Logitech 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

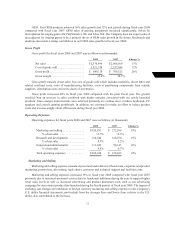

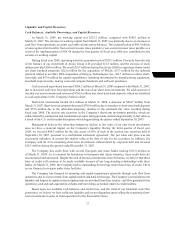

Liquidity and Capital Resources

Cash Balances, Available Borrowings, and Capital Resources

At March 31, 2008, net working capital was $723.2 million, compared with $549.1 million at

March 31, 2007. The increase in working capital from March 31, 2007 was primarily due to an increase in

cash flow from operations, accounts receivable and inventory balances. The reclassification of $89.7 million

of unrecognized tax benefits from current income taxes payable to non-current income taxes payable as a

result of the implementation of FIN 48 during the first quarter of fiscal year 2008 also contributed to the

increase in working capital.

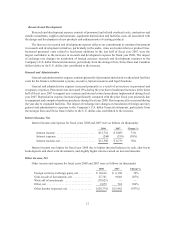

During fiscal year 2008, operating activities generated cash of $393.1 million. Proceeds from the sale

of the balance of our investment in Anoto Group A.B. provided $11.3 million, and the exercise of stock

options provided $50.6 million. We used $219.7 million during fiscal year 2008 to repurchase shares under

our share buyback programs, $22.0 million for the acquisition of WiLife, $37.7 million for the deferred

payment related to our May 2004 acquisition of Intrigue Technologies, Inc., $11.7 million to reduce short-

term debt, and $57.9 million for capital expenditures, including investments for manufacturing equipment,

leasehold improvements, tooling costs and computer hardware and software purchases.

Cash and cash equivalents increased $286.2 million at March 31, 2008 compared with March 31, 2007,

due to increased cash flow from operations and the sale of our short-term investments. We sold a portion of

our short-term investments and reinvested $130.9 million into short-term bank deposits, which are classified

as cash equivalents in the Company’s balance sheet.

Short-term investments totaled $3.9 million at March 31, 2008, a decrease of $210.7 million from

March 31, 2007. Short-term investments decreased $130.9 million due to transfers to short-term bank deposits

and $79.8 million due to the other-than-temporary declines in the estimated fair value recorded during

fiscal year 2008. The auction rate securities in the Company’s short-term investment portfolio, which are

collateralized by commercial and residential real estate mortgage loans, declined significantly in fair value as

a result of the U.S. credit market disruptions which began during the quarter ended September 30, 2007.

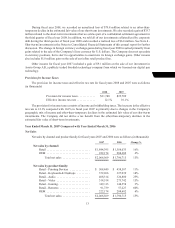

Management believes the other-than-temporary decline in fair value of our short-term investments

does not have a material impact on the Company’s liquidity. During the third quarter of fiscal year

2008, we received $84.3 million for the sale at par of 50% of each of the auction rate securities held at

September 30, 2007, pursuant to a confidential settlement agreement. The par value sale price was not

necessarily indicative of current fair market value at the date of sale for the securities. In addition, the

Company sold all of its remaining short-term investments collateralized by corporate debt and received

$28.3 million during the quarter ended December 31, 2007.

The Company has credit lines with several European and Asian banks totaling $131.9 million as

of March 31, 2008. As is common for businesses in European and Asian countries, these credit lines are

uncommitted and unsecured. Despite the lack of formal commitments from the banks, we believe that these

lines of credit will continue to be made available because of our long-standing relationships with these

banks. At March 31, 2008, the Company had no outstanding borrowings under these lines of credit. There

are no financial covenants under these facilities.

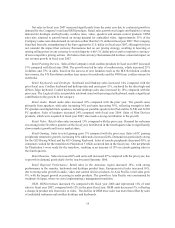

The Company has financed its operating and capital requirements primarily through cash flow from

operations and, to a lesser extent, from capital markets and bank borrowings. The Company’s normal short-term

liquidity and long-term capital resource requirements are provided from three sources: cash flow generated from

operations, cash and cash equivalents on hand, and borrowings, as needed, under its credit facilities.

Based upon our available cash balances and credit lines, and the trend of our historical cash flow

generation, we believe we have sufficient liquidity and are not dependent upon selling the remaining short-

term investments in order to fund operations for the foreseeable future.