Logitech 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-12

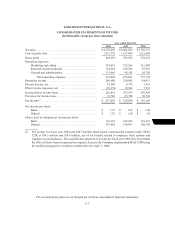

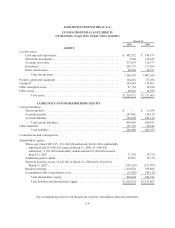

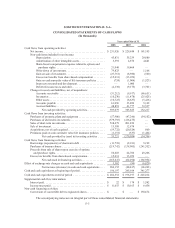

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

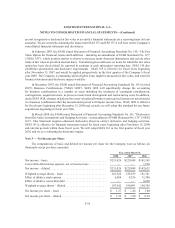

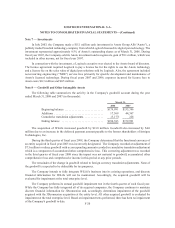

Net Income per Share

Basic net income per share is computed by dividing net income by the weighted average outstanding

shares. Diluted net income per share is computed using the weighted average outstanding shares and dilutive

share equivalents. Dilutive share equivalents consist of employee stock options and convertible debt.

The dilutive effect of in-the-money stock options is calculated based on the average share price for

each fiscal period using the treasury stock method, which assumes that the amount used to repurchase shares

includes the amount the employee must pay for exercising stock options, the amount of compensation cost

not yet recognized for future service, and the amount of tax benefits that would be recorded in additional

paid-in capital when the award becomes deductible. The dilutive effect of convertible debt is based upon

conversion, computed using the if-converted method.

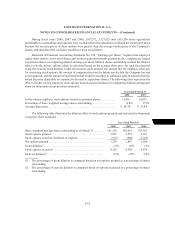

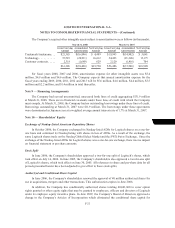

Share-Based Compensation Expense

The Company adopted the fair value recognition provisions of Statement of Financial Accounting

Standards No. 123 (revised 2004), “Share-Based Payments” (“SFAS 123R”), effective April 1, 2006, using

the modified prospective transition method. Therefore, results for periods prior to April 1, 2006 have not

been restated to include share-based compensation expense calculated in accordance with SFAS 123R. The

Company recognized share-based compensation expense in those periods in accordance with Accounting

Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB 25”). In March 2005,

the Securities and Exchange Commission (“SEC”) issued Staff Accounting Bulletin No. 107 (“SAB 107”)

regarding the SEC’s interpretation of SFAS 123R and the valuation of share-based payments for public

companies. Logitech has applied the provisions of SAB 107 in its adoption of SFAS 123R.

Share-based compensation expense for fiscal years 2008 and 2007 includes compensation expense,

reduced for estimated forfeitures, for share-based compensation awards granted prior to but not yet vested

as of April 1, 2006, based on the grant-date fair value estimated using the Black-Scholes-Merton option-

pricing valuation model in accordance with the original provisions of Statement of Financial Accounting

Standards No. 123, “Accounting for Stock-Based Compensation” (“SFAS 123”). These compensation costs

are recognized in accordance with Financial Accounting Standards Board Interpretation No. 28, “Accounting

for Stock Appreciation Rights and Other Variable Stock Option or Award Plans”, on a straight-line basis

over the service period for each separately vesting portion of the award (multiple-option approach).

Share-based compensation expense for fiscal years 2008 and 2007 also includes compensation

expense, reduced for estimated forfeitures, for awards granted after April 1, 2006 based on the grant-date

fair value estimated using the Black-Scholes-Merton option-pricing valuation model. These compensation

costs are recognized on a straight-line basis over the service period of the award, which is generally the

option vesting term of four years (single-option approach).

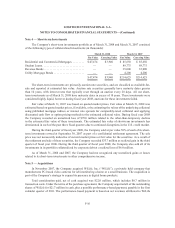

Prior to adopting SFAS 123R, tax benefits resulting from the exercise of stock options were presented

as operating cash flows in the consolidated statement of cash flows. SFAS 123R requires cash flows

resulting from excess tax benefits to be classified as cash flows from financing activities. Excess tax

benefits are realized tax benefits from tax deductions for exercised options in excess of the deferred tax

asset attributable to share-based compensation costs for such options.

The Company will recognize a benefit from share-based compensation in paid-in capital only if an

incremental tax benefit is realized after all other available tax attributes have been utilized. For income tax

footnote disclosure, the Company has elected to offset deferred tax assets against the valuation allowance