are not met, the cost is classified as a reduction of revenue.

Cash Equivalents

The Company considers all highly liquid instruments purchased with an original maturity of three

months or less to be cash equivalents.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist

principally of cash and cash equivalents and accounts receivable. The Company maintains cash and cash

equivalents with various financial institutions to limit exposure with any one financial institution.

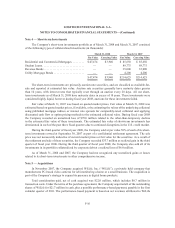

The Company sells to large OEMs, distributors and key retailers and, as a result, maintains individually

significant receivable balances with such customers. As of March 31, 2008, two customers each represented

15% of total accounts receivable. As of March 31, 2007, one customer represented 16% of total accounts

receivable. Typical payment terms require customers to pay for product sales generally within 30 to 60

days; however terms may vary by customer type, by country and by selling season. Extended payment

terms are sometimes offered to a limited number of customers during the second and third fiscal quarters.

The Company does not modify payment terms on existing receivables.