Logitech 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LISA-7

LOGITECH INTERNATIONAL S.A., APPLES

NOTES TO SWISS STATUTORY FINANCIAL STATEMENTS—(Continued)

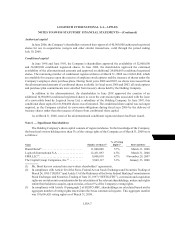

Authorized capital

In June 2006, the Company’s shareholders renewed their approval of 40,000,000 authorized registered

shares for use in acquisitions, mergers and other similar transactions, valid through the period ending

July 10, 2008.

Conditional capital

In June 1996 and June 1995, the Company’s shareholders approved the availability of 32,000,000

and 24,000,000 conditional registered shares. In June 2002, the shareholders approved the continued

availability of the aforementioned amounts and approved an additional 24,000,000 conditional registered

shares. The remaining number of conditional registered shares at March 31, 2008 was 60,661,860, which

are available for issuance upon the exercise of employee stock options and the issuance of shares under the

Company’s employee share purchase plans. During fiscal years 2008 and 2007, no shares were issued from

the aforementioned amounts of conditional shares available. In fiscal years 2008 and 2007, all stock options

and purchase plan commitments were satisfied from treasury shares held by the Holding Company.

In addition to the aforementioned, the shareholders in June 2001 approved the creation of an

additional 10,900,000 conditional registered shares to cover the conversion rights associated with the issue

of a convertible bond by Logitech Jersey Ltd, a subsidiary of the Holding Company. In June 2007, this

conditional share capital for 10,900,000 shares was eliminated. The conditional share capital was no longer

required, as the Company satisfied its conversion obligations during fiscal year 2006 by the delivery of

treasury shares rather than the issuance of shares from conditional share capital.

As at March 31, 2008, none of the aforementioned conditional registered shares had been issued.

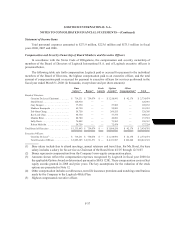

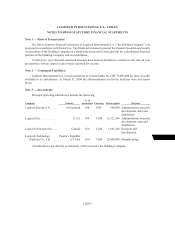

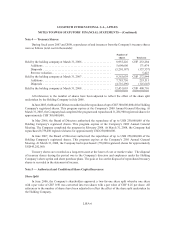

Note 6 — Significant Shareholders:

The Holding Company’s share capital consists of registered shares. To the knowledge of the Company,

the beneficial owners holding more than 3% of the voting rights of the Company as of March 31, 2008 were

as follows:

Name Number of Shares(2)

% of Voting

Rights(3) Relevant Date

Daniel Borel(1) ............................ 11,000,000 5.7% March 31, 2008

Logitech International S.A. ................. 12,431,093 6.5% March 31, 2008

FMR LLC(4) .............................. 9,006,810 4.7% November 29, 2007

The Capital Group Companies, Inc.(5) ......... 5,869,117 3.1% January 23, 2008

(1) Mr. Borel has not entered into any written shareholders’ agreements.

(2) In compliance with Article 20 of the Swiss Federal Act on Stock Exchanges and Securities Trading of

March 24, 1995 (“SESTA”) and Article 13 of the Ordinance of the Swiss Federal Banking Commission on

Stock Exchanges and Securities Trading of June 25, 1997 (“SESTO-FBC”), conversion and acquisition

rights are not taken into consideration for the calculation of the relevant shareholdings, unless such rights

entitle their holders to acquire, upon exercise, at least 3% of the Company’s voting rights.

(3) In compliance with Article 10 paragraph 2 of SESTO-FBC, shareholdings are calculated based on the

aggregate number of voting rights entered into the Swiss commercial register. This aggregate number

was 191,606,620 voting rights as of March 31, 2008.