Logitech 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

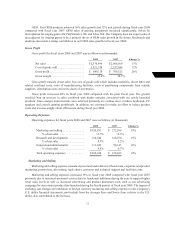

13

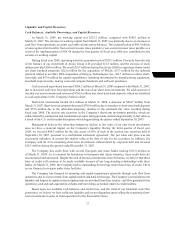

During fiscal year 2008, we recorded an unrealized loss of $79.8 million related to an other-than-

temporary decline in the estimated fair value of our short-term investments. We also recorded a gain of $33.7

million related to the short-term investments that we sold as part of a confidential settlement agreement in

the third quarter of fiscal year 2008. In addition, we sold all of our investments collateralized by corporate

debt during the third quarter of fiscal year 2008 and recorded a realized loss of $6.0 million. See Note 4 -

Short-term Investments in the Notes to Consolidated Financial Statements of this annual report for further

discussion. The change in foreign currency exchange gains during fiscal year 2008 resulted primarily from

gains related to the sale of the Company’s Euro currency for U.S. dollars. The Company does not speculate

in currency positions, but is alert to opportunities to maximize its foreign exchange gains. Other income

also includes $1.0 million gain on the sale of our ioPen retail product line.

Other income for fiscal year 2007 included a gain of $9.1 million on the sale of our investment in

Anoto Group AB, a publicly traded Swedish technology company from which we licensed our digital pen

technology.

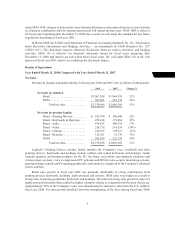

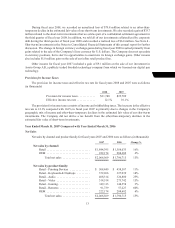

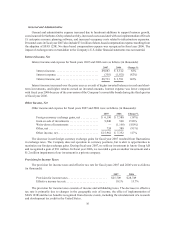

Provision for Income Taxes

The provision for income taxes and effective tax rate for fiscal years 2008 and 2007 were as follows

(in thousands):

2008 2007

Provision for income taxes ............ $31,788 $25,709

Effective income tax rate ............. 12.1% 10.1%

The provision for income taxes consists of income and withholding taxes. The increase in the effective

tax rate to 12.1% compared with 10.1% in fiscal year 2007 is primarily due to changes in the Company’s

geographic mix of income and other-than-temporary declines in the estimated fair value of our short-term

investments. The Company did not derive a tax benefit from the other-than-temporary declines in the

estimated fair value of short-term investments.

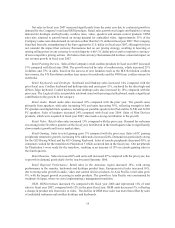

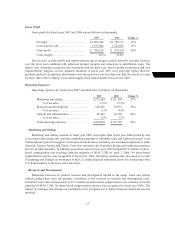

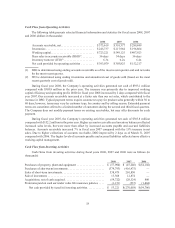

Year Ended March 31, 2007 Compared with Year Ended March 31, 2006

Net Sales

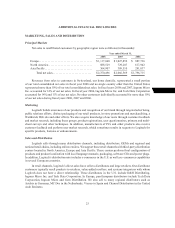

Net sales by channel and product family for fiscal years 2007 and 2006 were as follows (in thousands):

2007 2006 Change %

Net sales by channel:

Retail .............................. $1,844,395 $ 1,588,033 16%

OEM .............................. 222,174 208,682 6%

Total net sales ................... $2,066,569 $ 1,796,715 15%

Net sales by product family:

Retail - Pointing Devices .............. $ 508,449 $ 458,587 11%

Retail - Keyboards & Desktops ......... 372,266 327,039 14%

Retail - Audio ....................... 408,314 326,880 25%

Retail - Video ....................... 314,514 273,742 15%

Retail - Gaming ...................... 149,113 144,558 3%

Retail - Remotes ..................... 91,739 57,227 60%

OEM .............................. 222,174 208,682 6%

Total net sales.................... $2,066,569 $ 1,796,715 15%