Logitech 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-19

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

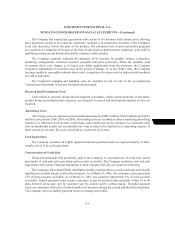

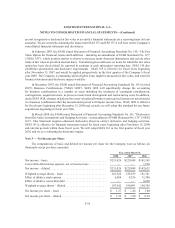

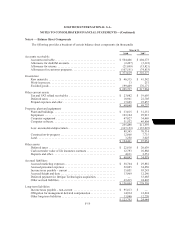

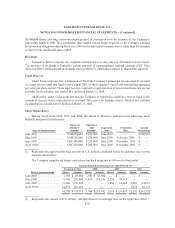

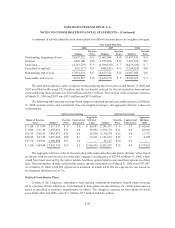

Note 6 — Balance Sheet Components

The following provides a breakout of certain balance sheet components (in thousands):

March 31,

2008 2007

Accounts receivable:

Accounts receivable .......................................... $ 504,406 $ 404,373

Allowance for doubtful accounts ................................ (2,497) (3,322)

Allowance for returns......................................... (21,099) (15,821)

Allowances for customer programs .............................. (107,191) (74,853)

$ 373,619 $ 310,377

Inventories:

Raw materials............................................... $ 46,315 $ 41,542

Work-in-process ............................................. 13 251

Finished goods .............................................. 199,409 176,171

$ 245,737 $ 217,964

Other current assets:

Tax and VAT refund receivables ................................ $ 23,882 $ 19,695

Deferred taxes .............................................. 18,961 22,705

Prepaid expenses and other .................................... 17,825 25,857

$ 60,668 $ 68,257

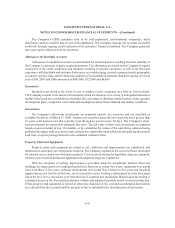

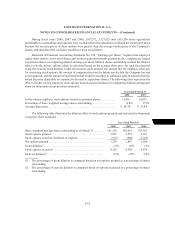

Property, plant and equipment:

Plant and buildings........................................... $ 33,815 $ 31,351

Equipment ................................................. 123,104 95,915

Computer equipment ......................................... 47,027 34,469

Computer software........................................... 51,552 49,804

255,498 211,539

Less: accumulated depreciation ................................. (167,153) (135,225)

88,345 76,314

Construction-in-progress ...................................... 12,866 7,715

Land...................................................... 3,250 3,025

$ 104,461 $ 87,054

Other assets:

Deferred taxes .............................................. $ 22,618 $ 20,639

Cash surrender value of life insurance contracts .................... 12,793 10,888

Deposits and other ........................................... 4,631 2,551

$ 40,042 $ 34,078

Accrued liabilities:

Accrued marketing expenses................................... $ 30,764 $ 29,881

Accrued personnel expenses ................................... 52,895 34,450

Income taxes payable – current ................................. 15,051 93,245

Accrued freight and duty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,969 12,246

Deferred payment for Intrigue Technologies acquisition.............. — 33,685

Other accrued liabilities ....................................... 43,415 24,803

$ 156,094 $ 228,310

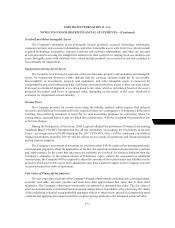

Long-term liabilities:

Income taxes payable – non-current ............................. $ 95,013 $ —

Obligation for management deferred compensation ................. 14,934 12,424

Other long-term liabilities ..................................... 13,846 12,220

$ 123,793 $ 24,644