Logitech 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-11

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

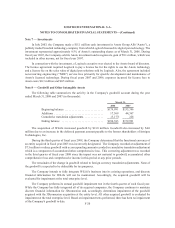

Goodwill and Other Intangible Assets

The Company’s intangible assets principally include goodwill, acquired technology, trademarks,

customer contracts and customer relationships, and other. Intangible assets with finite lives, which include

acquired technology, trademarks, customer contracts and customer relationships, and other, are recorded

at cost and amortized using the straight-line method over their useful lives ranging from one month to ten

years. Intangible assets with indefinite lives, which include goodwill, are recorded at cost and evaluated at

least annually for impairment.

Impairment of Long-Lived Assets

The Company reviews long-lived assets, such as investments, property and equipment, and intangible

assets, for impairment whenever events indicate that the carrying amounts might not be recoverable.

Recoverability of investments, property and equipment, and other intangible assets is measured by

comparing the projected undiscounted net cash flows associated with those assets to their carrying values.

If an asset is considered impaired, it is written down to fair value, which is determined based on the asset’s

projected discounted cash flows or appraised value, depending on the nature of the asset. Goodwill is

evaluated for impairment at least annually.

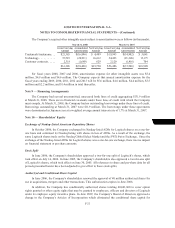

Income Taxes

The Company provides for income taxes using the liability method, which requires that deferred

tax assets and liabilities be recognized for the expected future tax consequences of temporary differences

resulting from differing treatment of items for tax and accounting purposes. In estimating future tax

consequences, expected future events are taken into consideration, with the exception of potential tax law

or tax rate changes.

During the first quarter of fiscal year 2008, Logitech adopted the provisions of Financial Accounting

Standards Board (“FASB”) Interpretation No. 48 (As Amended), “Accounting for Uncertainty in Income

Taxes—an interpretation of FASB Statement No. 109” (“FIN 48”). Note 13 of the condensed consolidated

financial statements describes FIN 48 and the effects on our results of operations and financial position

arising from its adoption.

The Company’s assessment of uncertain tax positions under FIN 48 requires that management make

estimates and judgments about the application of tax law, the expected resolution of uncertain tax positions

and other matters. In the event that uncertain tax positions are resolved for amounts different than the

Company’s estimates, or the related statutes of limitations expire without the assessment of additional

income taxes, the Company will be required to adjust the amounts of the related assets and liabilities in the

period in which such events occur. Such adjustments may have a material impact on the Company’s income

tax provision and its results of operations.

Fair Value of Financial Instruments

The carrying value of certain of the Company’s financial instruments, including cash, cash equivalents,

accounts receivable, accounts payable and short-term debt approximates fair value due to their short

maturities. The Company’s short-term investments are reported at estimated fair value. The fair value of

short-term investments is estimated based on quoted market prices, if available, or by estimating the values

of the underlying collateral using published mortgage indices or interest rate spreads for comparably-rated

collateral and applying discounted cash flow or option pricing methods to the estimated collateral value.