Logitech 2008 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

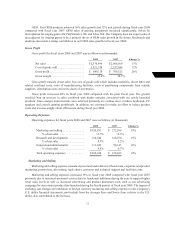

3

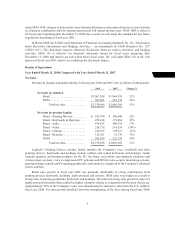

with fiscal year 2007. We achieved strong gross margin improvements through our emphasis on product

innovation, supply chain efficiencies and controlling and reducing our product cost structure. Net income

was $231.0 million, which included an investment write-down of $79.8 million and a gain on sale of

investments of $27.7 million, compared with net income of $229.8 million in fiscal year 2007.

Our strategy for fiscal year 2009 remains to position Logitech as a premium supplier in our product

categories, offering affordable luxury to the consumer while continuing to compete aggressively in all

market segments, from the entry level through the high-end. Our focus will be on managing resources to

create an innovative product portfolio targeted at current and future consumer trends as well as increasing

the value of the Logitech brand from a competitive, channel partner and consumer experience perspective.

We intend to take advantage of the significant opportunities in emerging markets, while leveraging the

growth opportunities remaining in our mature markets.

In our pointing devices, keyboards and desktops product lines, we plan to continue our expansion

into the notebook arena. We also see significant opportunities for our mice and keyboards in the business

market. In the audio arena, we expect that our strong presence in the speaker category, combined with

our proposed new products, will allow us to continue to generate growth. We also plan to leverage the

opportunities provided by our streaming media product line. During fiscal year 2009, we plan to build on

the momentum achieved in our video product line in the fourth quarter of fiscal year 2008 and continue

our focus on in-store marketing, new products, and partnerships to generate a sustained return to growth.

We also expect our video security products to gain momentum throughout the next fiscal year. With the

introduction of new gaming products for popular console game titles like the Gran Turismo 5, we expect to

return to growth in the gaming product line as well. In our Harmony remote control product line, we will

continue to focus on improving every aspect of the user experience to increase our already high level of

customer satisfaction and expand the universe of Harmony users. To support our planned growth, we intend

to continue to scale our processes to handle the increased complexity of our product lines and improve the

product life cycle management process. We also plan to continue managing our operating expenses in line

with our gross profit growth for the year.

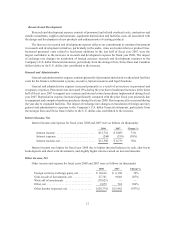

Critical Accounting Estimates

The preparation of financial statements and related disclosures in conformity with generally accepted

accounting principles in the United States of America (“U.S. GAAP”) requires the Company to make

judgments, estimates and assumptions that affect reported amounts of assets, liabilities, net sales and

expenses, and the disclosure of contingent assets and liabilities.

We consider an accounting estimate critical if it: (i) requires management to make judgments and

estimates about matters that are inherently uncertain; and (ii) is important to an understanding of Logitech’s

financial condition and operating results.

We base our estimates on historical experience and on various other assumptions we believe to be

reasonable under the circumstances. Although these estimates are based on management’s best knowledge

of current events and actions that may impact the Company in the future, actual results could differ from

those estimates. Management has discussed the development, selection and disclosure of these critical

accounting estimates with the Audit Committee of the Board of Directors.

We believe the following accounting estimates are most critical to our business operations and to

an understanding of our financial condition and results of operations, and reflect the more significant

judgments and estimates used in the preparation of our consolidated financial statements.