Logitech 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

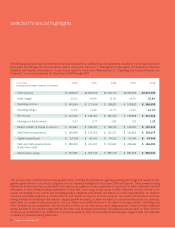

The following selected historical information has been derived from audited fi nancial statements included in our annual reports for

such years. Accordingly, the table should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” in our annual report for Fiscal Year 2008 and Item 5, “Operating and Financial Review and

Prospects,” in our annual reports for Fiscal Years 2004 through 2007.

This annual report contains forward-looking statements, including the statements regarding evolving technology and market trends,

growth opportunities in our product categories and our business strategies for fi scal year 2009 and beyond. These forward-looking

statements involve risks and uncertainties that could cause Logitech’s actual performance and results to differ materially from that

anticipated in these forward-looking statements. Factors that could cause actual results to differ materially include if we fail to in-

novate successfully in our current and emerging product categories and identify new feature or product opportunities; our ability to

introduce successful products in a timely manner and market acceptance of those products; our product introductions and mar-

keting activities not resulting in the product category growth we expect, or when we expect it; consumer demand for our products,

particularly our newly-introduced products, and our ability to accurately forecast it; the effect of pricing, product, marketing and

other initiatives by our competitors, and our reaction to them, on our sales and product category growth, as well as those additional

factors set forth in our periodic fi lings with the Securities and Exchange Commission, including our annual report on Form 10-K for

the fi scal year ended March 31, 2008 and our quarterly reports on Form 10-Q available at www.sec.gov. Logitech does not undertake

to update any forward-looking statements.

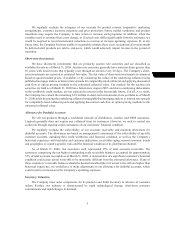

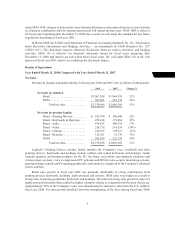

selected fi nancial highlights

20 Logitech Annual Report 08

Fiscal Year 2004 2005 2006 2007 2008

(in thousands of U.S. dollars, except per share amounts)

Total revenues

Gross margin

Operating income

Operating margin

Net income

Earnings per diluted share

Diluted number of shares (in millions)

Cash fl ow from operations

Capital expenditures

Cash and cash equivalents net

of short-term debt

Shareholders’ equity

$1,268,470 $1,482,626 $1,796,715 $2,066,569 $2,370,496

32.2% 34.0% 32.0% 34.3% 35.8%

$ 145,554 $ 171,674 $ 198,911 $ 230,862 $ 286,680

11.5% 11.6% 11.1% 11.2% 12.1%

$ 132,153 $ 149,266 $ 181,105 $ 229,848 $ 231,026

0.67 0.77 0.92 1.20 1.23

$ 200,640 $ 198,250 $ 198,769 $ 190,991 $ 187,942

$ 166,460 $ 213,674 $ 152,217 $ 303,825 $ 393,079

$ 24,718 $ 40,541 $ 54,102 $ 47,246 $ 57,900

$ 280,624 $ 331,402 $ 230,943 $ 398,966 $ 486,292

$ 457,080 $ 526,149 $ 685,176 $ 844,524 $ 960,044