Logitech 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Our purchases of plant and equipment during fiscal year 2008 were principally for machinery and

equipment for two new production and manufacturing facilities, including a new surface mount technology

factory in China, leasehold improvements for a new office facility in Switzerland, computer hardware and

software purchases, and normal expenditures for tooling. The Company’s purchases of property, plant

and equipment in fiscal year 2007 were primarily normal expenditures for tooling costs, machinery and

equipment, and computer hardware and software. During fiscal year 2006, purchases of plant and equipment

included costs for construction of a new factory in Suzhou, China.

During the third quarter of fiscal year 2008, we sold 50% of all of our short-term investments as

part of a confidential settlement agreement and received $84.3 million in cash. In addition, we sold our

remaining short-term investments collateralized by corporate debt for $28.3 million, at a realized loss of

$6.0 million. We also reinvested $130.9 million into short-term bank deposits, which are classified as cash

equivalents in the Company’s balance sheet.

We received $11.3 million during fiscal year 2008 from the sale in March 2007 of the balance of our

investment in Anoto. We also received $2.0 million from the sale of our ioPen retail product line. In April

2006, we sold 42% of our Anoto stock for $12.9 million.

In fiscal year 2008, the Company acquired WiLlife, Inc. for $22.0 million, net of cash acquired of $0.1

million and including $0.7 million in transaction costs. We also paid a deferred payment of $37.7 million

to the former shareholders of Intrigue Technologies, Inc., which we acquired in May 2004. In fiscal year

2007, we acquired Slim Devices Inc. for $20.4 million, net of $0.2 million cash acquired and including $0.6

million in transaction costs.

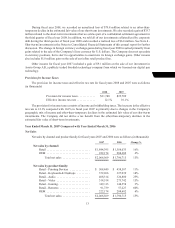

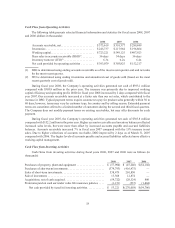

Cash Flow from Financing Activities

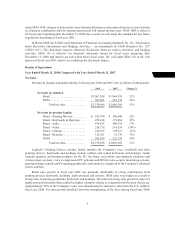

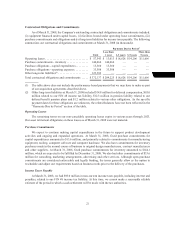

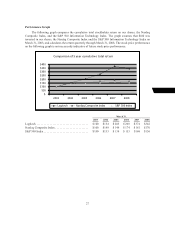

The following tables present information on our cash flows from financing activities, including

information on our share repurchases during fiscal years 2008, 2007 and 2006 (in thousands except per

share amounts):

2008 2007 2006

Borrowings (repayments) of short-term debt ......... $ (11,739 ) $ (2,181) $ 5,192

Purchases of treasury shares...................... (219,742) (138,095) (241,352)

Proceeds from sale of shares upon exercise of options

and purchase rights .......................... 50,603 44,706 49,206

Excess tax benefits from share-based compensation . . . 15,231 13,076 —

Net cash used in financing activities ............. $(165,647) $ (82,494) $(186,954 )

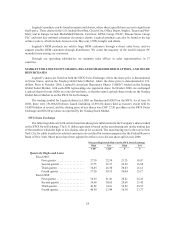

2008 2007 2006

Number of shares repurchased .................... 7,784 5,610 12,276

Value of shares repurchased ...................... $ 219,742 $ 138,095 $ 241,352

Average price per share.......................... $ 28.23 $ 24.62 $ 19.66

During fiscal year 2008, we repaid in full our short-term debt borrowings of $11.7 million. We also

repurchased 7.8 million shares for $219.7 million under the buyback programs announced in May 2006 and

June 2007. The buyback programs announced in May 2006 and June 2007 each authorized the purchase

of up to $250.0 million in Logitech shares. The sale of shares upon exercise of options pursuant to the

Company’s stock plans realized $50.6 million during fiscal year 2008. In addition, cash of $15.2 million was

provided by tax benefits recognized on the exercise of share-based payment awards.