Logitech 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-33

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The Company files Swiss and foreign tax returns. For all these tax returns, the Company is generally

not subject to tax examinations for years prior to 1999.

Although timing of the resolution or closure on audits is highly uncertain, the Company does not

believe it is reasonably possible that the unrecognized tax benefits would materially change in the next 12

months.

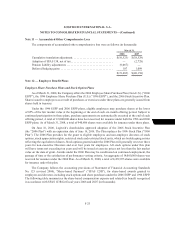

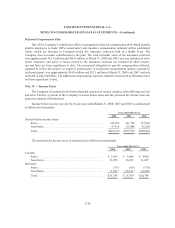

Note 14 — Derivative Financial Instruments – Foreign Exchange Hedging

The Company enters into foreign exchange forward contracts to reduce the short-term effects of

foreign currency fluctuations on certain foreign currency receivables or payables and to provide against

exposure to changes in foreign currency exchange rates related to its subsidiaries’ forecasted inventory

purchases. These forward contracts generally mature within one to three months. The Company may also

enter into foreign exchange swap contracts to extend the terms of its foreign exchange forward contracts.

Prior to the third quarter of fiscal year 2008, forward contracts related to forecasted inventory

purchases were accounted for as cash flow hedges and gains or losses on the contracts were deferred as a

component of accumulated other comprehensive loss until the inventory purchases were sold, at which time

the gains or losses were reclassified to cost of goods sold.

The notional amounts of foreign exchange forward contracts outstanding at March 31, 2008 and 2007

relating to foreign currency receivables or payables were $8.4 million and $9.0 million. There were no

outstanding forward contracts related to forecasted inventory purchases at March 31, 2008. The notional

amount of such forward contracts outstanding at March 31, 2007 was $38.5 million. The notional amounts

of foreign exchange swap contracts outstanding at March 31, 2008 and 2007 were $21.5 million and

$11.5 million. The notional amount represents the future cash flows under contracts to purchase foreign

currencies.

Net losses recognized into cost of goods sold during fiscal years 2008, 2007 and 2006 were $4.1

million, $0.3 million and $2.6 million. Unrealized net losses on forward contracts outstanding at March 31,

2008 were immaterial.

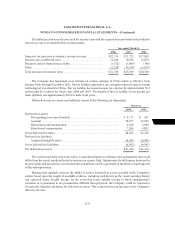

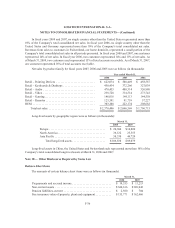

Note 15 — Commitments and Contingencies

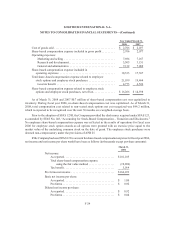

The Company leases facilities under operating leases, certain of which require it to pay property taxes,

insurance and maintenance costs. Operating leases for facilities are generally renewable at the Company’s

option and usually include escalation clauses linked to inflation. Future minimum annual rentals under

non-cancelable operating leases at March 31, 2008 are as follows (in thousands):

Year ending March 31,

2009 ................................................ $13,013

2010 ................................................ 10,547

2011 ................................................ 8,081

2012 ................................................ 7,242

2013 ................................................ 6,964

Thereafter............................................ 11,696

$57,543