Logitech 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

Foreign Currency Exchange Rates

The Company is exposed to foreign currency exchange rate risk as it transacts business in multiple

foreign currencies, including exposure related to anticipated sales, anticipated purchases and assets and

liabilities denominated in currencies other than the U.S. dollar. Logitech transacts business in over 30

currencies worldwide, of which the most significant to operations are the Euro, Chinese renminbi (“CNY”),

British pound sterling, Japanese yen, Taiwanese dollar, Canadian dollar and Mexican peso. The functional

currency of the Company’s operations is primarily the U.S. dollar. To a lesser extent, certain operations

use the Euro, Swiss franc, Japanese yen or the local currency of the country as their functional currencies.

Accordingly, unrealized foreign currency gains or losses resulting from the translation of net assets or

liabilities denominated in foreign currencies to the U.S. dollar are accumulated in the cumulative translation

adjustment component of other comprehensive income in shareholders’ equity.

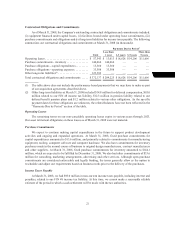

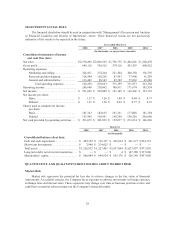

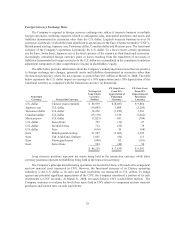

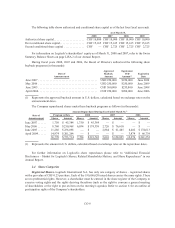

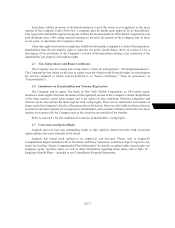

The table below provides information about the Company’s underlying transactions that are sensitive

to foreign exchange rate changes, primarily assets and liabilities denominated in currencies other than

the functional currency, where the net exposure is greater than $0.5 million at March 31, 2008. The table

below represents the U.S. dollar impact on earnings of a 10% appreciation and a 10% depreciation of the

functional currency as compared with the transaction currency (in thousands):

Functional

Currency Transaction Currency

Net Exposed

Long (Short)

Currency

Position

FX Gain (Loss)

From 10%

Appreciation of

Functional

Currency

FX Gain (Loss)

From 10%

Depreciation of

Functional

Currency

U.S. dollar Chinese yuan renminbi $ 88,959 $ (8,087) $ 9,884

Japanese yen U.S. dollar (19,843) 1,804 (2,205)

Taiwanese dollar U.S. dollar 14,226 (1,293) 1,581

Canadian dollar U.S. dollar (13,159) 1,196 (1,462)

Mexican peso U.S. dollar (7,053) 641 (784)

U.S. dollar Swiss franc 787 (72) 87

U.S. dollar Swedish krona 712 (65) 79

U.S. dollar Euro (616) 56 (68)

Euro British pound sterling 21,587 (1,962) 2,399

Euro Utd. Arab Emir. Dirham 1,035 (94) 115

Euro Norwegian kroner (909) 83 (101)

Euro Swiss franc 503 (46) 56

$ 86,229 $ (7,839) $ 9,581

Long currency positions represent net assets being held in the transaction currency while short

currency positions represent net liabilities being held in the transaction currency.

The Company’s principal manufacturing operations are located in China, with much of its component

and raw material costs transacted in CNY. However, the functional currency of its Chinese operating

subsidiary is the U.S. dollar as its sales and trade receivables are transacted in U.S. dollars. To hedge

against any potential significant appreciation of the CNY, the Company transferred a portion of its cash

investments to CNY accounts. At March 31, 2008, net assets held in CNY totaled $89.0 million. The

Company continues to evaluate the level of net assets held in CNY relative to component and raw material

purchases and interest rates on cash equivalents.